Highlight Leadership Skills

By mentioning that you've led a team, you're not just a solo performer, but someone who can manage and lead others. This is a skill highly valued in the equity research field where collaboration is key.

Approved by hiring managers, here are proven resume summary examples you can use on your Equity Research resume. Learn what real hiring managers want to see on your resume, and when to use which.

By mentioning that you've led a team, you're not just a solo performer, but someone who can manage and lead others. This is a skill highly valued in the equity research field where collaboration is key.

Managing a hefty portfolio like '$400M' is impressive, but outperforming a major index? That's something else. It gives me confidence in your ability to make smart, profitable decisions. It's one thing to play the game, it's another to consistently win.

By mentioning the specific quantitative modeling tools 'MATLAB and Python' you use, you demonstrate a proficiency in complex analysis methods. This tells me you can not only understand the market but predict and capitalize on its movements.

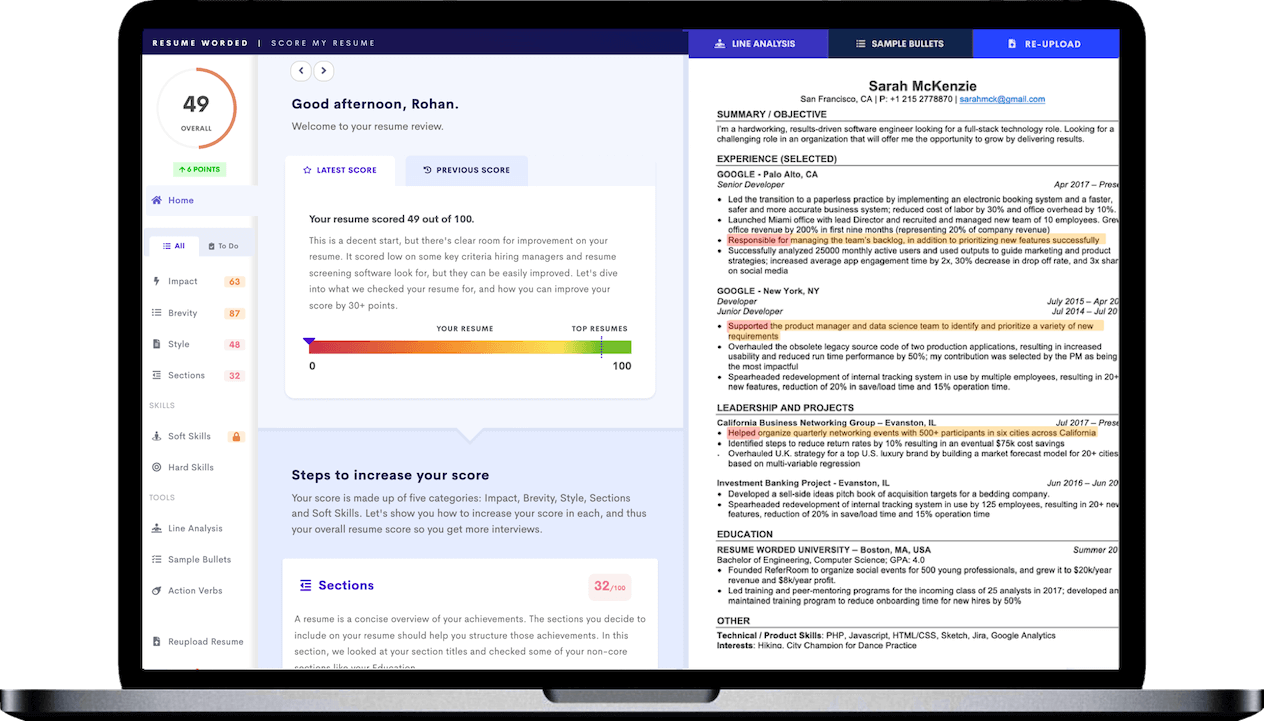

Applying for jobs can feel like throwing your resume into a black hole. Our tool helps you optimize your resume so it gets noticed by the right people. Get a detailed analysis and personalized suggestions for improvement in just a few clicks.Score My Resume Now

By underlining that you guided '$200M' of investments, you're not just saying that you're experienced. You're showing me that you can steer a hefty sum towards consistent returns, which shows me that you're a reliable navigator in the unpredictable world of investments.

Naming the specific financial modeling tools you use, such as 'Argus and Stata', tells me you have a solid understanding of the intricacies of real estate finances. It suggests that you're capable of producing accurate and robust financial models, a critical skill in equity research.

By pointing out that you assisted in managing a $200M portfolio with an 8% annual return, you show your direct contribution to success. It assures recruiters of your hands-on experience.

SQL and Excel are critical tools for data handling in equity research. By explicitly stating your familiarity with these tools, you signal your readiness to hit the ground running.

When you specifically mention how you advised clients on a substantial amount of investments like '$300M', it shows you can handle serious money and make impactful decisions. It's not just about doing the job, it's about making a difference. As a recruiter, I'm not just hiring a professional, I'm hiring a game-changer.

By noting your proficiency in specific data analysis tools like 'R' and 'Tableau', you demonstrate your ability to handle complex data sets, which is crucial for an Equity Research Consultant. Not only does it let me know you're comfortable with numbers, but also that you can turn data into insights.

By mentioning that you've analyzed over 50+ tech stocks, you're demonstrating a concentrated expertise in a particular sector. This can be a valuable asset in a research team looking for sector-specific knowledge.

Your familiarity with FactSet and Excel shows that you're comfortable with important industry tools. This is particularly important for an intern, as it demonstrates you've already started building the skills necessary to succeed in this field.

Oversight of a $1B portfolio is no small feat. When you mention this, you're driving home your experience in managing substantial assets, a key requirement for a leadership role in equity research.

Implementing machine learning techniques shows you're not just following the status quo, but you're actively seeking out innovative ways to improve accuracy and efficiency in equity research. This gives you an edge in today's data-driven environment.

As a junior analyst, your contributions matter. By showcasing a 5% increase in portfolio value, you demonstrate that even at an early stage, you've been able to make a significant impact.

Today's equity research involves a lot of data analysis. Highlighting your skills in Bloomberg Terminal and Python shows you're up-to-date with the tools of the trade and can leverage them to deliver results.

When you highlight that your research reports influenced '$700M' worth of investments, it demonstrates that your work carries substantial weight and impact. I can see you're not just analyzing the market, you're shaping investment decisions.

By stating that you employed 'SAS and Eikon' for data analysis, you demonstrate your proficiency in specialized financial tools. This suggests to me that you can dig deep into the data to provide accurate and insightful financial forecasts.

Directing a team to a 15% increase in portfolio value is a tangible result that recruiters want to see. It shows that you not only led the team, but you drove them to succeed.

Guiding C-suite executives in investment decisions signals that you're comfortable operating at the highest levels of a company. It shows you're a trusted advisor who can handle big responsibilities.

"My free resume review was truly eye-opening. I found out why I wasn't getting interviews and exactly what to add to get past resume screeners. I've already had way more callbacks since I used it. I recommend it to all my friends who are job searching."

"Probably the best thing I've done this year. Showed me what my strengths were and the jobs and industries I should be focusing on. The most impactful part though was how it identified this spiral I'd been doing subconsciously - yikes, freakishly accurate."

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Showcase Your Successes

When you talk about your successes such as delivering insightful market analyses and managing over $500M in assets, it gives recruiters concrete proof of your capabilities. It's like saying "Here's what I've done, and I can do it for you too."