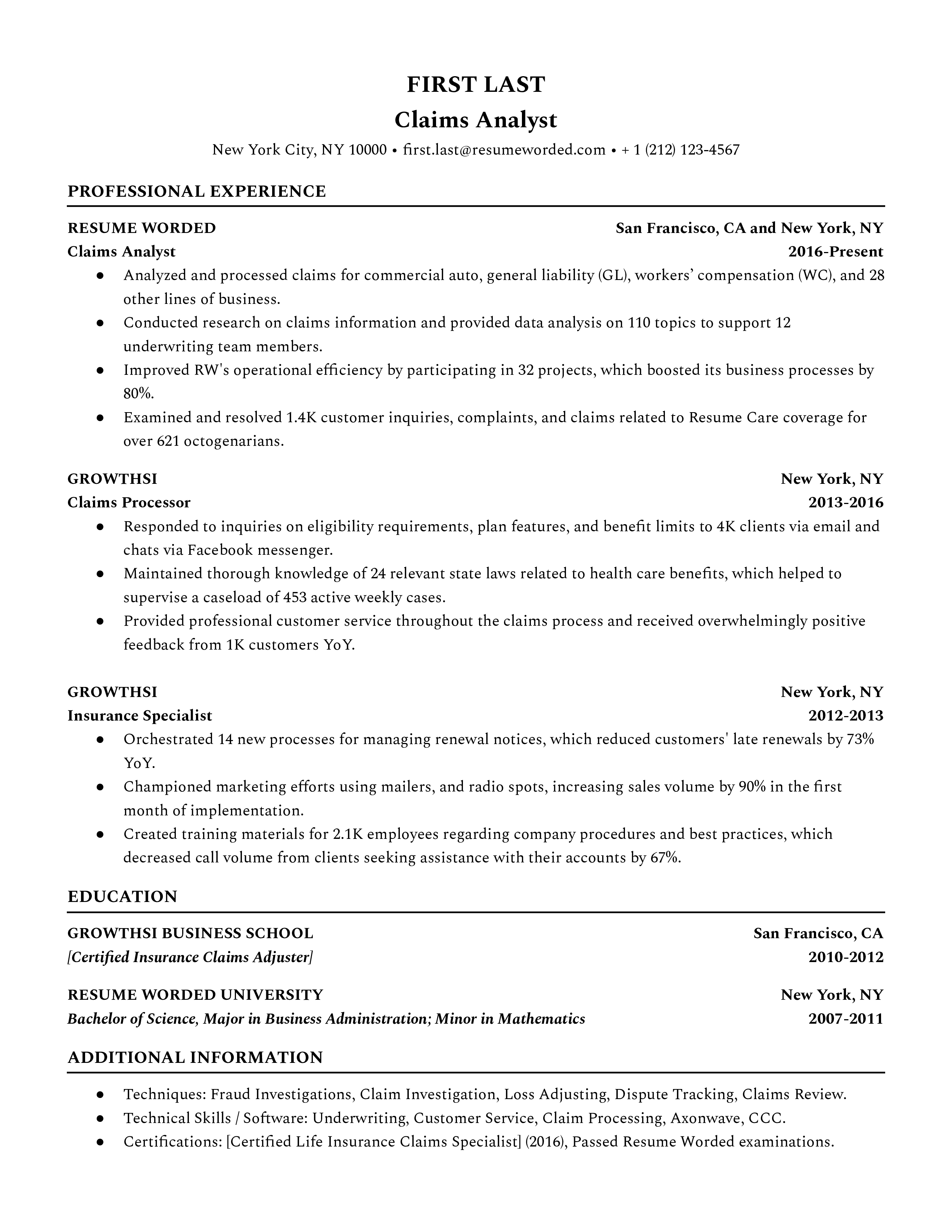

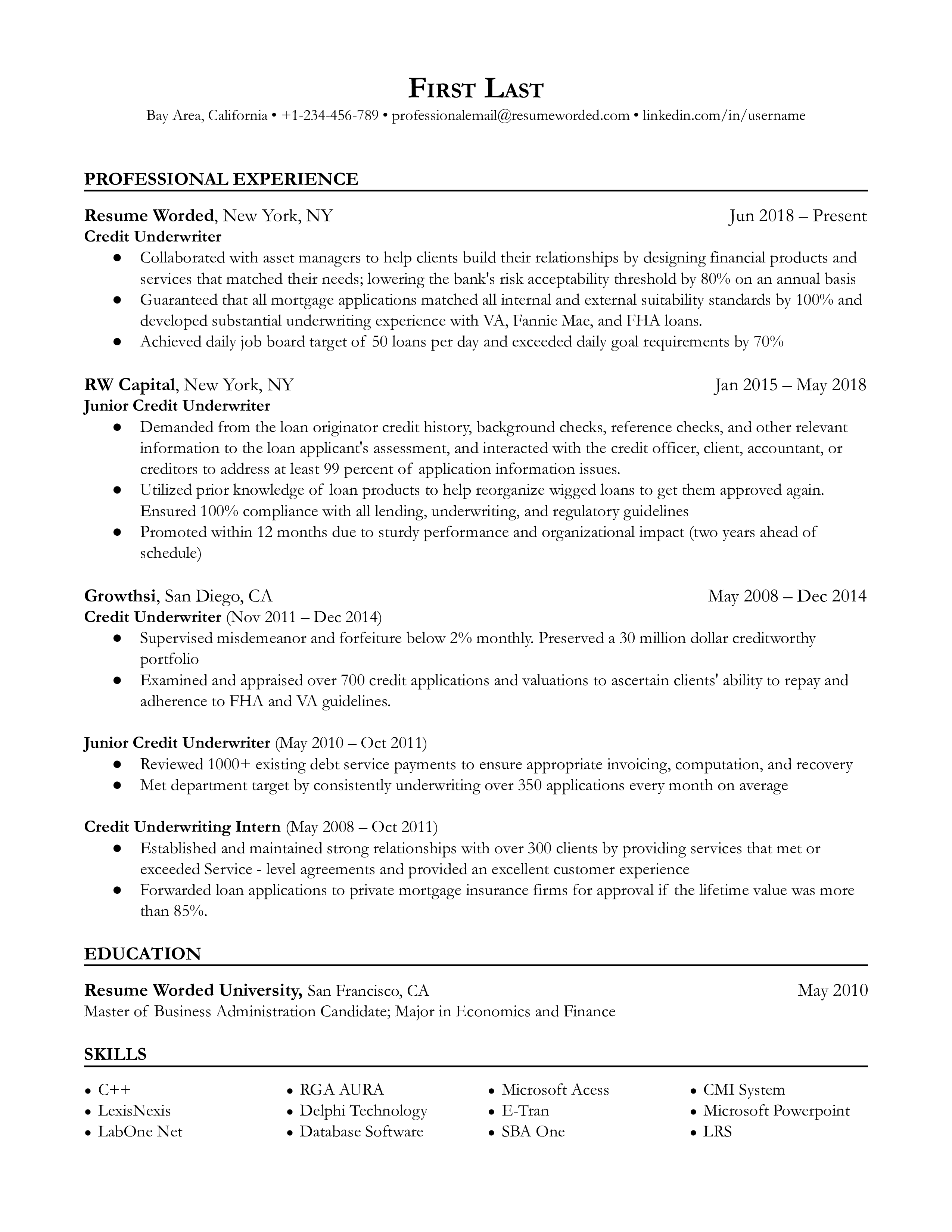

Handling large portfolios

A portfolio of 500+ loans speaks volume about your capacity to manage a heavy workload. Coupling it with maintaining 100% compliance illustrates your attention to detail and understanding of industry regulations.

