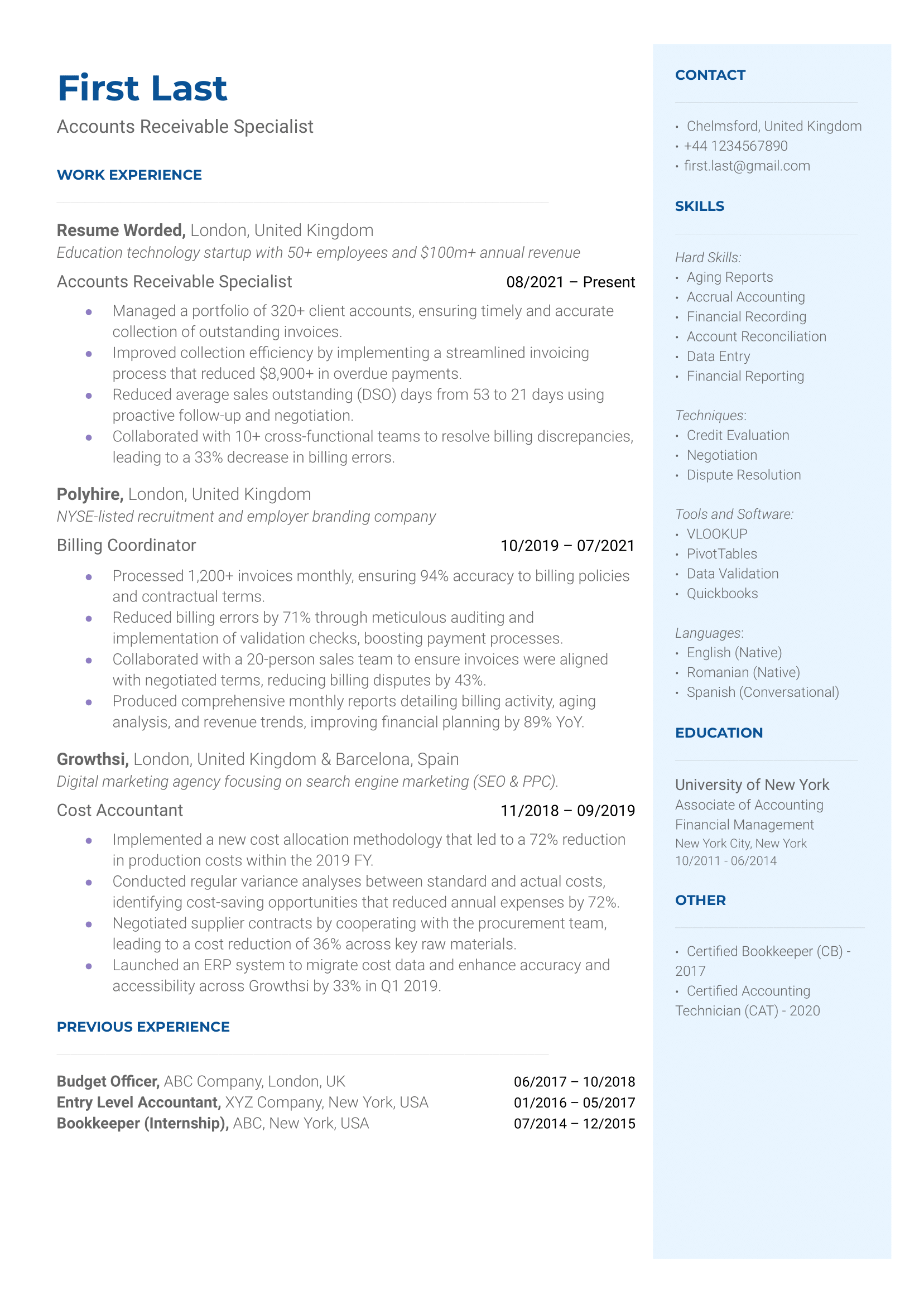

Quantify Your Success

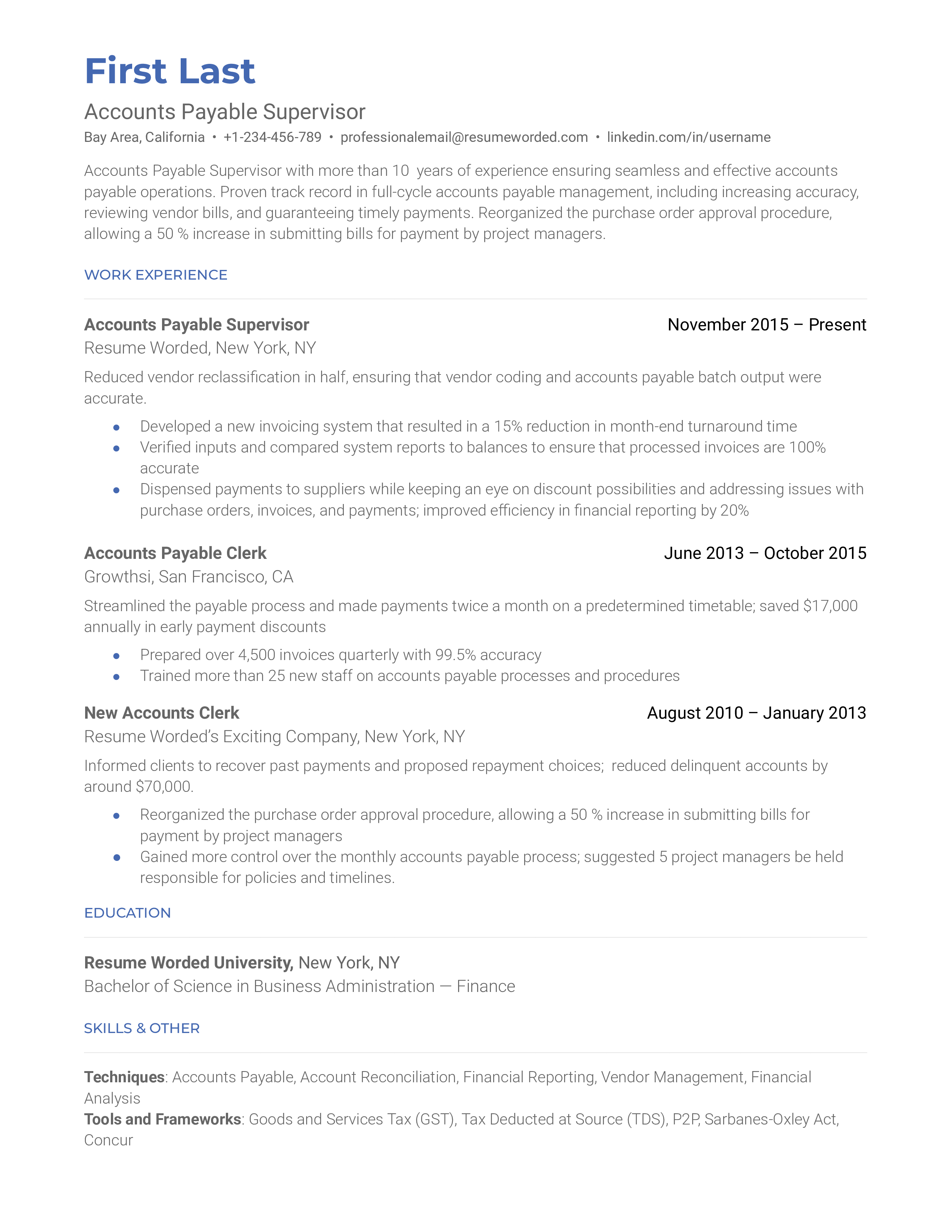

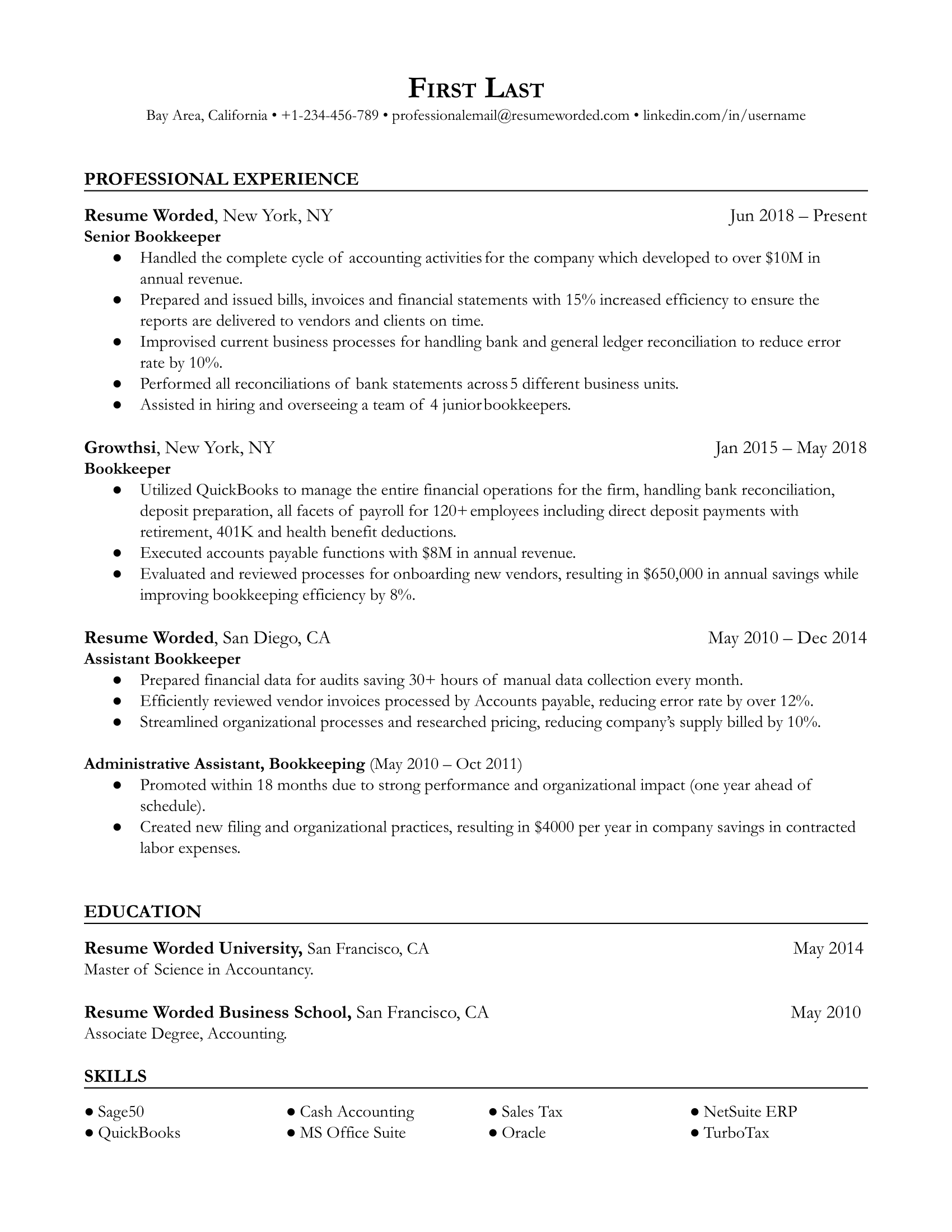

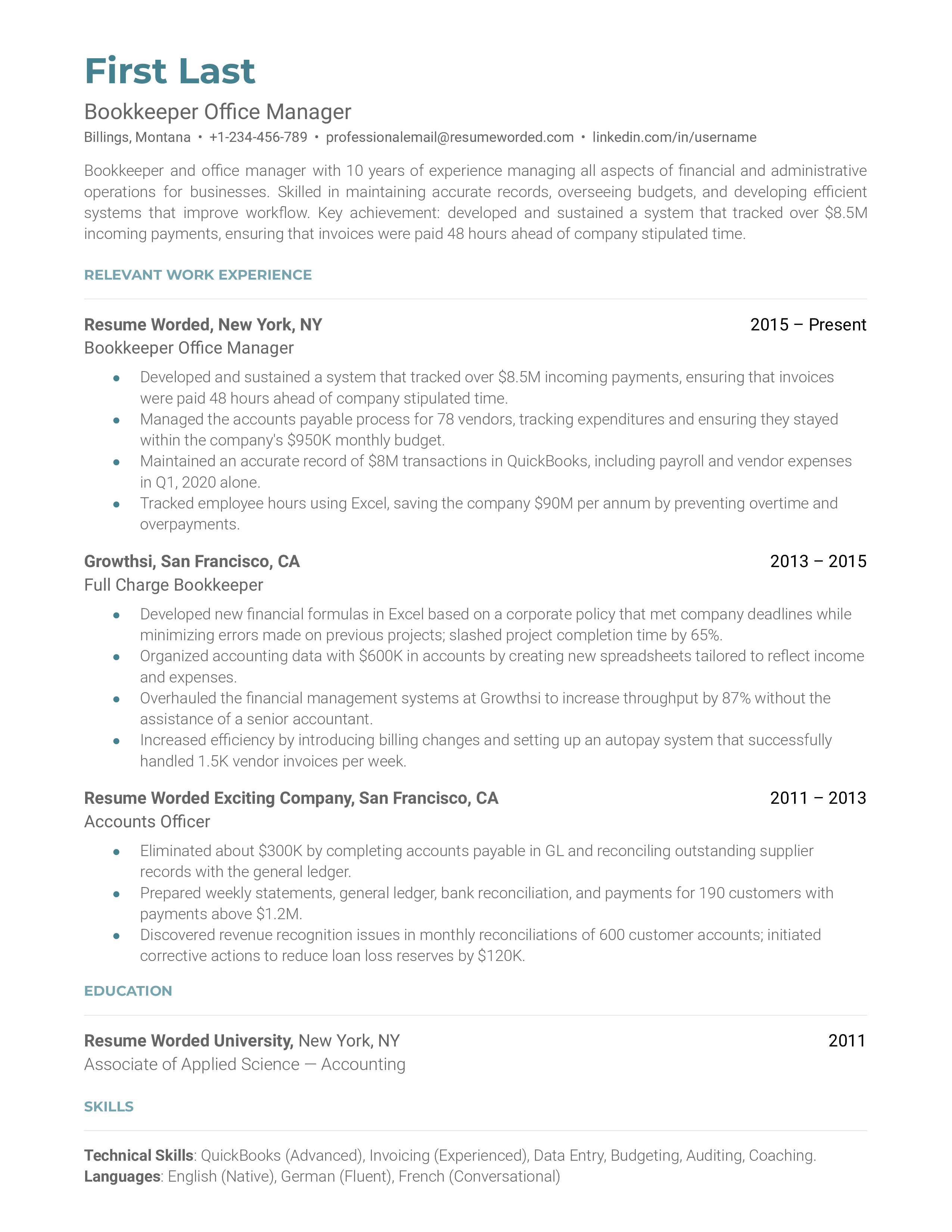

