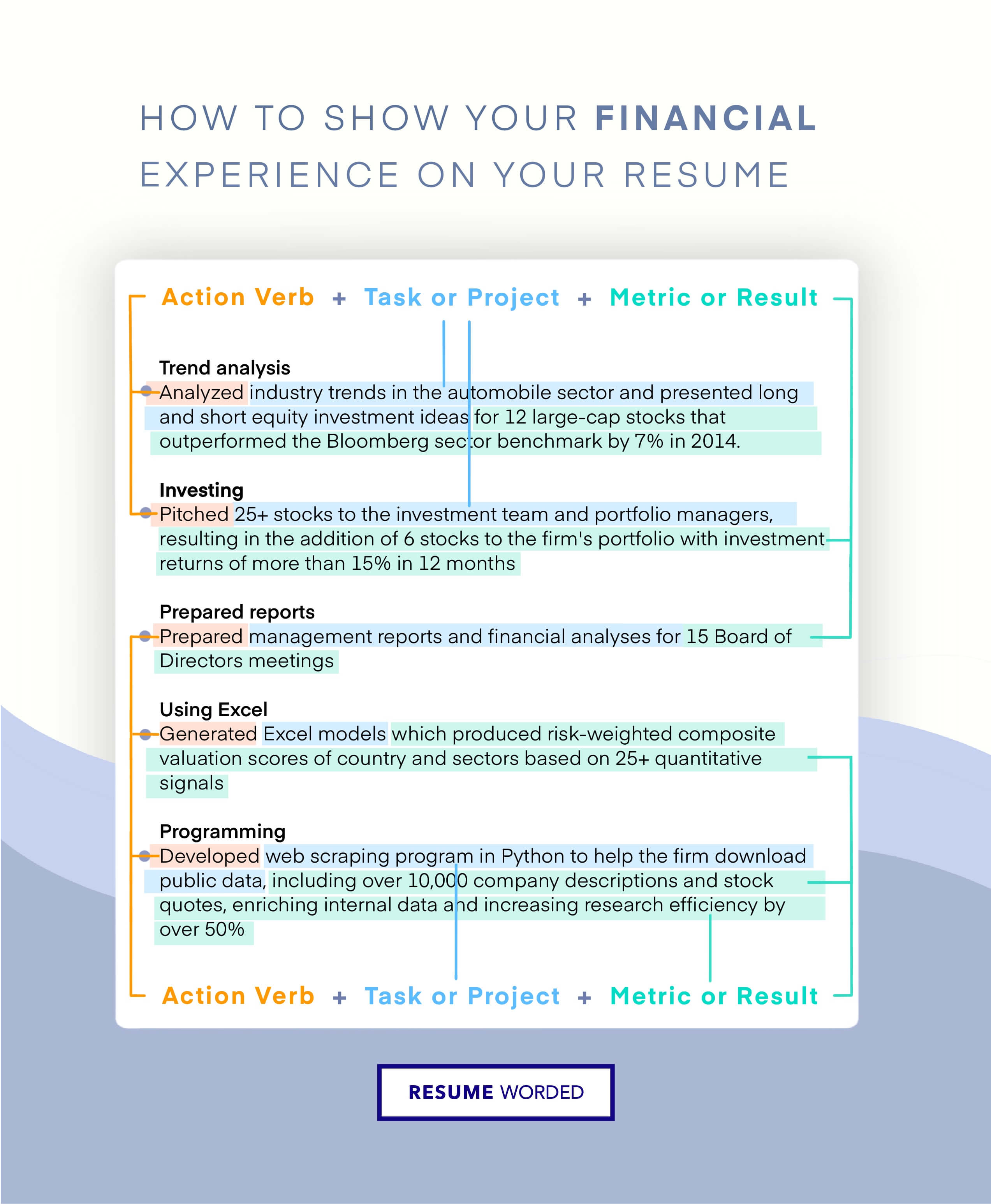

