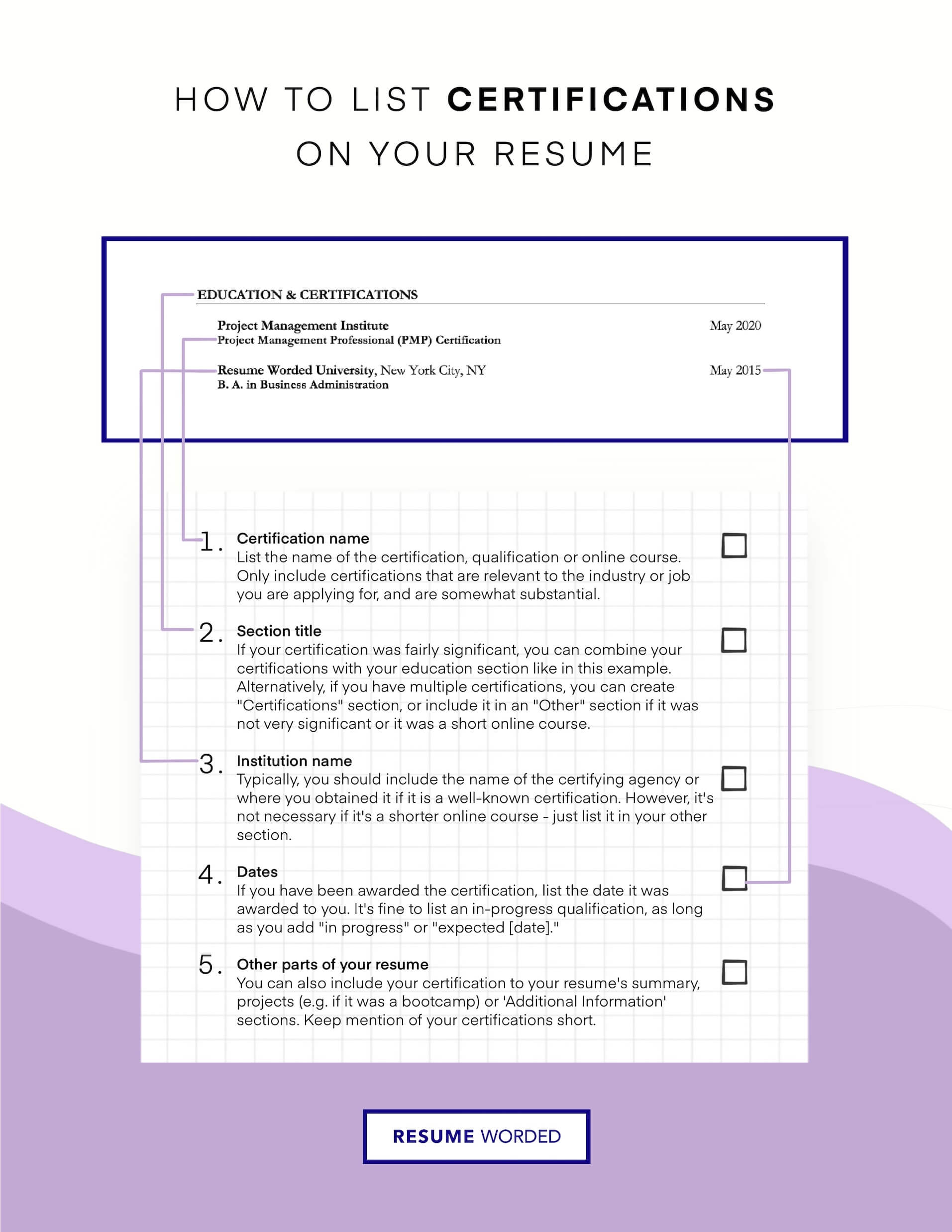

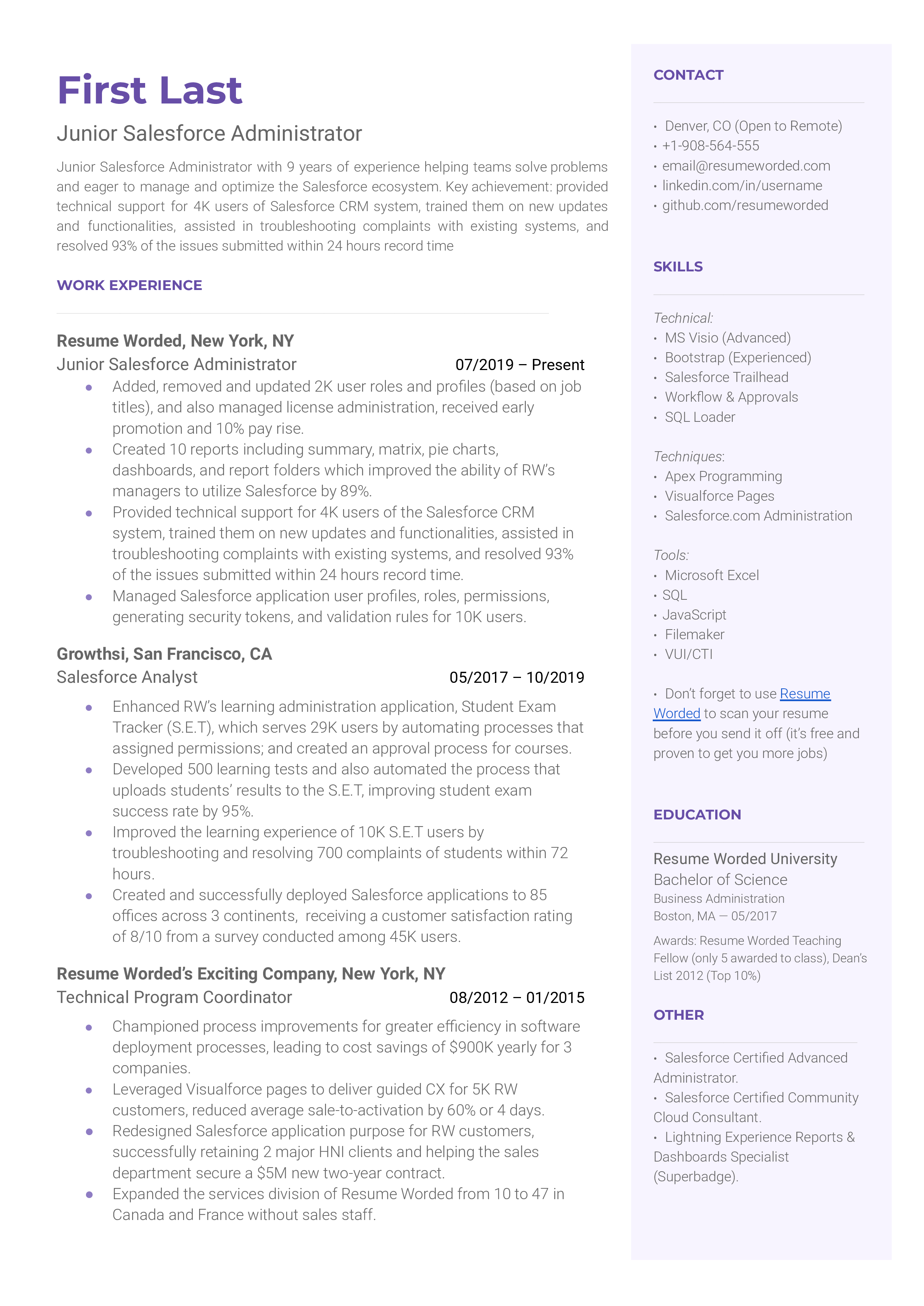

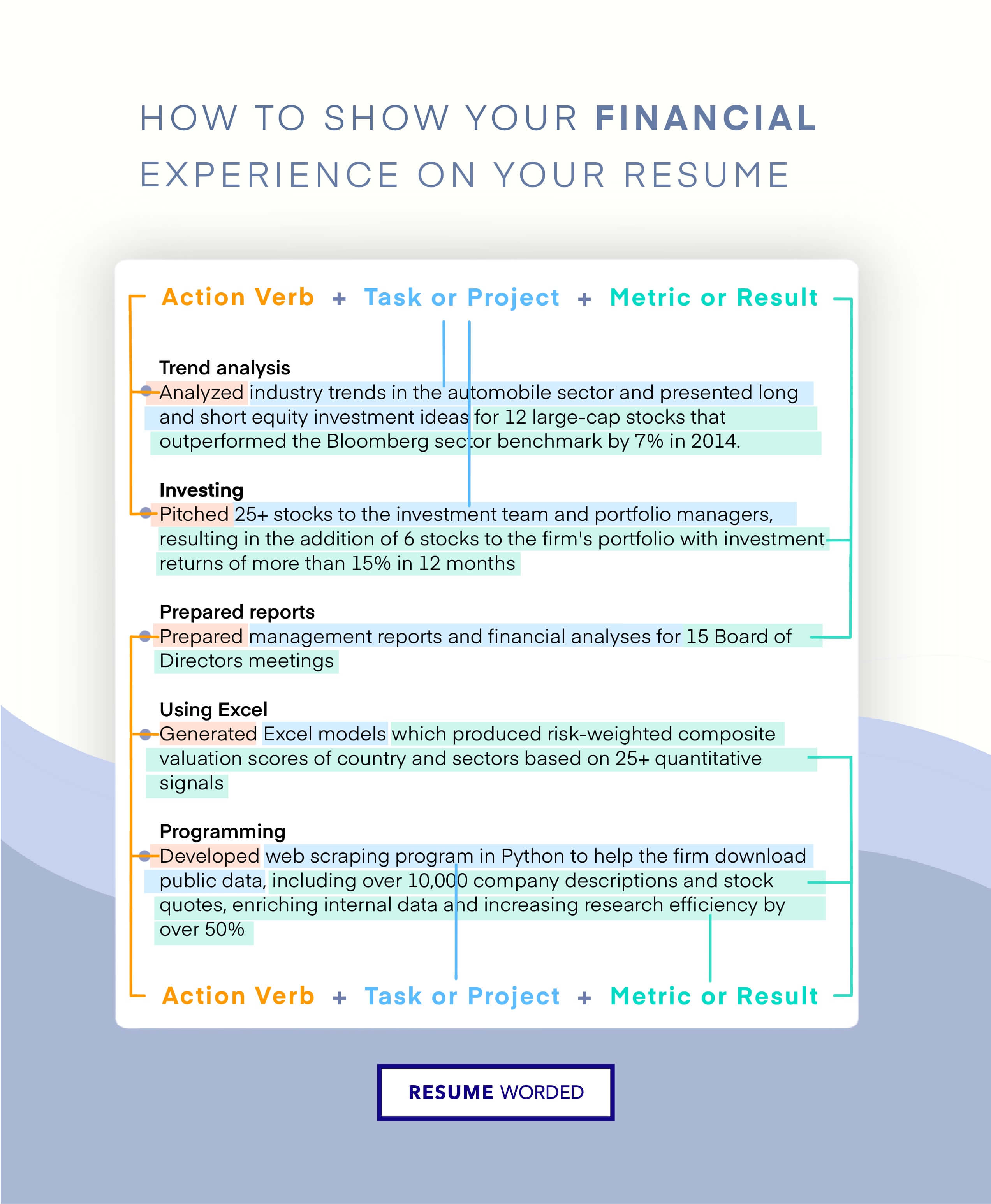

