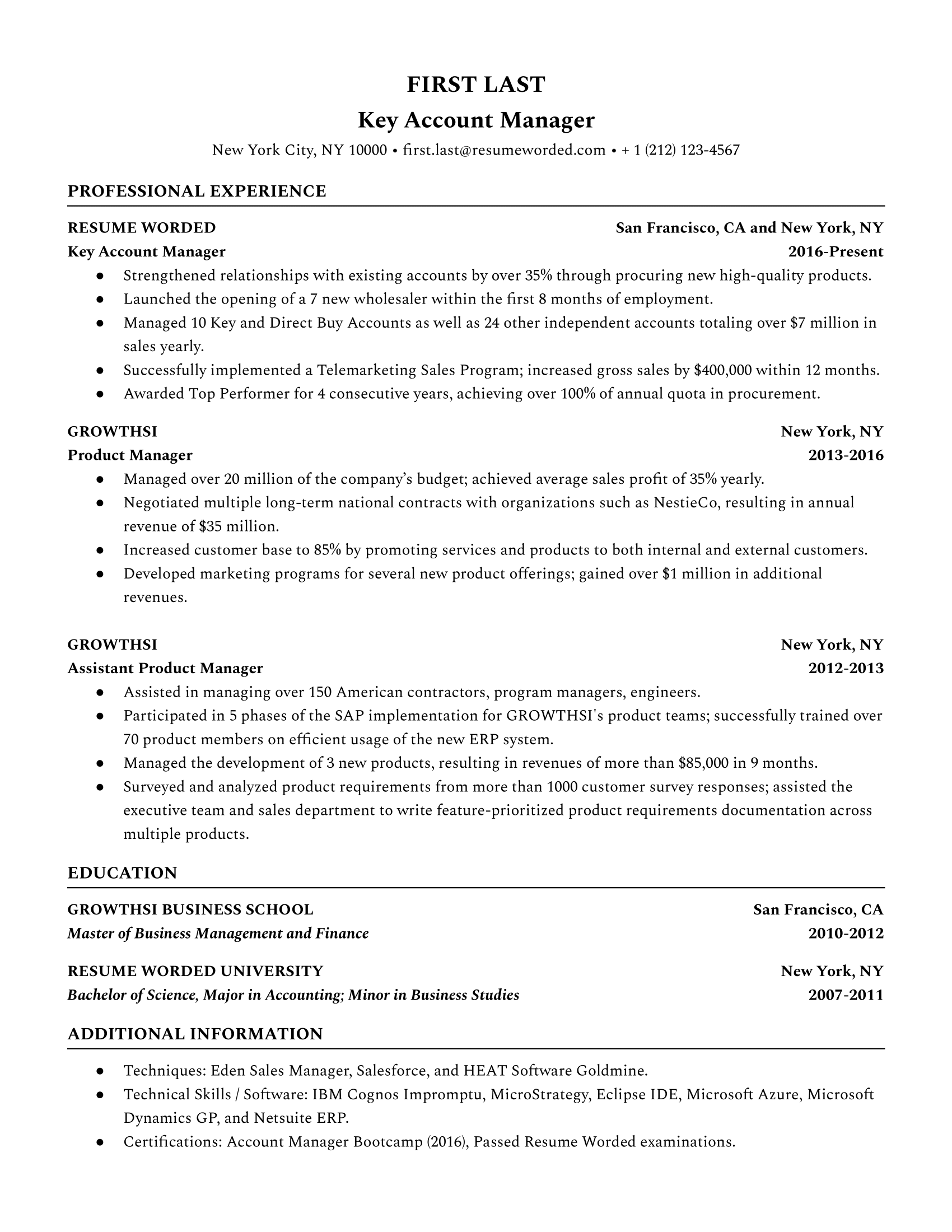

Illustrating problem-solving abilities

When the candidate mentions how they've turned underperforming departments into revenue generators, they're painting a picture of their problem-solving skills. Potential employers may see this as a sign of initiative and accountability.