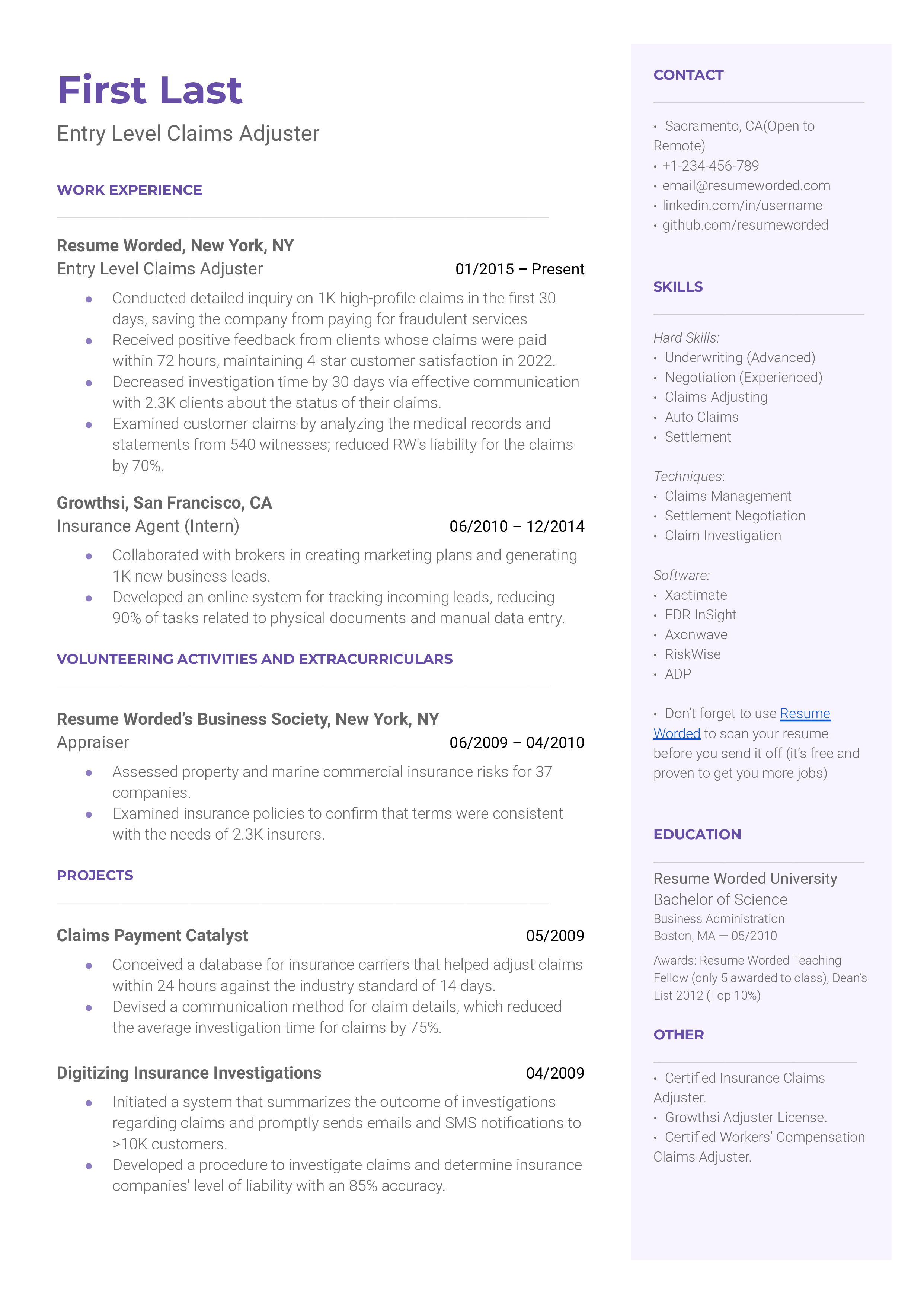

Experience with top-tier institutions

Exposure to top-tier financial institutions implies that you've worked in competitive, high-stakes environments. It also indicates familiarity with the best practices in the industry.