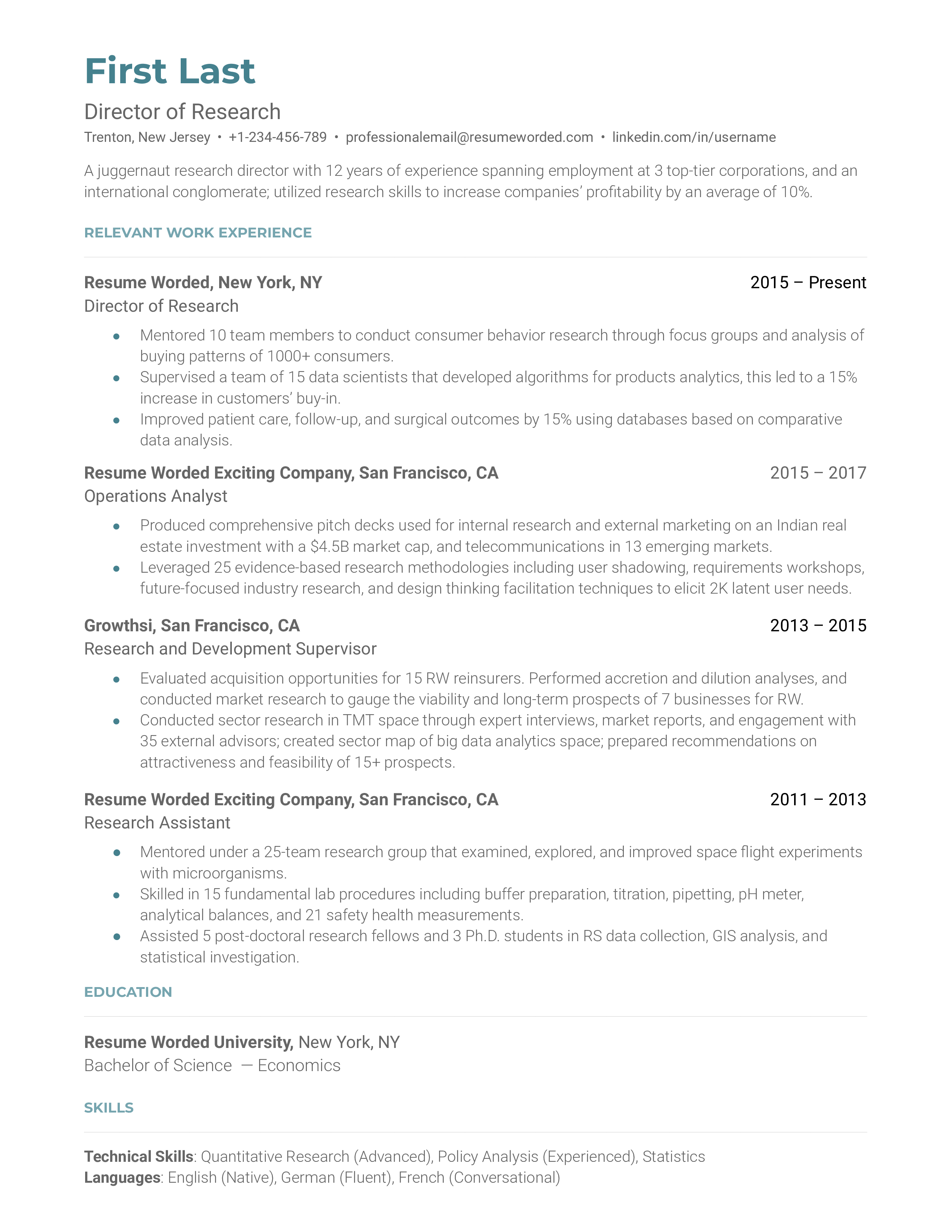

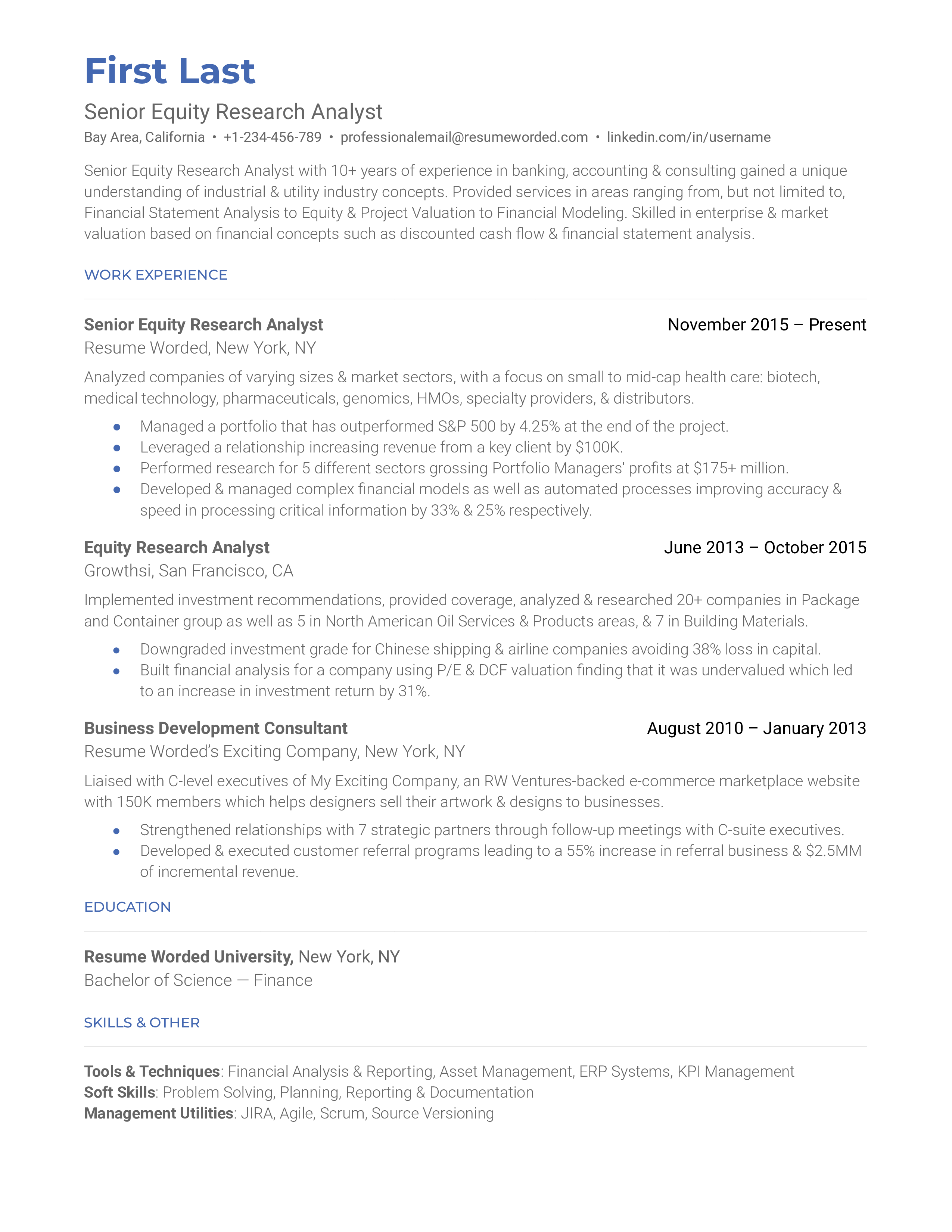

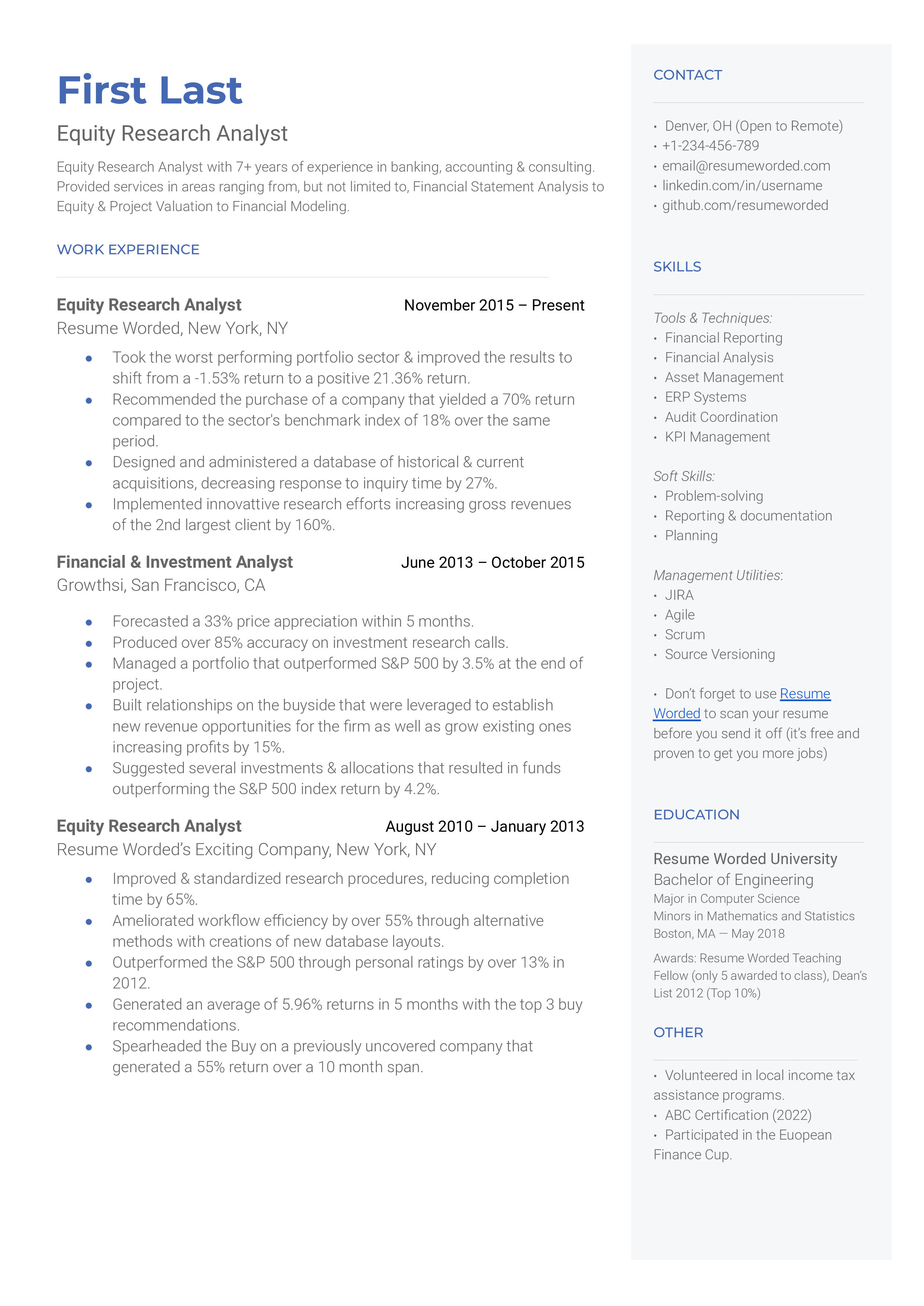

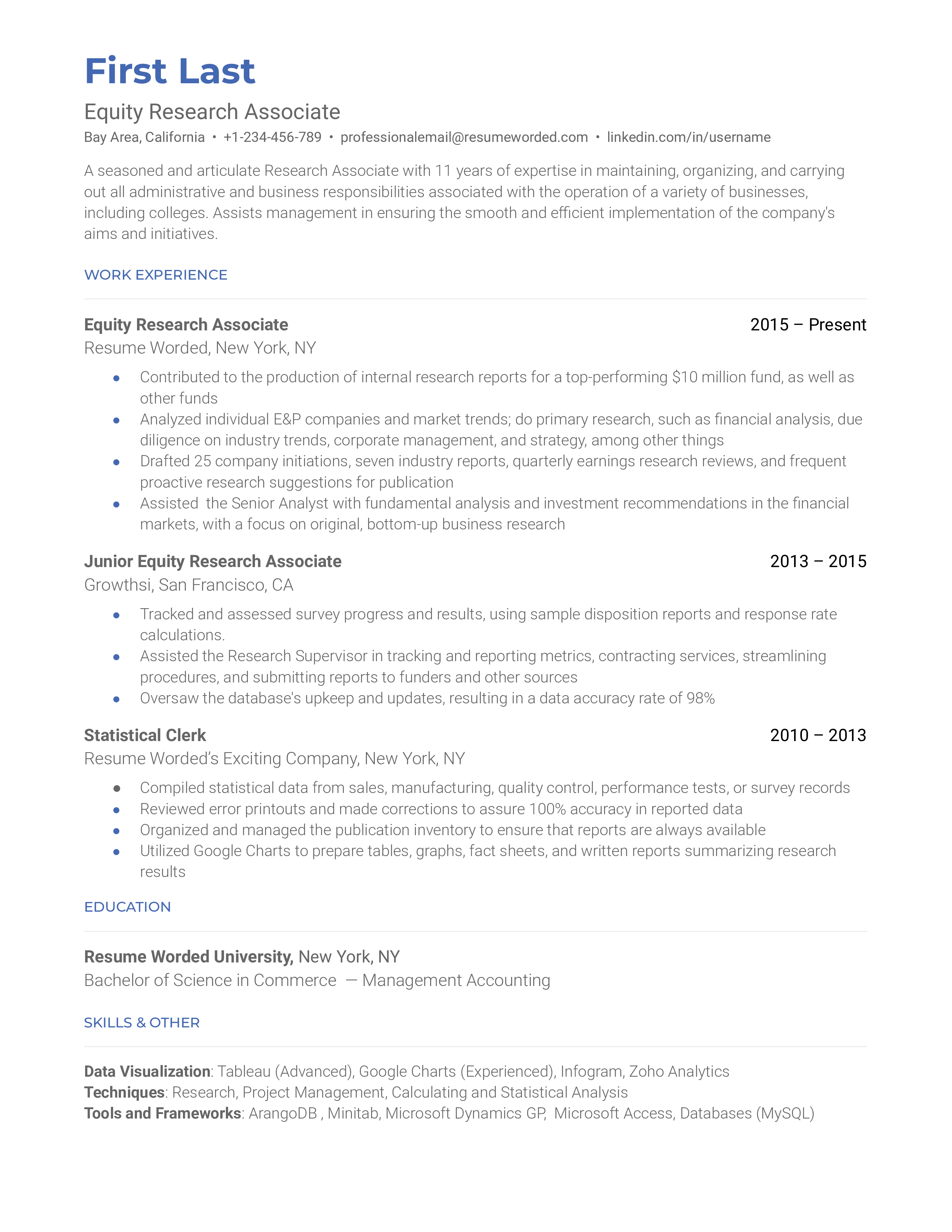

When you specify that you've managed a portfolio of 300+ accounts and recovered $500k in aged receivables, you're helping employers understand your capability to handle volume and deliver results. It's one thing to say you're good at your job; it's another to back it up with numbers.

Showcase Your Skills

By stating your proficiency in using collections software like FICO Debt Manager and Experian Tallyman, you're showing potential employers that you have hands-on knowledge of tools that can streamline their processes. Employers are more likely to shortlist candidates who are already familiar with the software they use, as it reduces the training time.

Demonstrate Value By Highlighting Achievements

By spelling out your track record in reducing delinquencies and improving cash flow, you're showing the potential employer the direct value you've provided in past roles. This hands-on experience and proven success can make you a more attractive candidate and sets a positive tone for the rest of the resume.