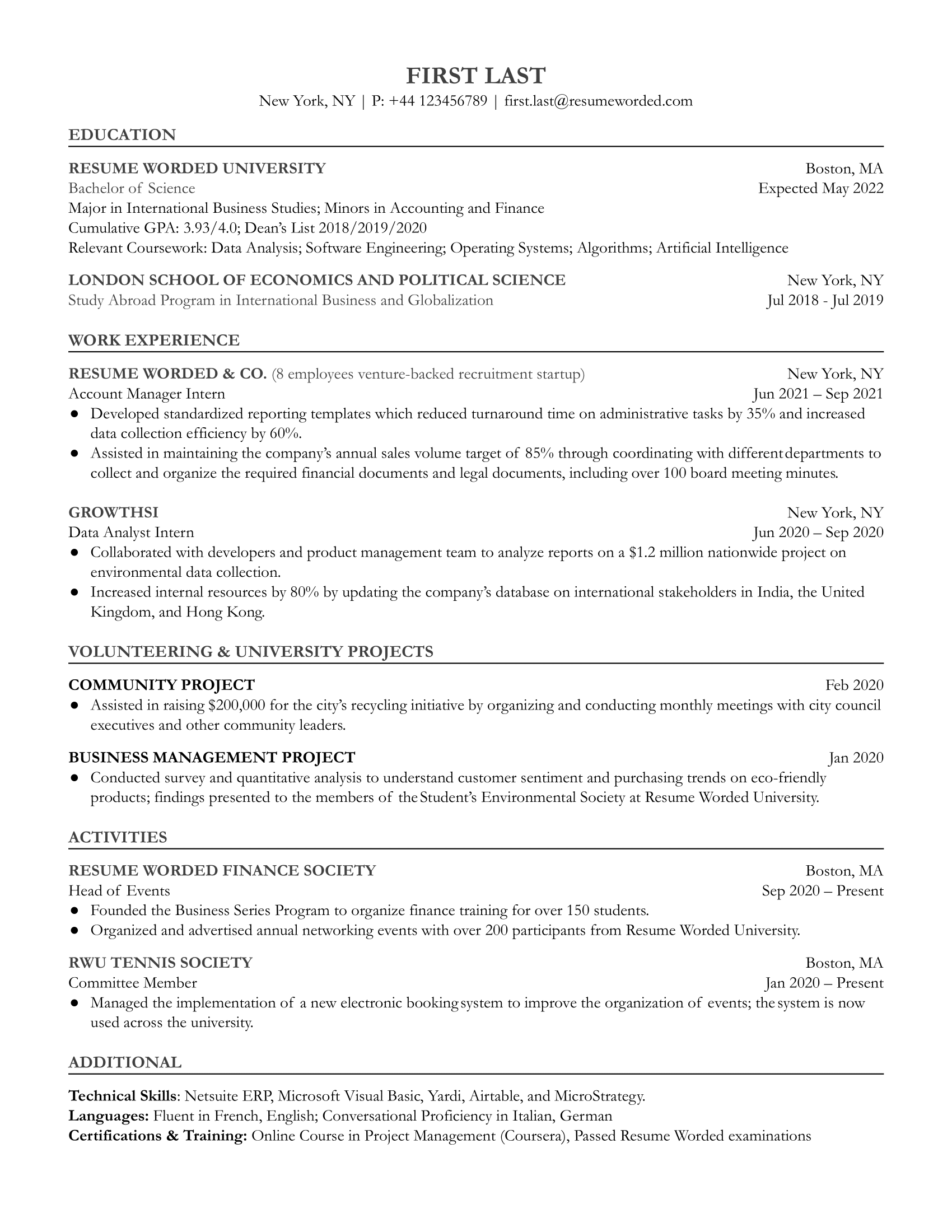

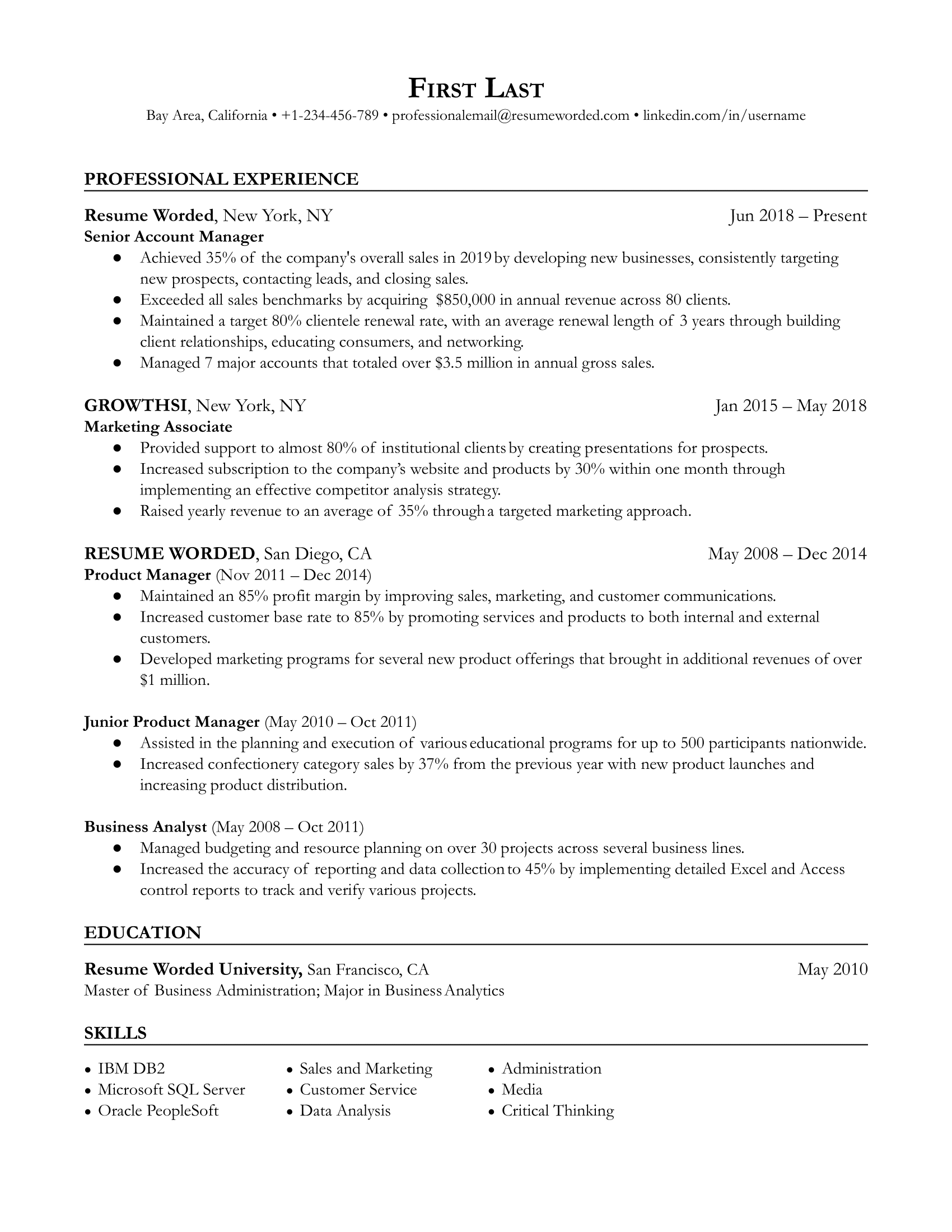

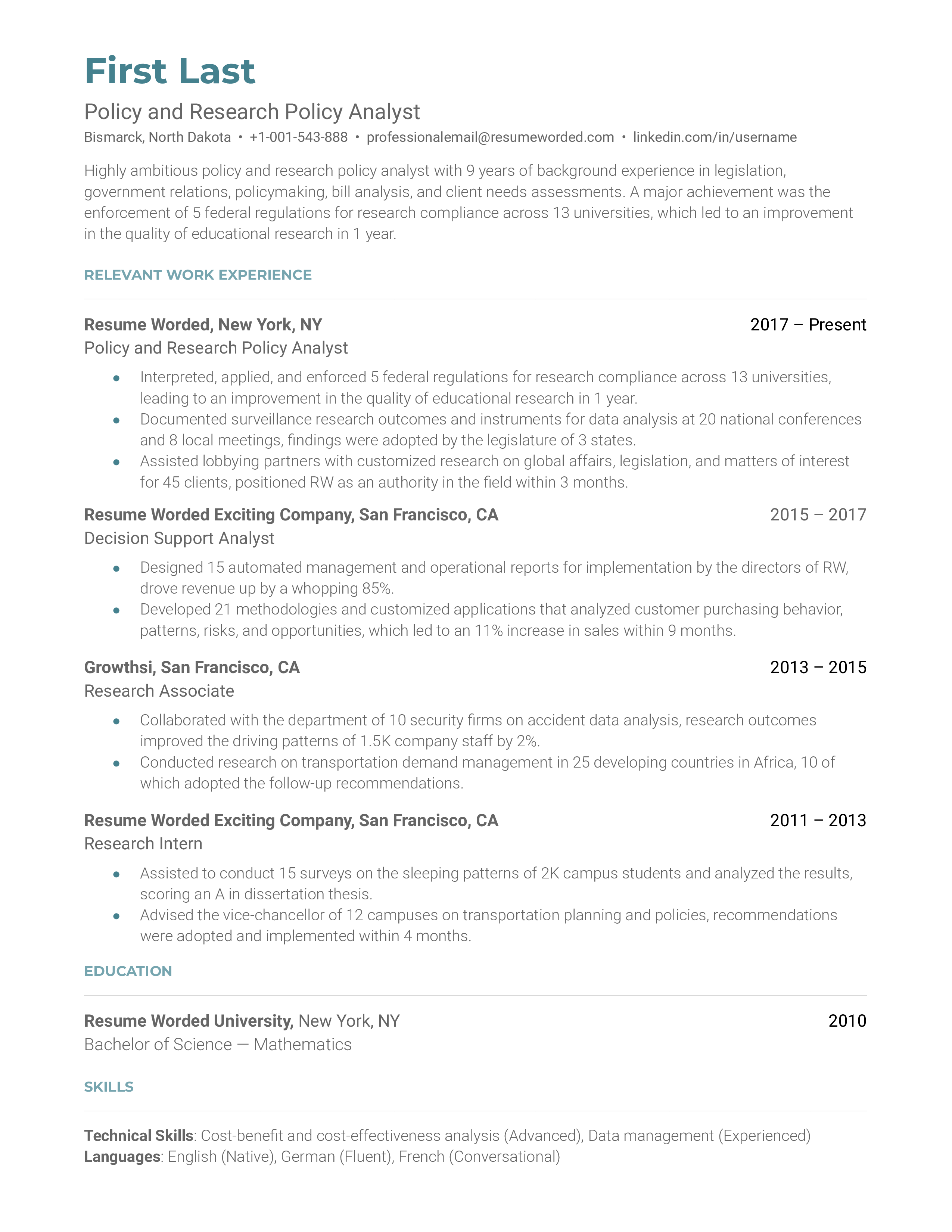

Quantifying achievements

Achieving a 15% increase in customer retention is an impactful accomplishment. Quantifying achievements like this shows potential employers the tangible results the candidate can bring to their company.

