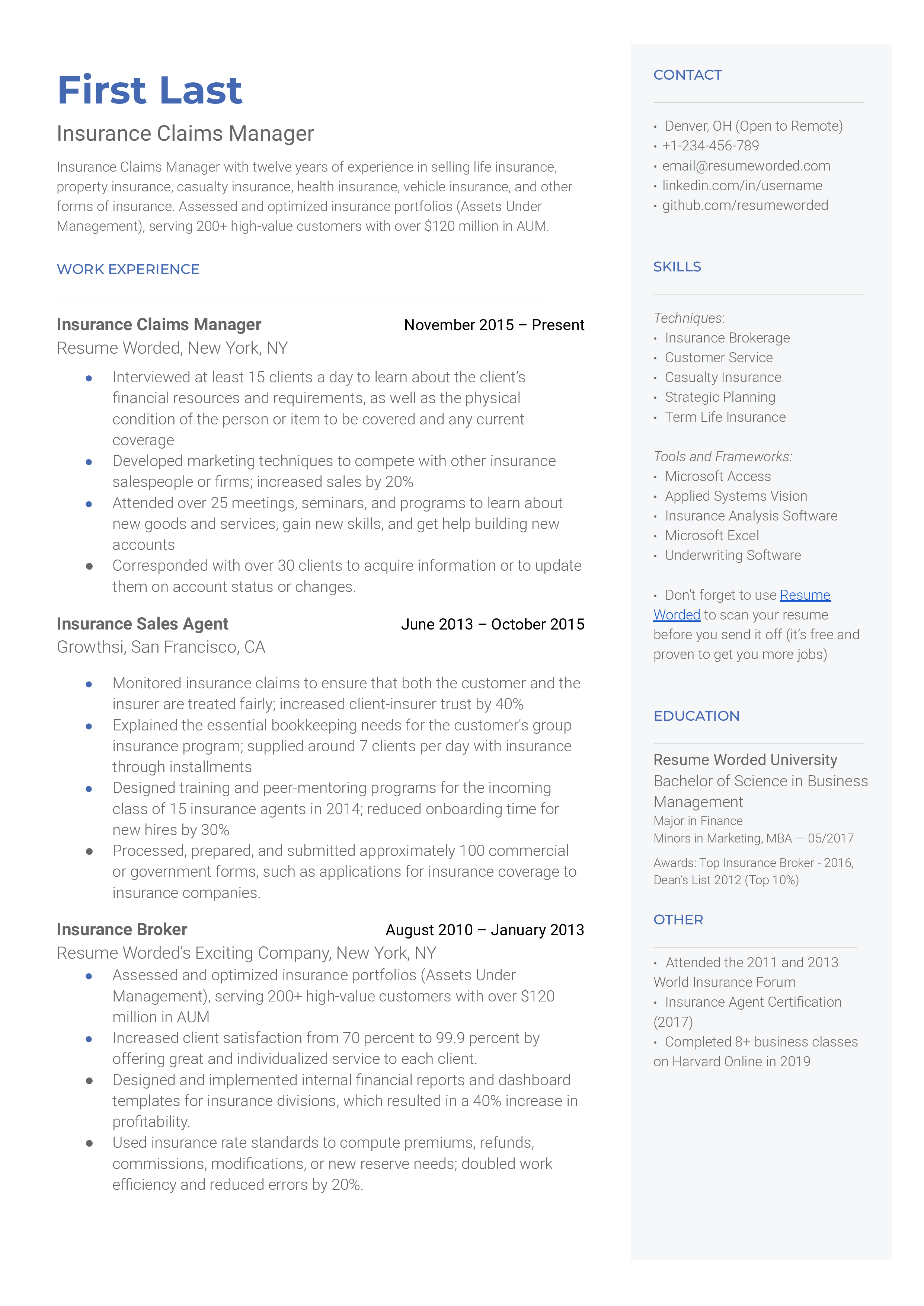

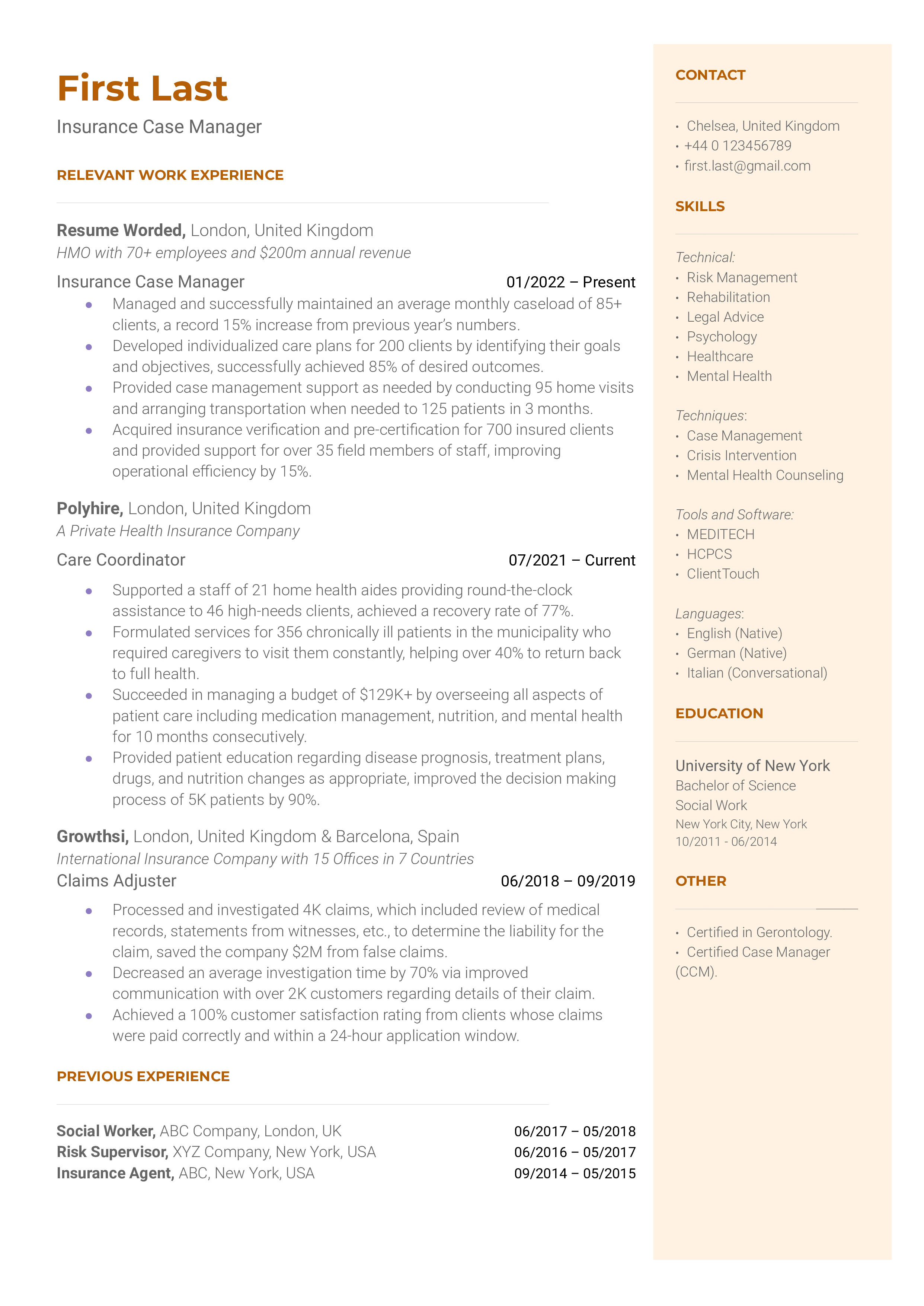

Showcasing Specialization

Pointing out your specialization, like 'specializing in auto and property claims', makes you an appealing candidate for similar roles. It also indicates that you have in-depth knowledge of that particular area, making you a potential asset for the company.

Highlighting Years of Experience

When you state your experience right off the bat like 'Claims Adjuster with 8 years of experience', it instantly grabs attention. It gives a sense of your know-how in the field. But remember, raw years aren’t everything. It's about what you've learned, accomplished, and how you've grown in those years.