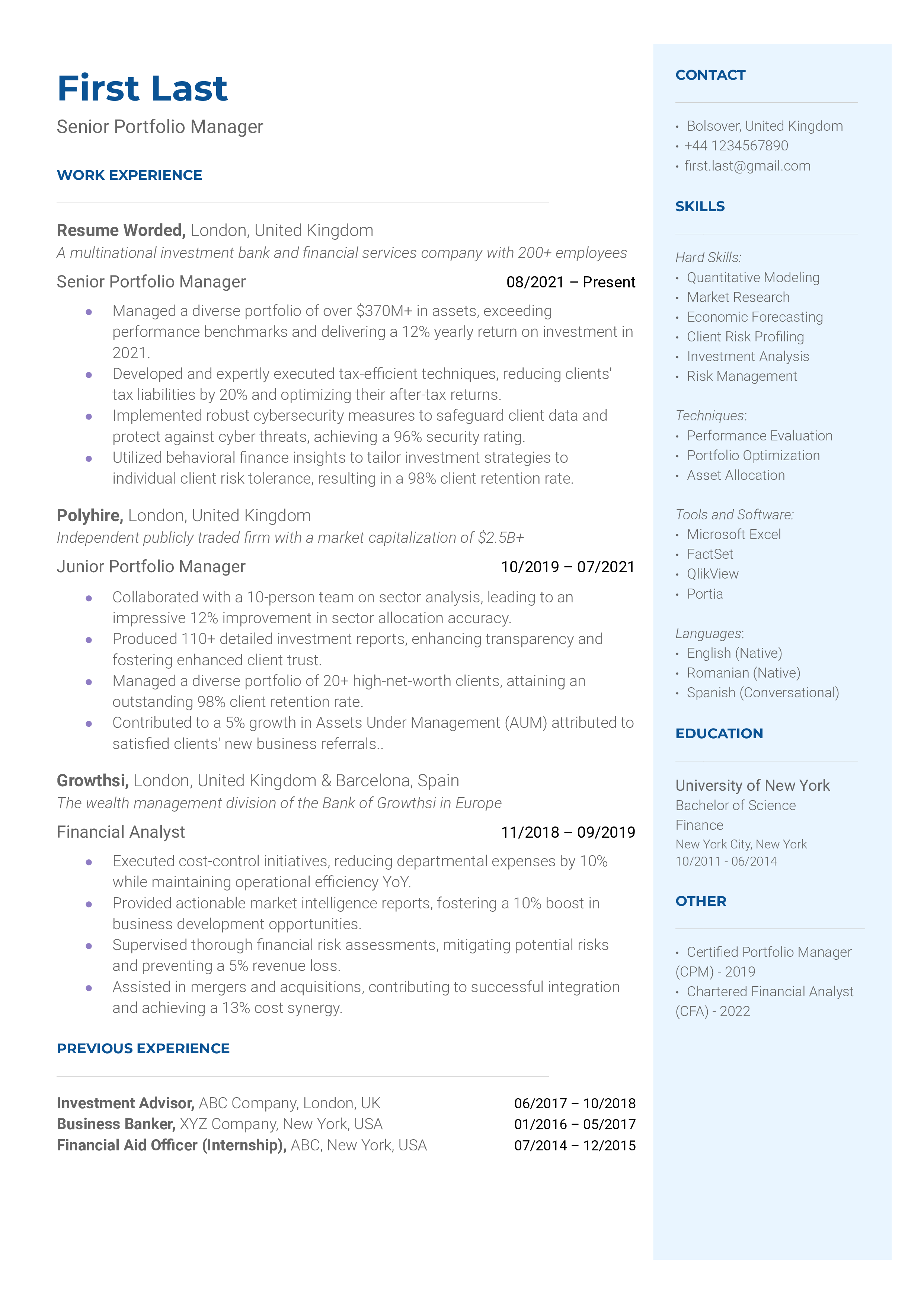

Showcasing leadership skills

When you mention you've led cross-functional teams, it's a subtle way to tell recruiters you possess strong leadership skills. It's a way to show you're comfortable in a team-leader role without directly stating it.

Focusing on strategic contributions

By drawing attention to your ability to create financial models and reports that guide strategic decision-making, you're positioning yourself not just as an executor, but a strategic thinker. That's a valuable skill set in the world of investment banking.

Highlighting major transactions

By mentioning the large transactions you've managed and closed, you're directly demonstrating your capability to handle large-scale projects. This can instill confidence in potential employers about your ability to perform under pressure and manage high-stakes deals.