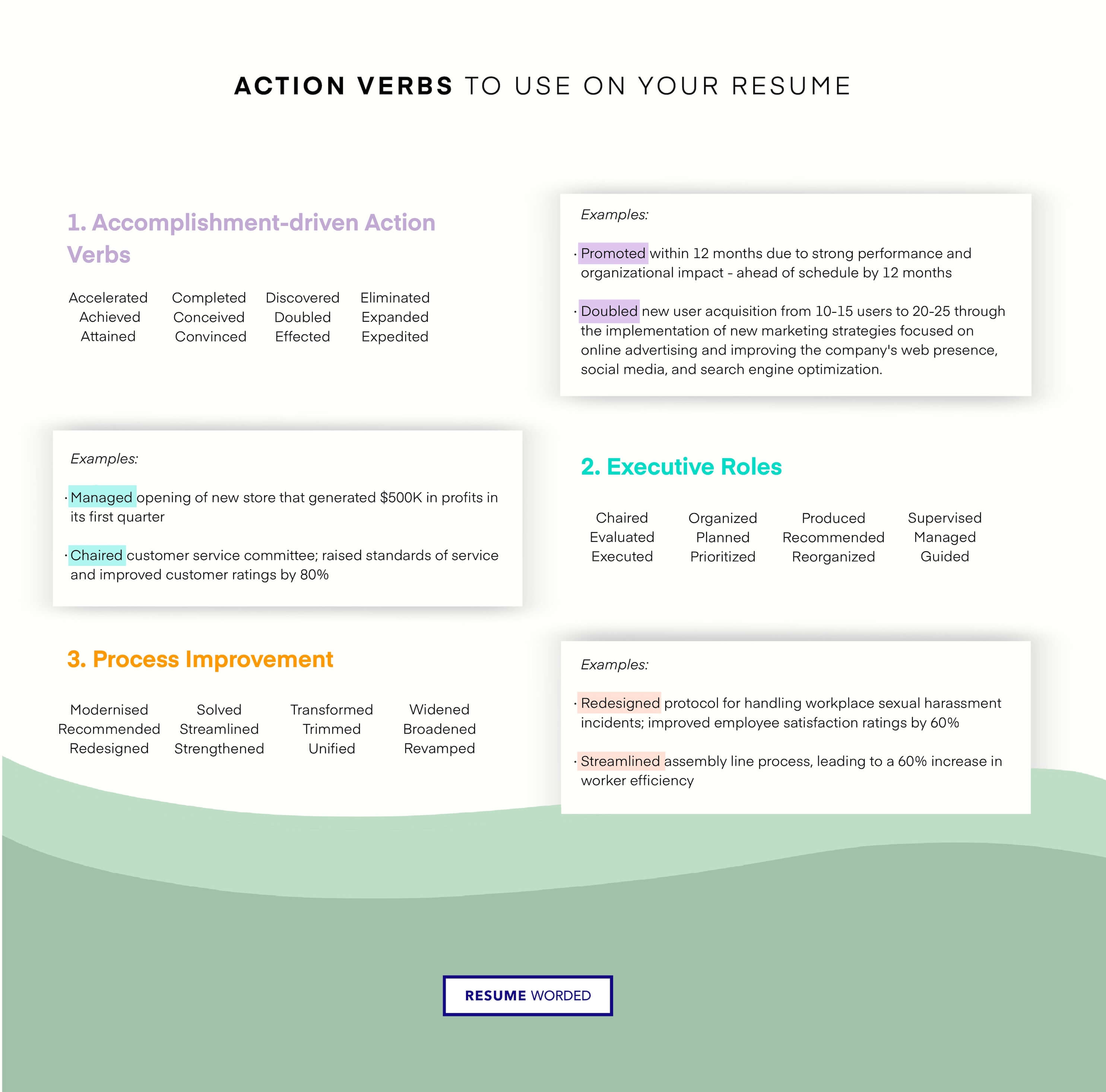

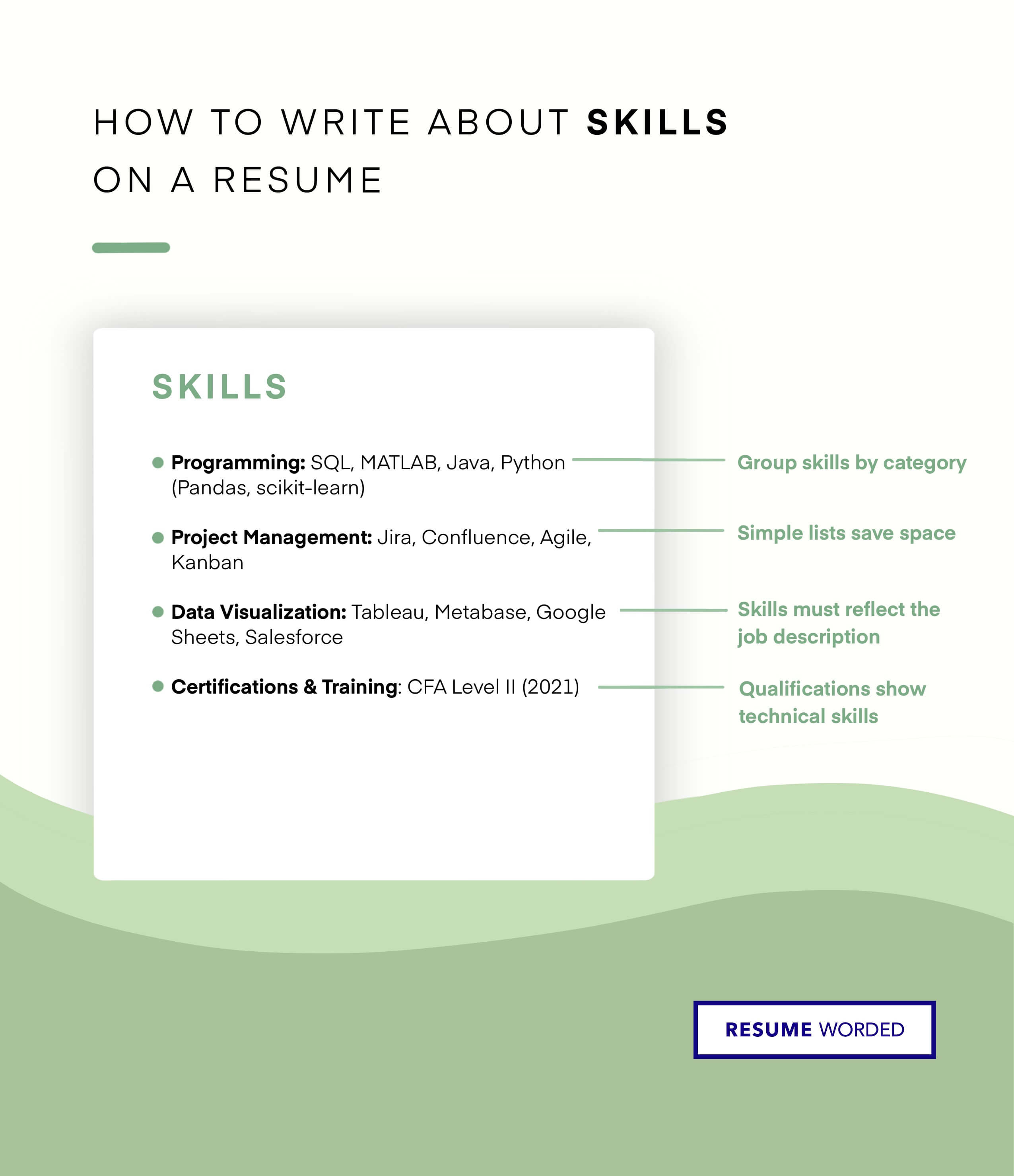

Include any relevant certification in your resume.

Salesforce offers certifications that can help you validate your skills. They are highly recognized in the industry, and since it’s provided by a reputable source, you’ll seem more reliable to recruiters. If you have any Salesforce certifications, don’t forget to add them to your resume.