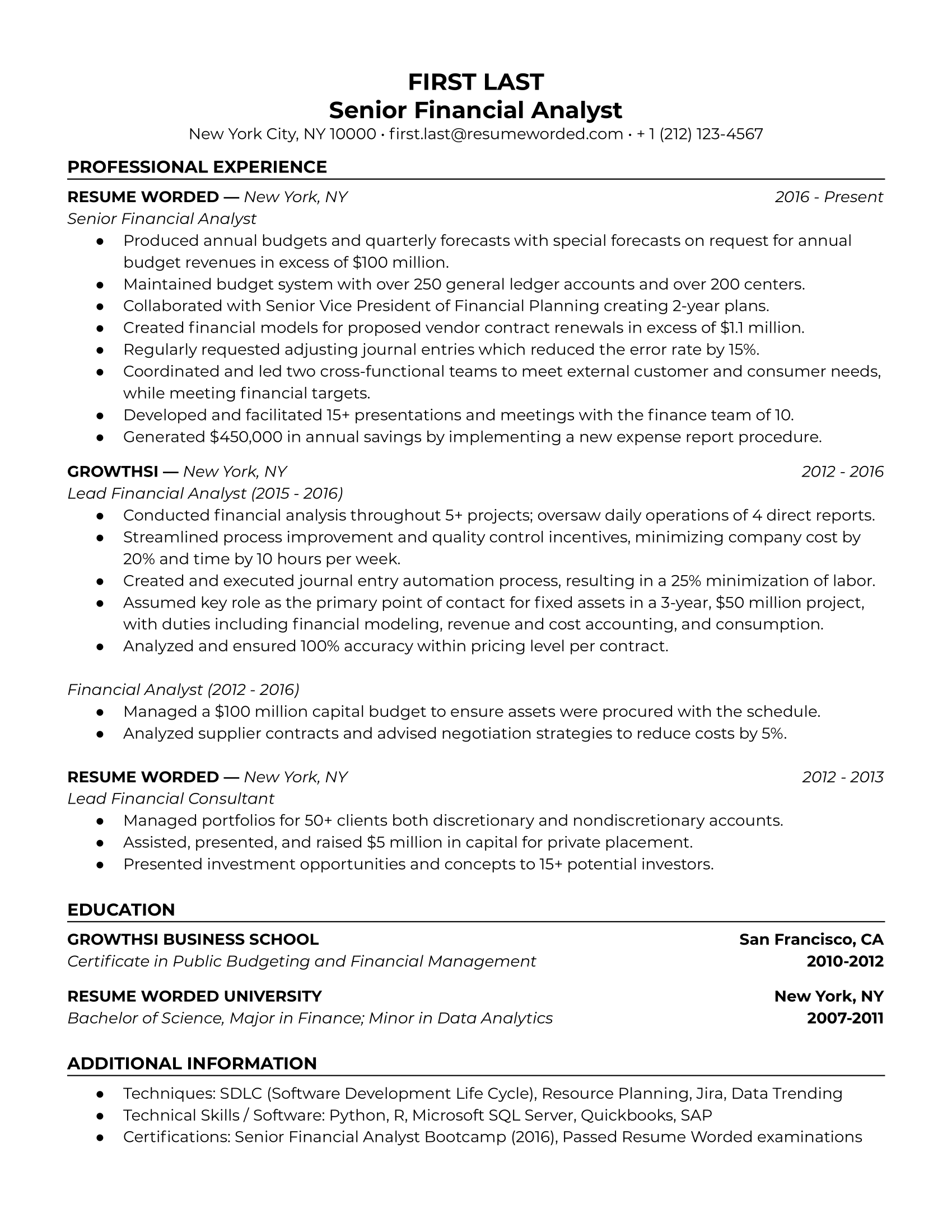

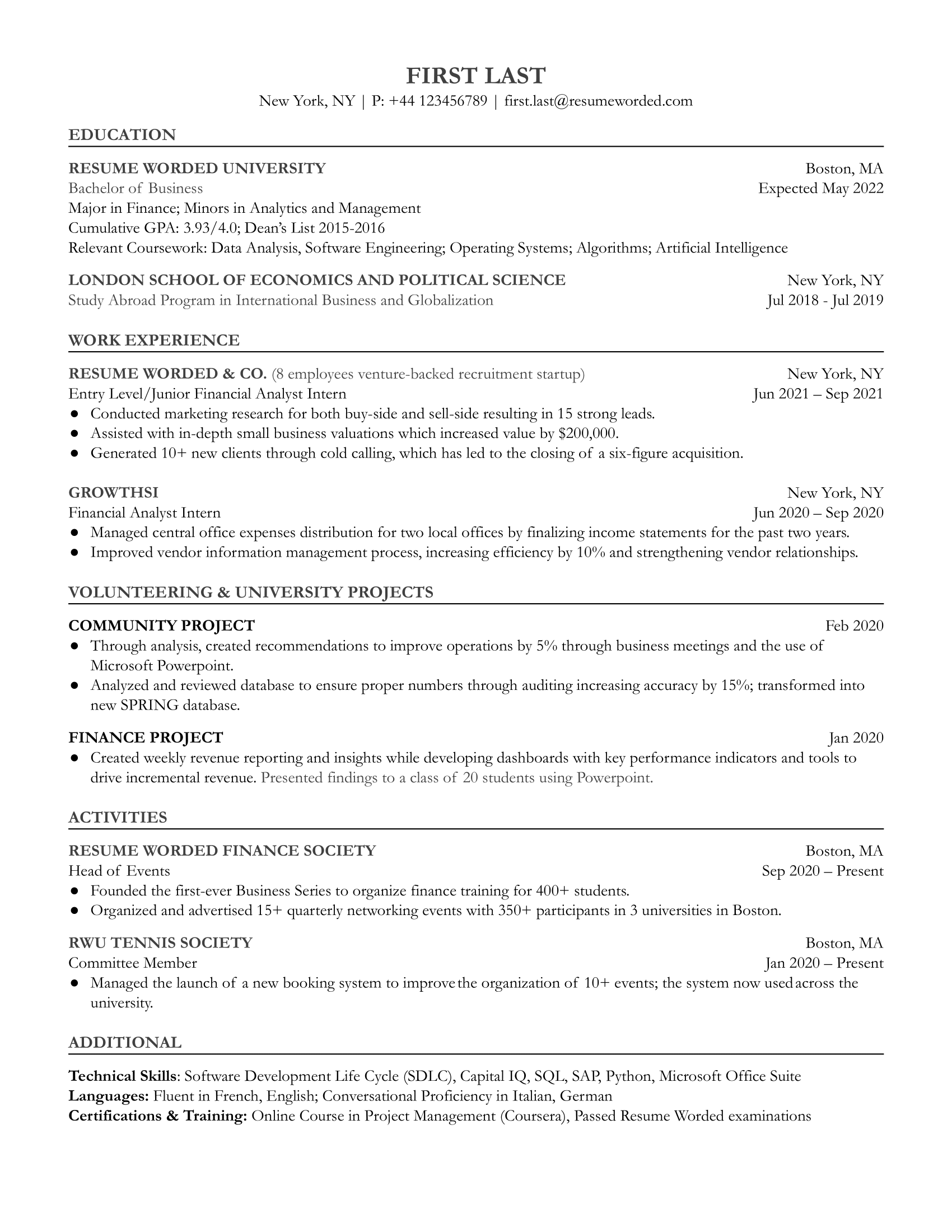