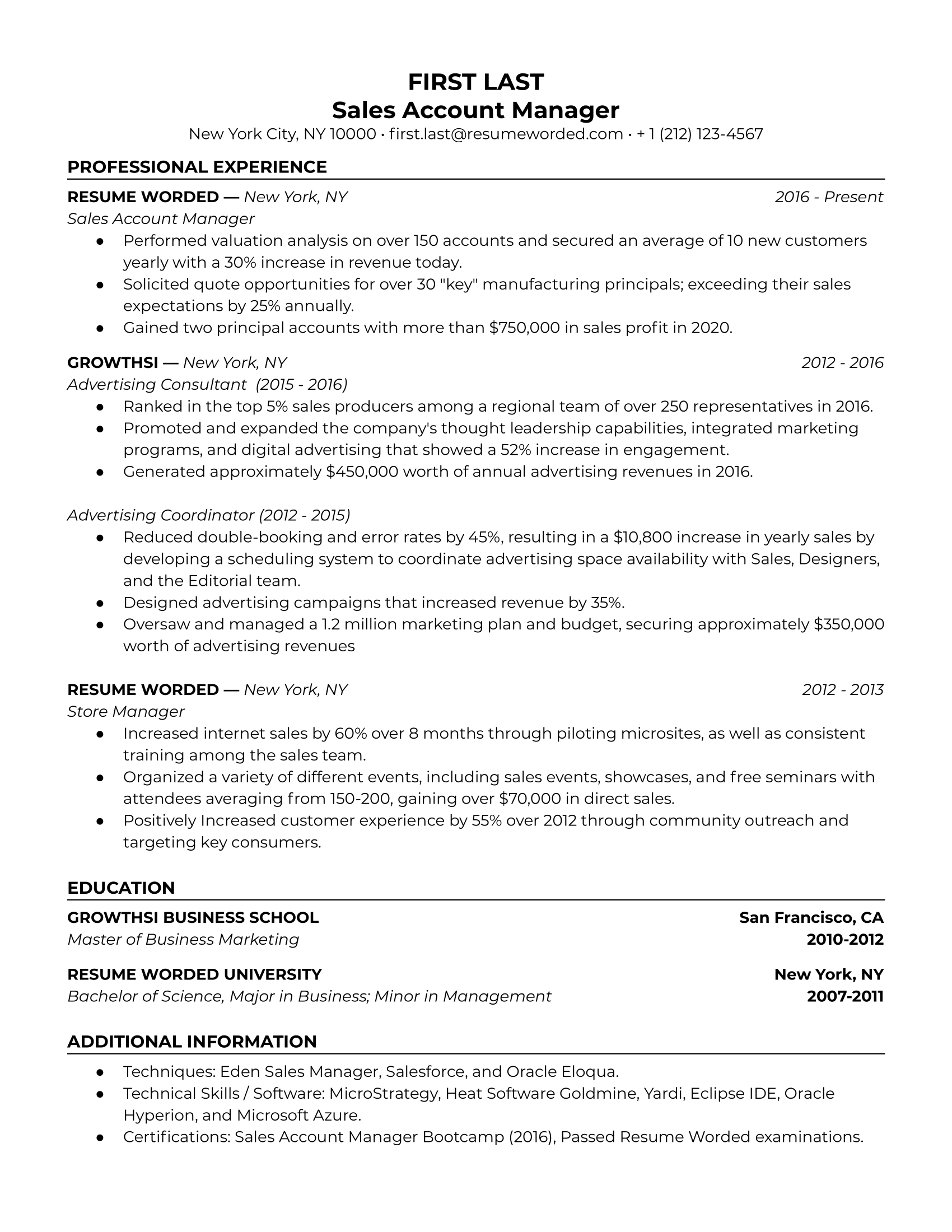

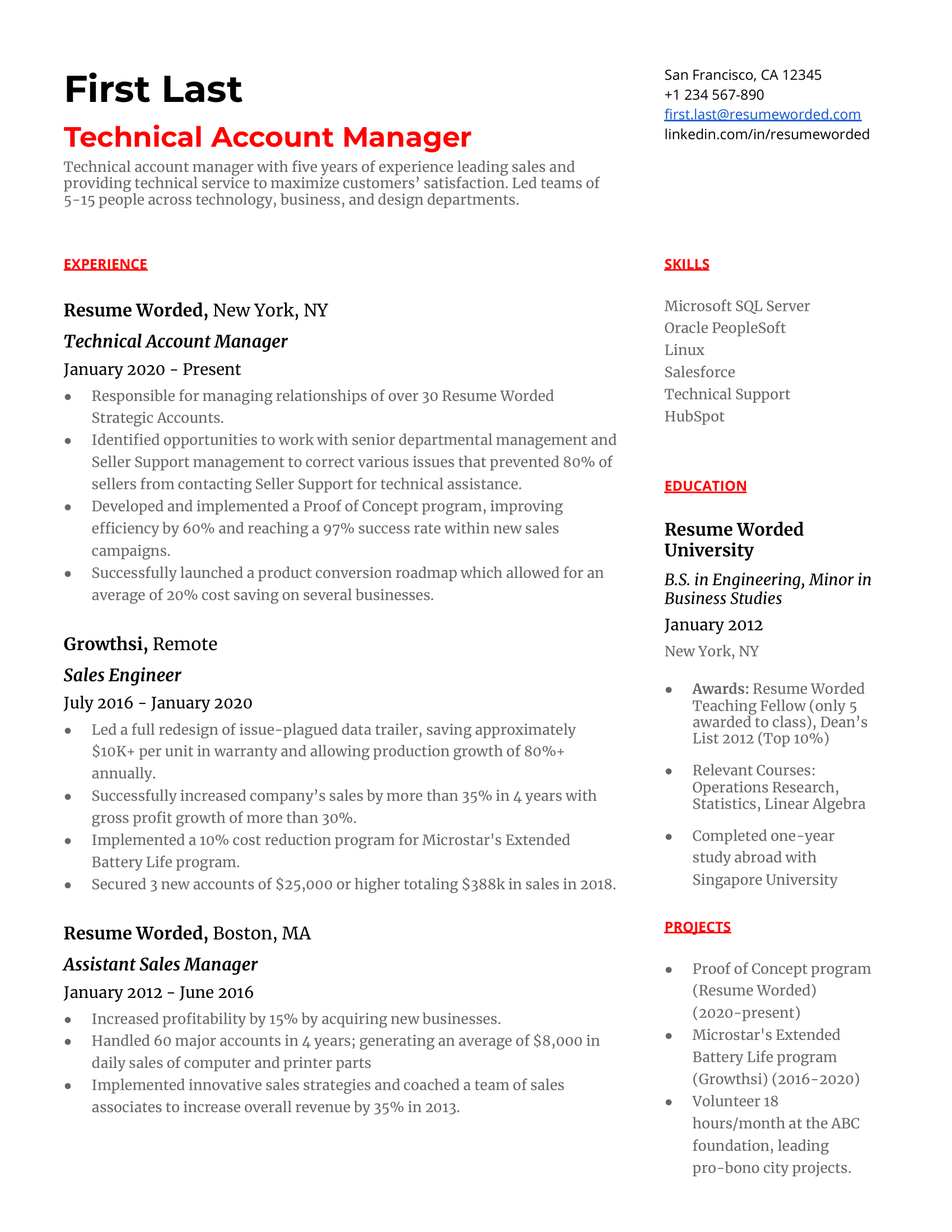

Demonstrating leadership skills

Managing a team and exceeding sales targets is evidence of effective leadership and the ability to motivate a team towards a common goal.

