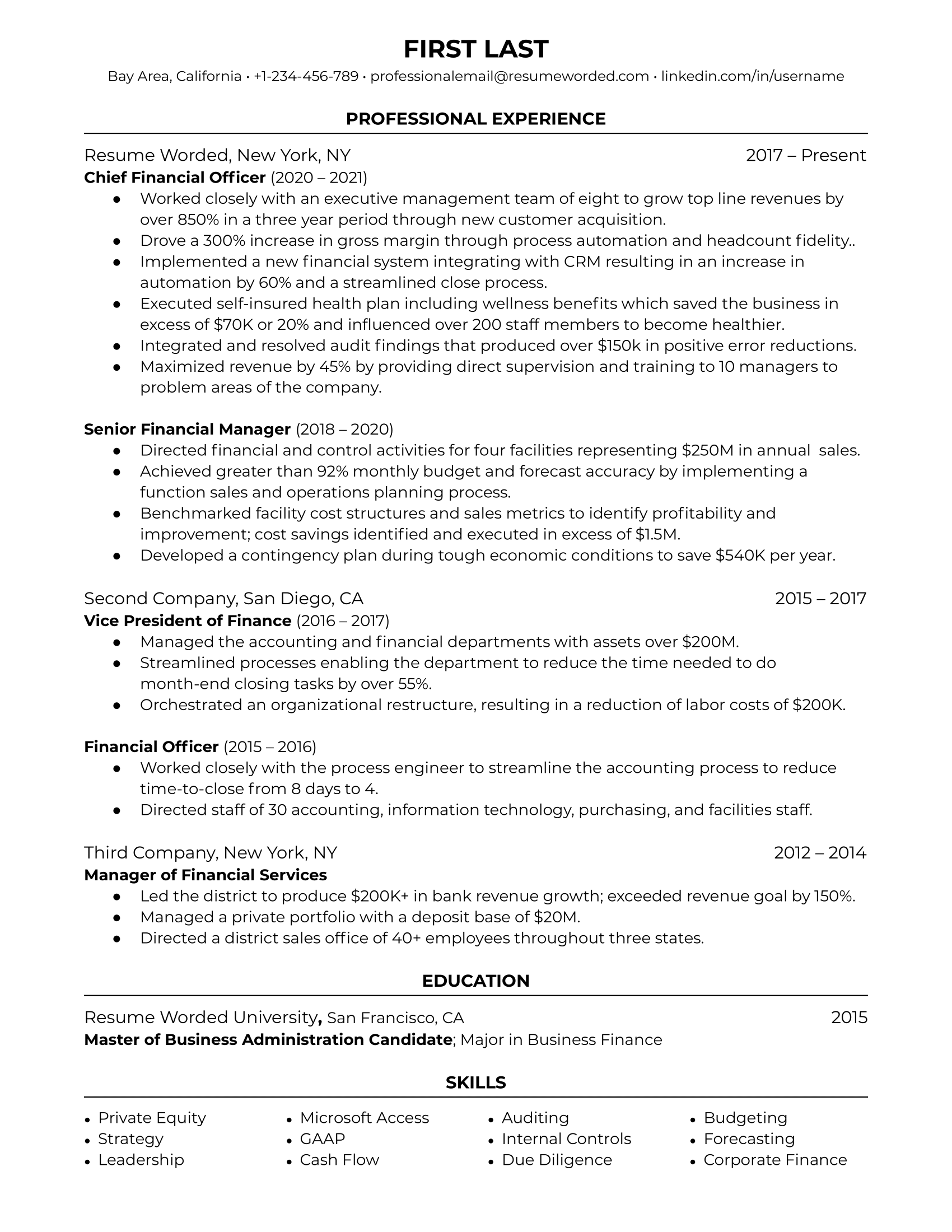

Quantify your achievements

Increasing client portfolio returns by 20% - that's the sort of hard data we love to see! It's not just a vague promise of great results, it's a concrete example of what you've achieved. It tells recruiters exactly what you can do.

Highlight client retention rate

A 98% client retention rate is an impressive figure. It shows that you're not just good at getting clients, you're also good at keeping them. This proves that you've got excellent client management skills.

Showcase years of experience

When you say "Financial Advisor with a decade of experience", it immediately gets attention. Why? It shows stability and commitment. You're not hopping around every six months - you're someone who sticks around and gets the job done over the long haul.