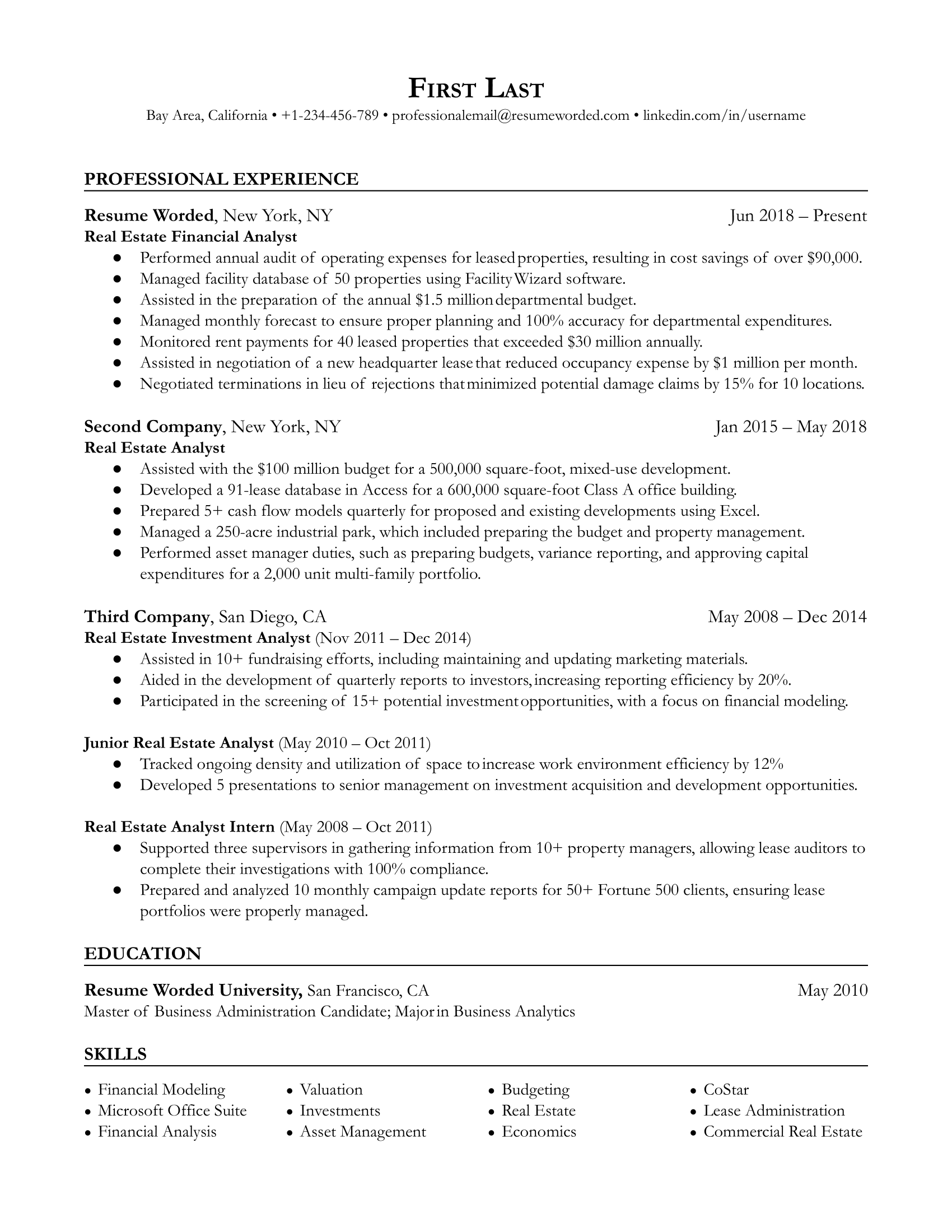