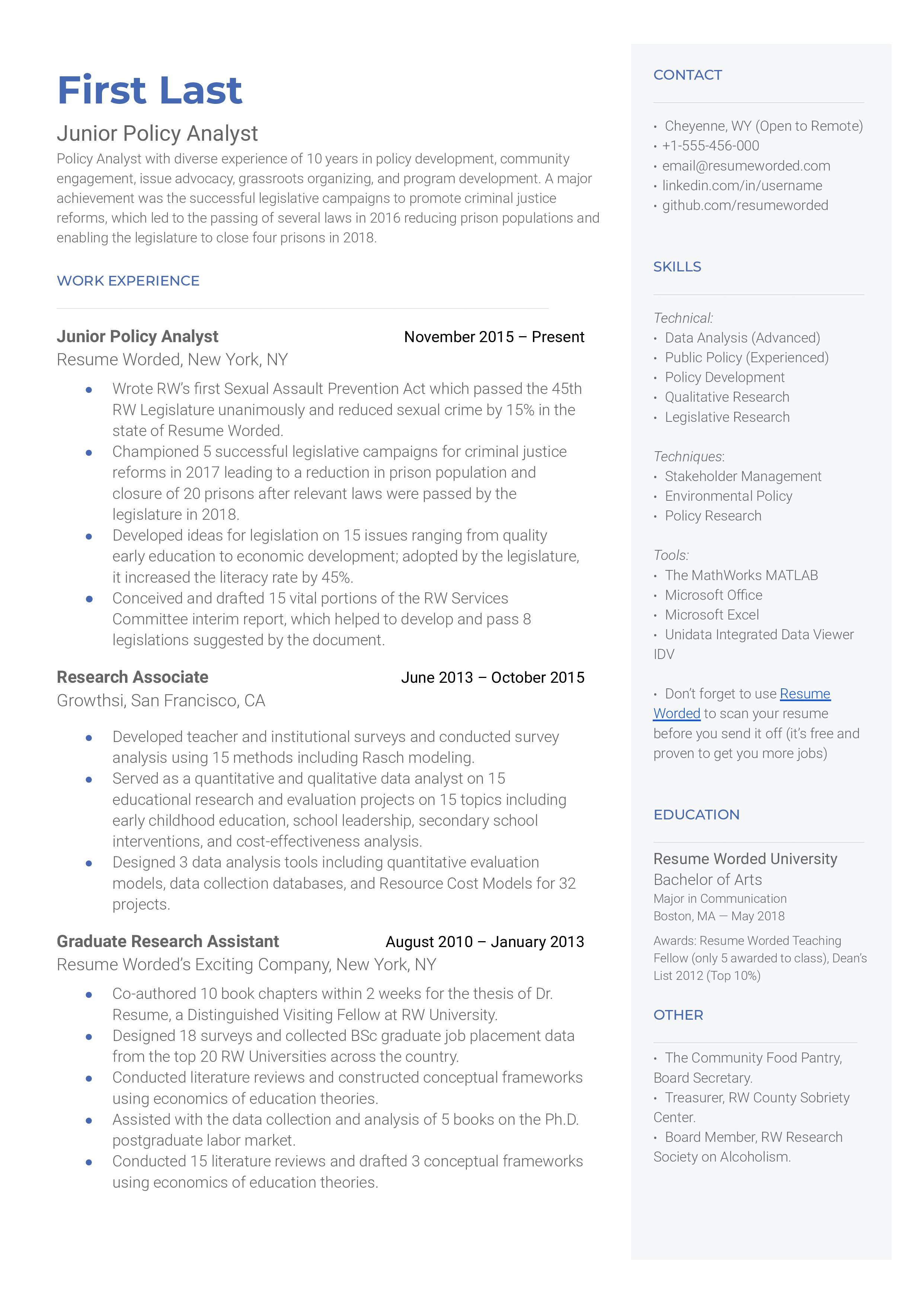

Showcasing versatility

Experience in both small startups and large corporate settings indicates adaptability and a broad skillset which is appealing to employers who are looking for versatile employees.

