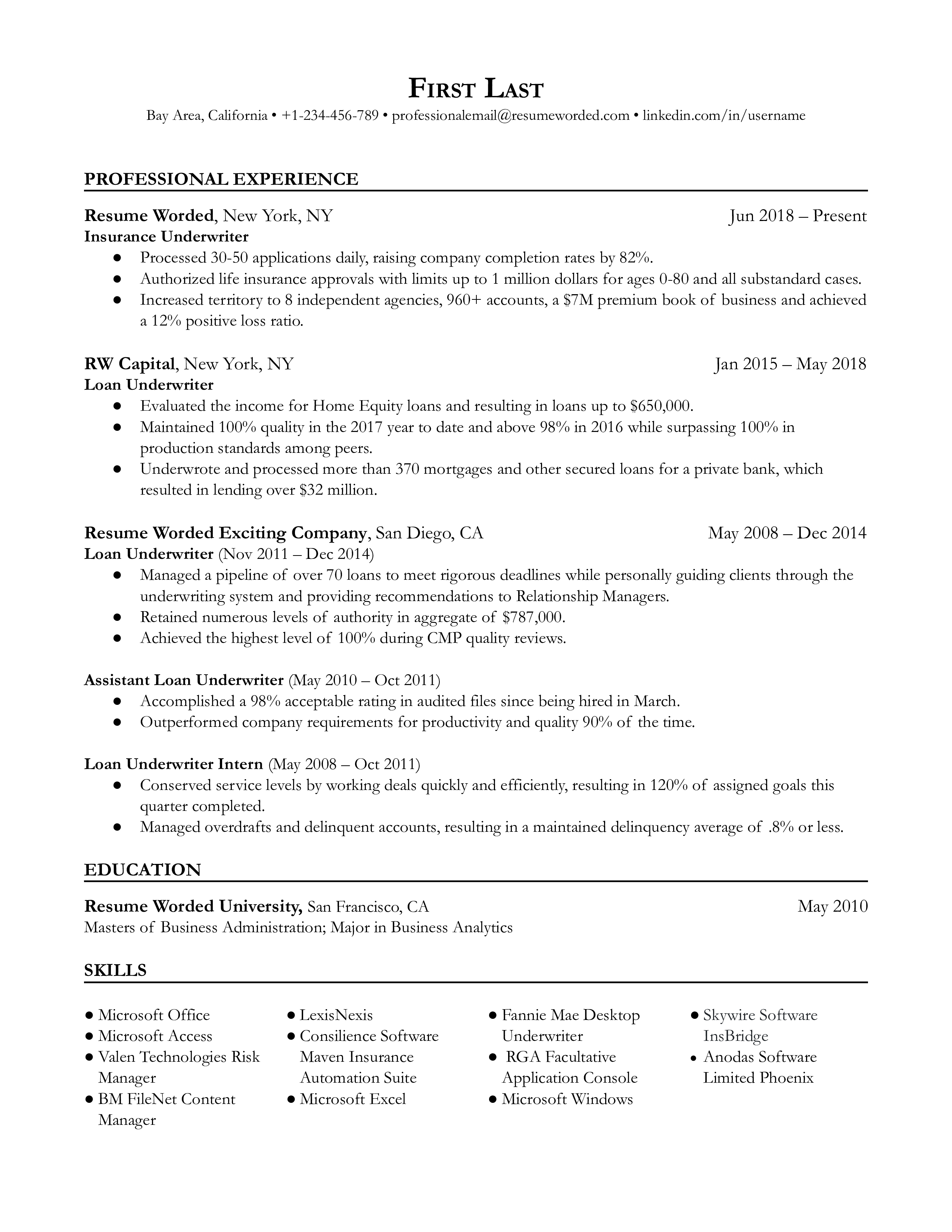

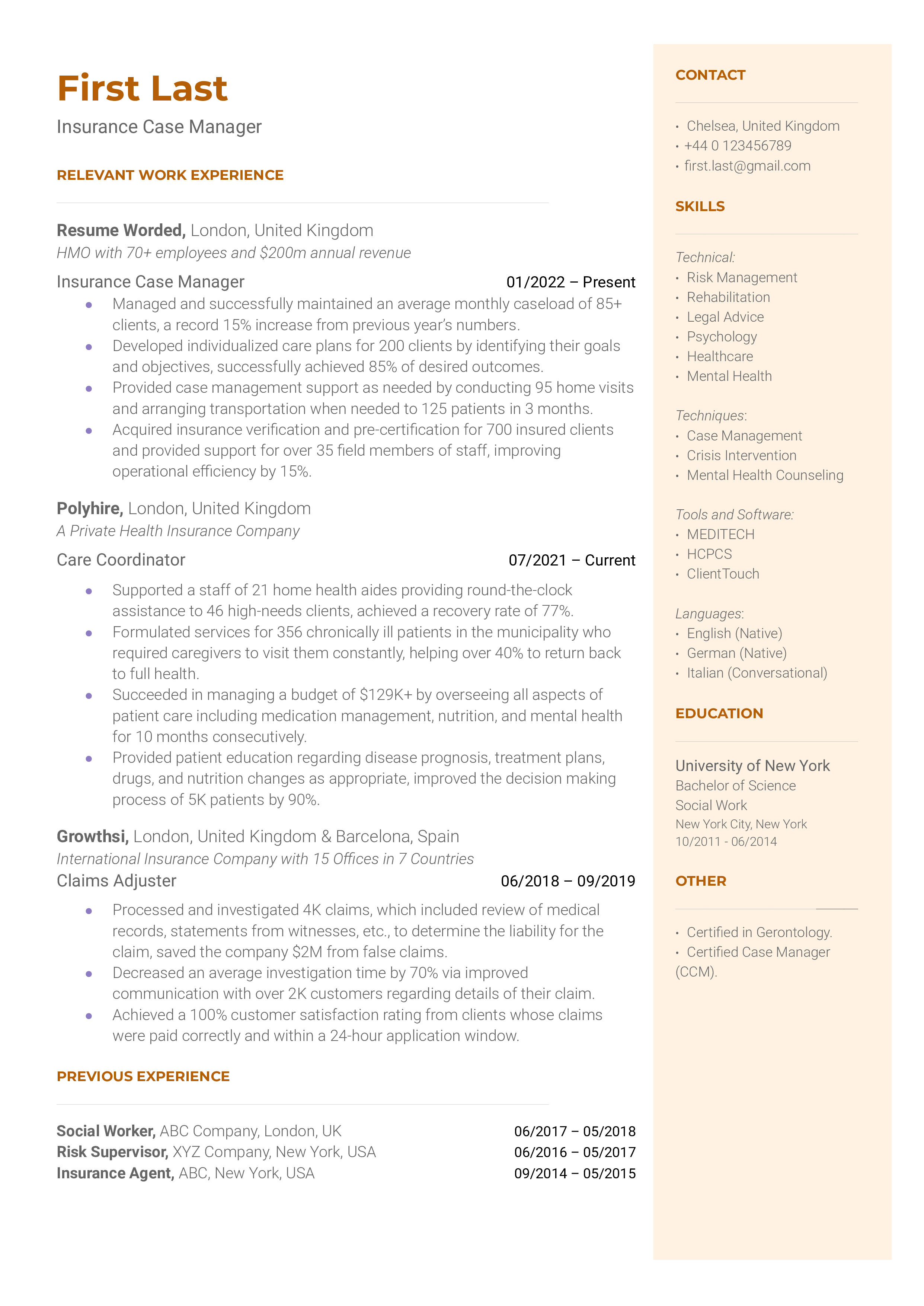

Showcase your strategic contribution

Underwriters are often seen as simply gatekeepers, but you've shown that you can be strategic, too. By developing and implementing risk management strategies, you demonstrate your ability to improve profitability, not just avoid losses. This is a game-changer in how employers will view your application.

Demonstrate quantifiable impact

As an underwriter, your ability to minimize losses is a key skill. By highlighting a solid 30% reduction in claim losses, you're showing that you can deliver real, bottom-line results. Employers love numbers. It gives them a tangible sense of what you could bring to their team.