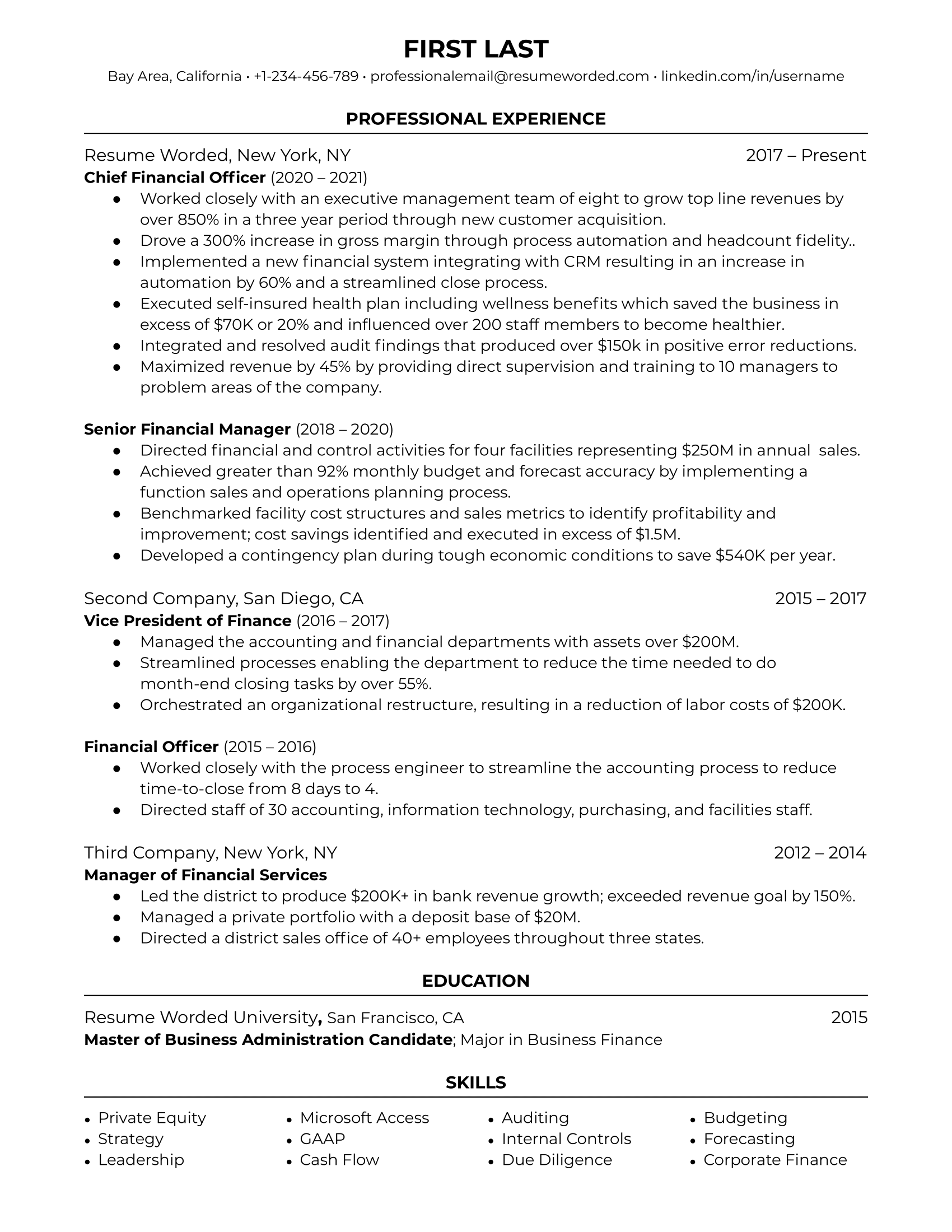

