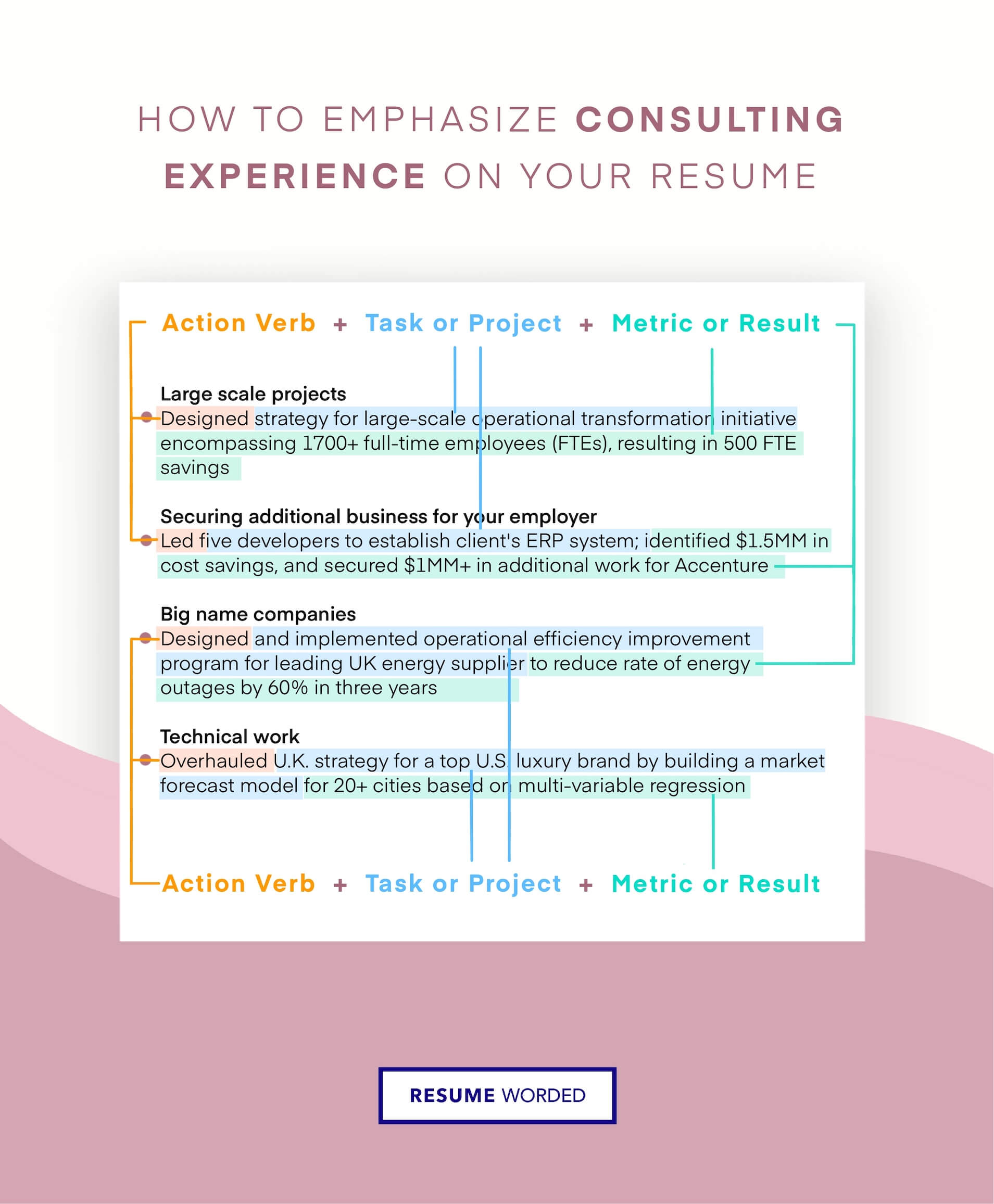

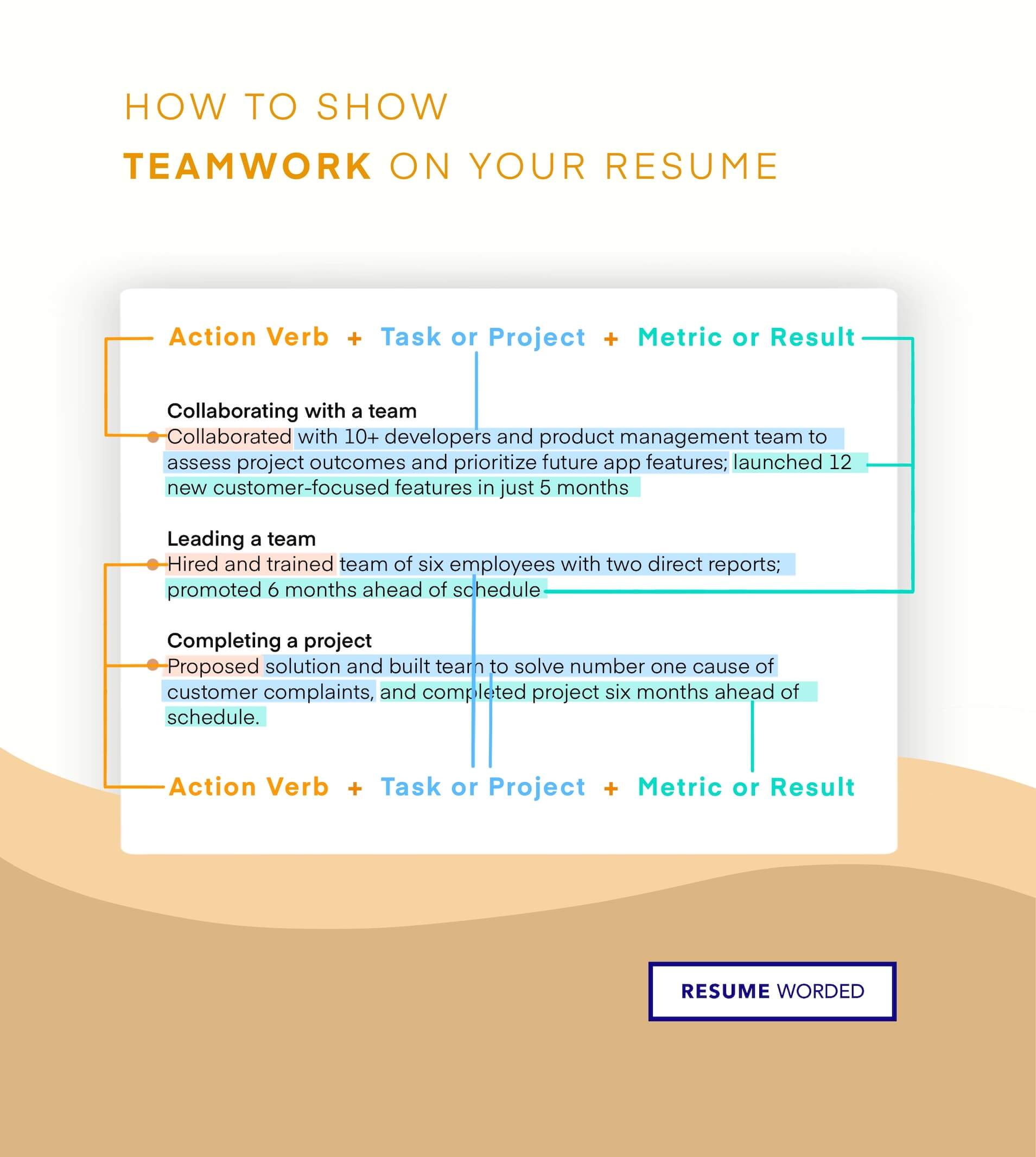