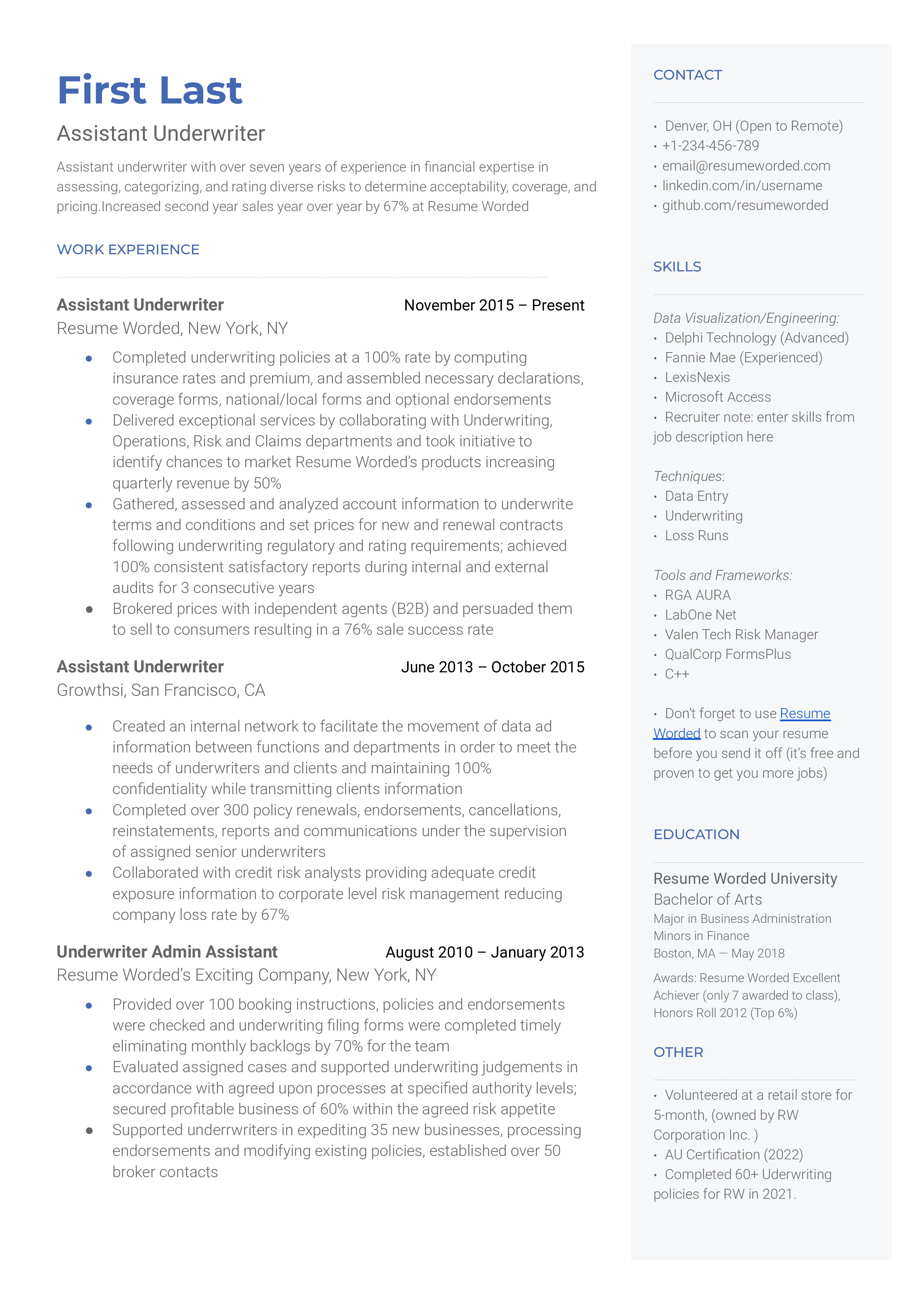

System implementation impact

By specifying that you implemented an efficient tracking system, you're not only showing initiative, but also your ability to impact efficiency positively. The 25% reduction in processing time is a solid, quantifiable result that concrete evidence of your performance.