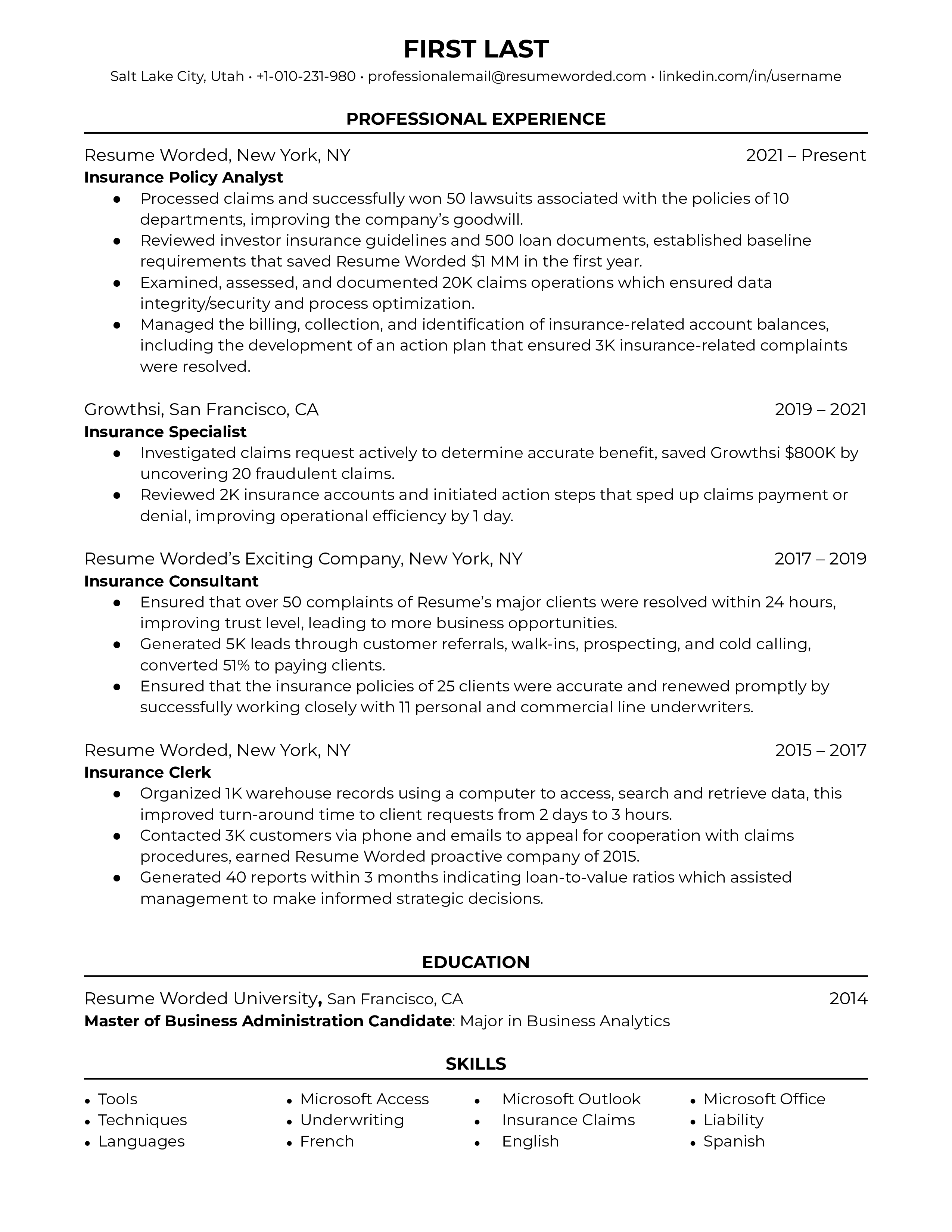

Establishing industry leadership

By stating they're a proven leader in the insurance industry, the candidate immediately sets a high bar. This kind of statement can help to position them as a high-value candidate, suggesting they're capable of taking charge and driving results.