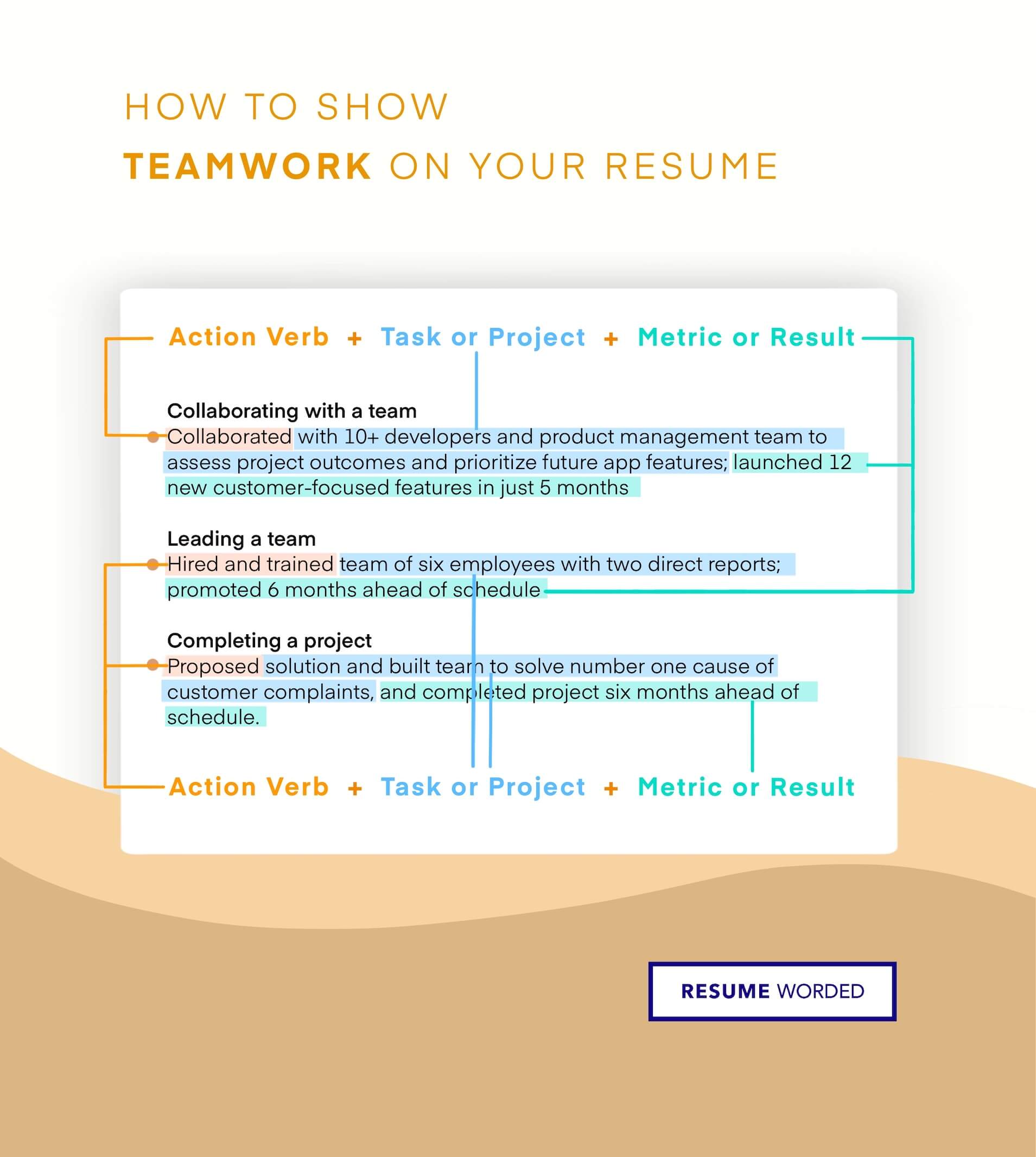

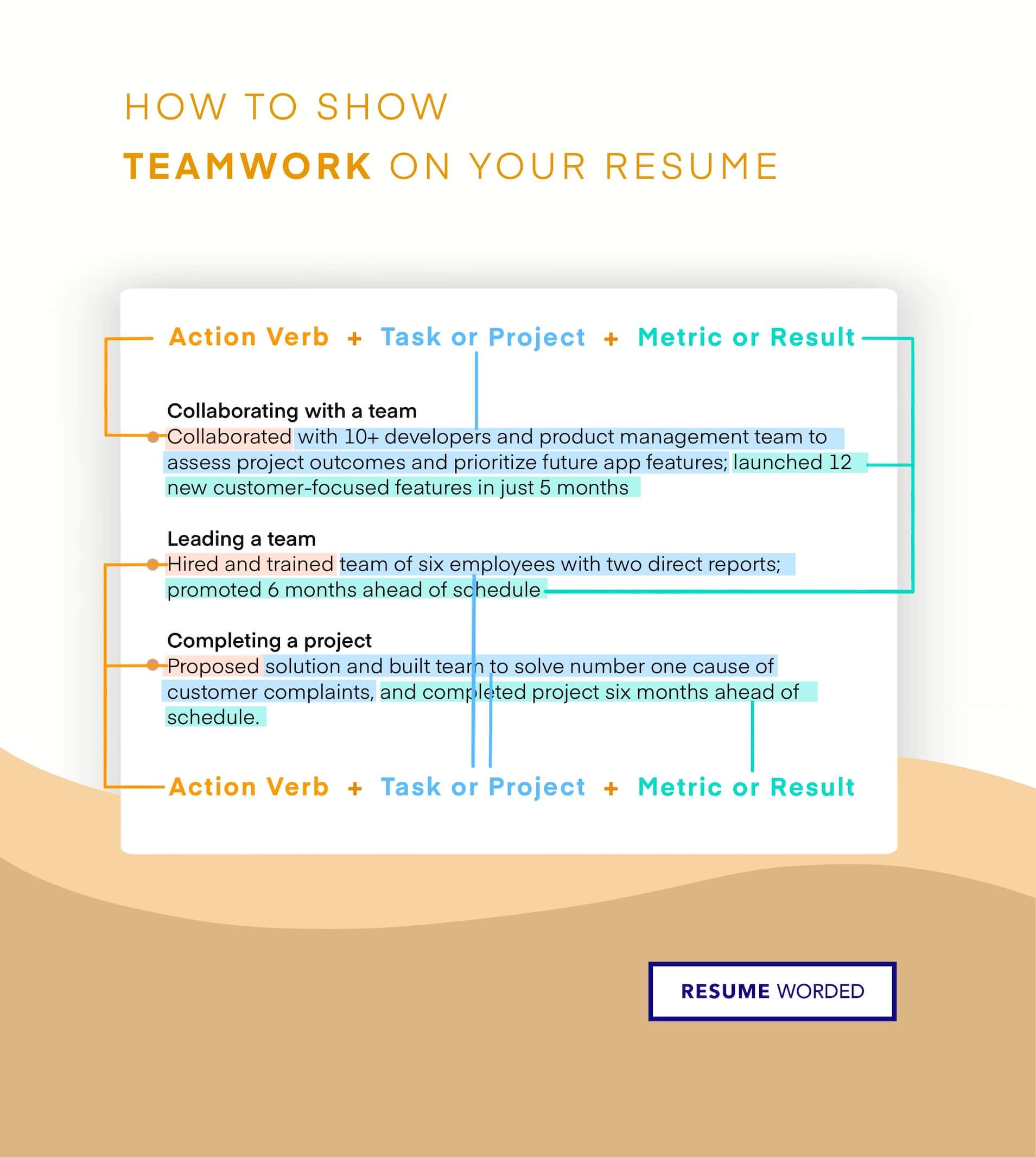

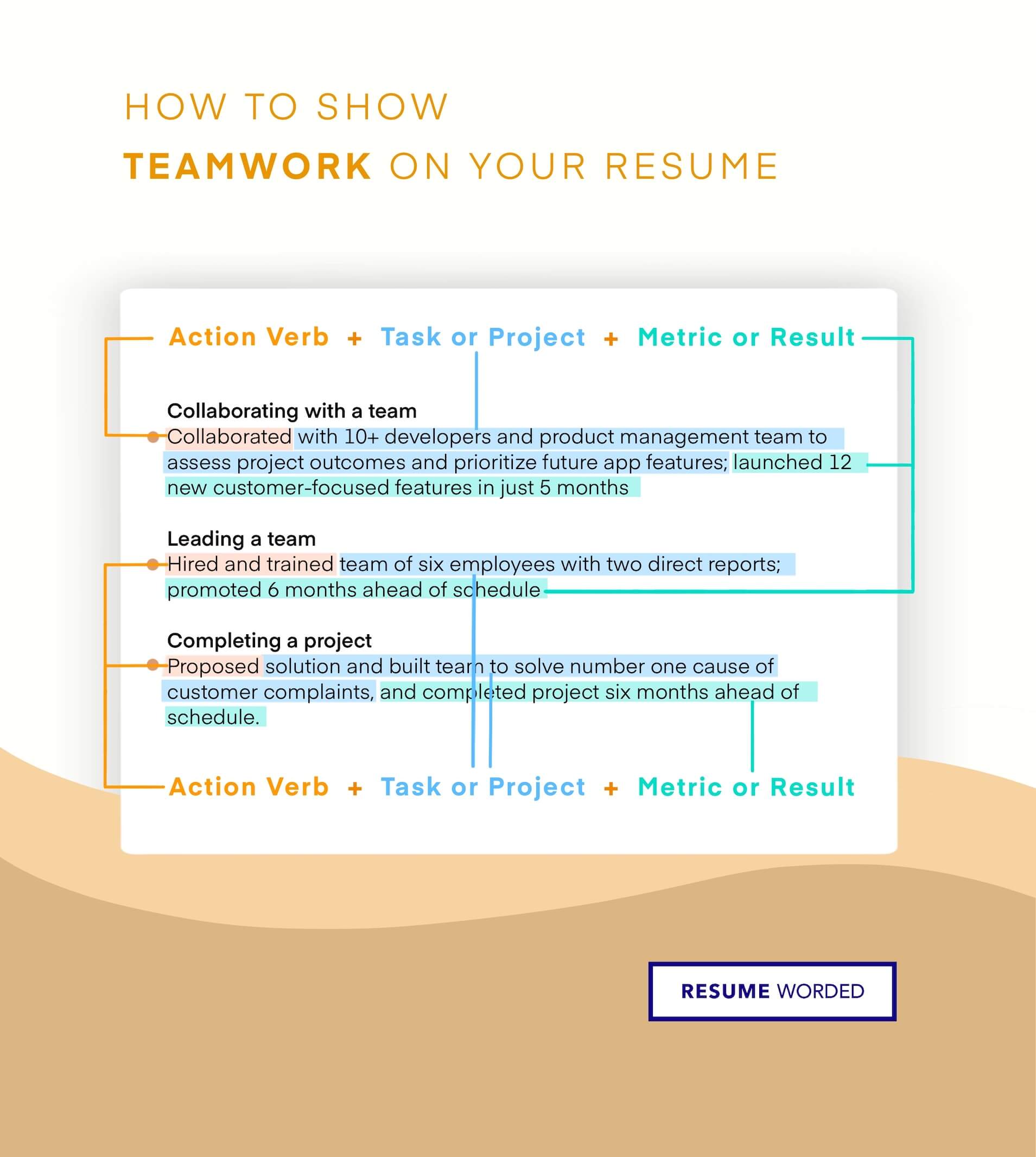

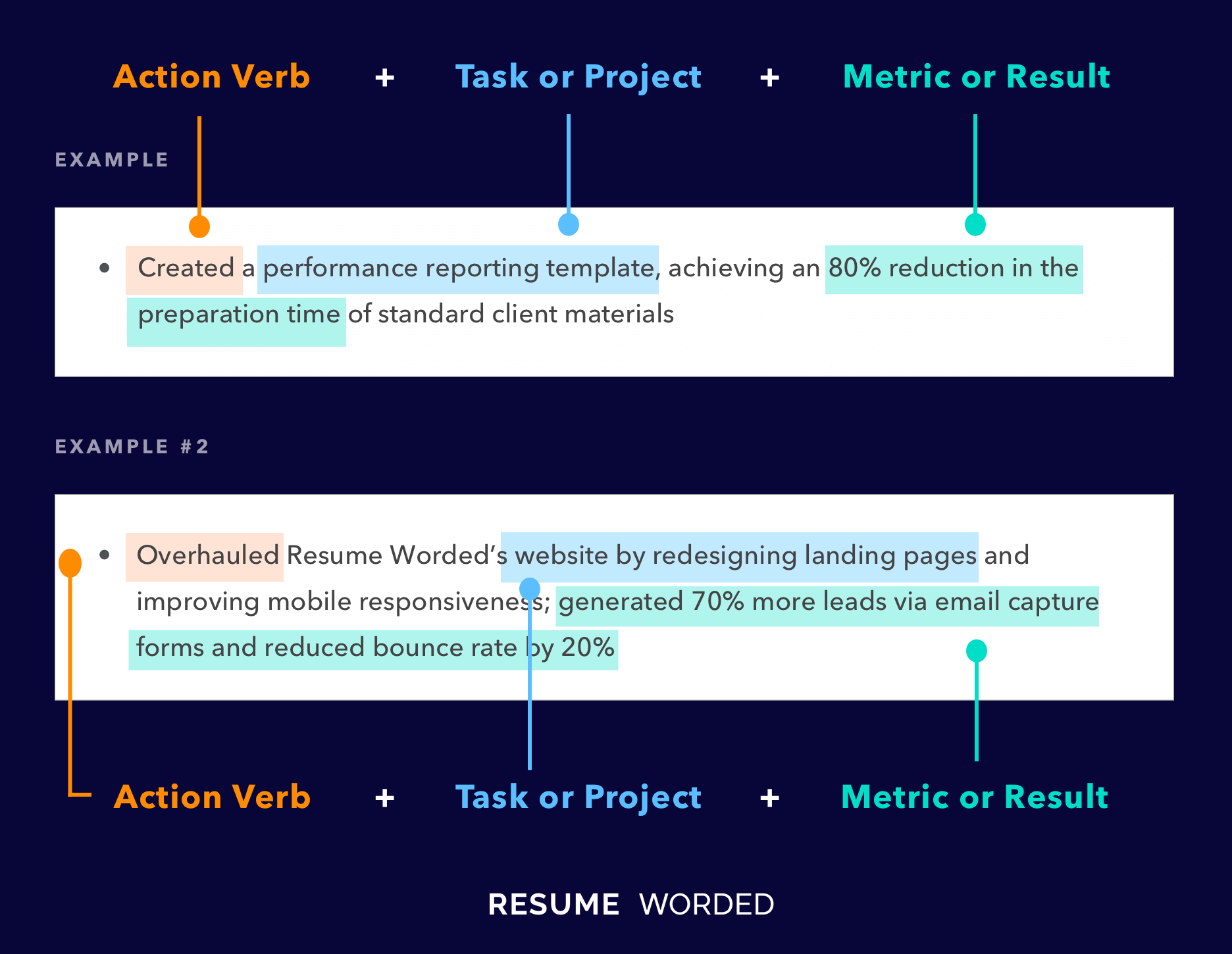

Highlight the success of your team under your leadership.

Show your competency as a manager of a team by listing your team’s successes. Quantify their increased efficiency and productivity. If your team has won any internal or external awards for their work, include that as well.