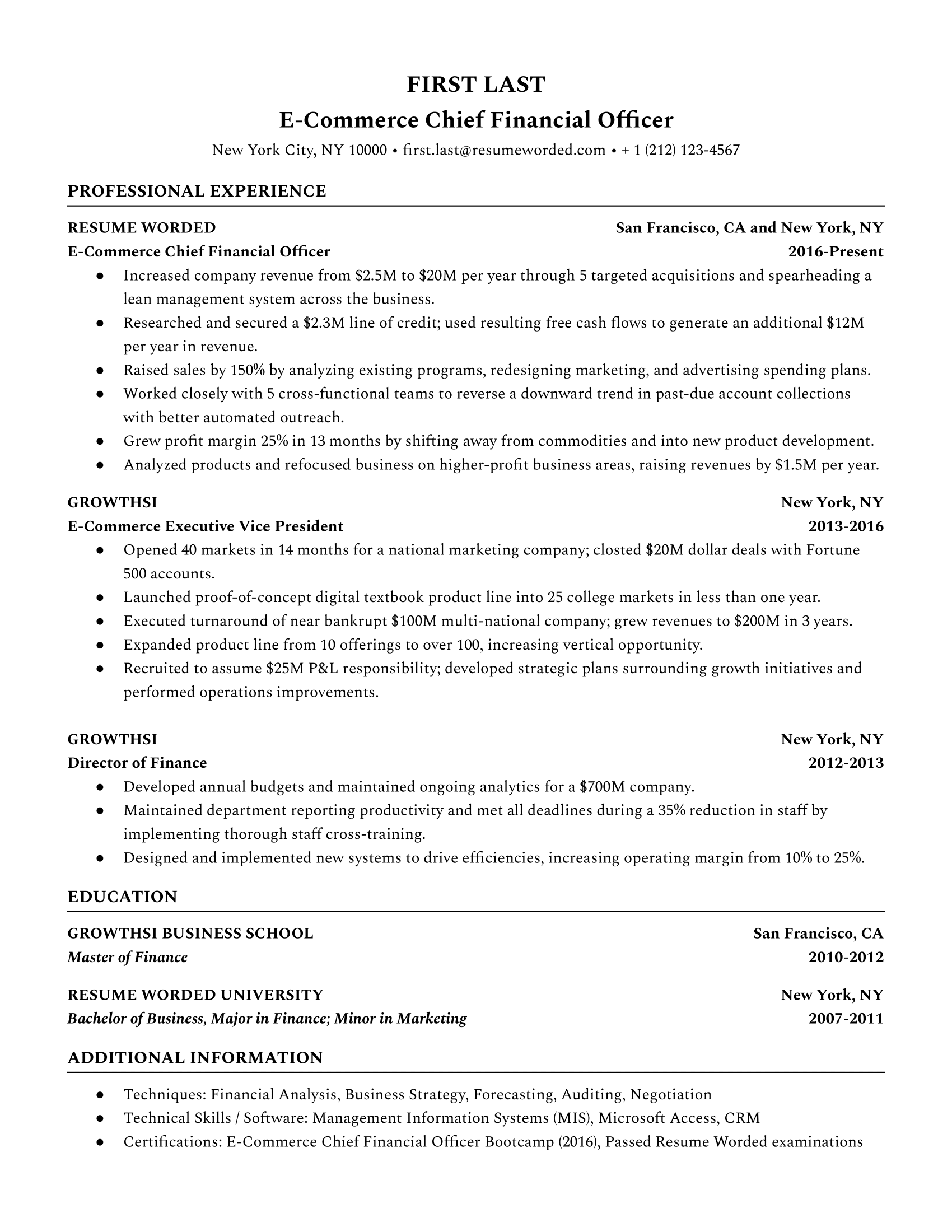

Focuses on relevant work history

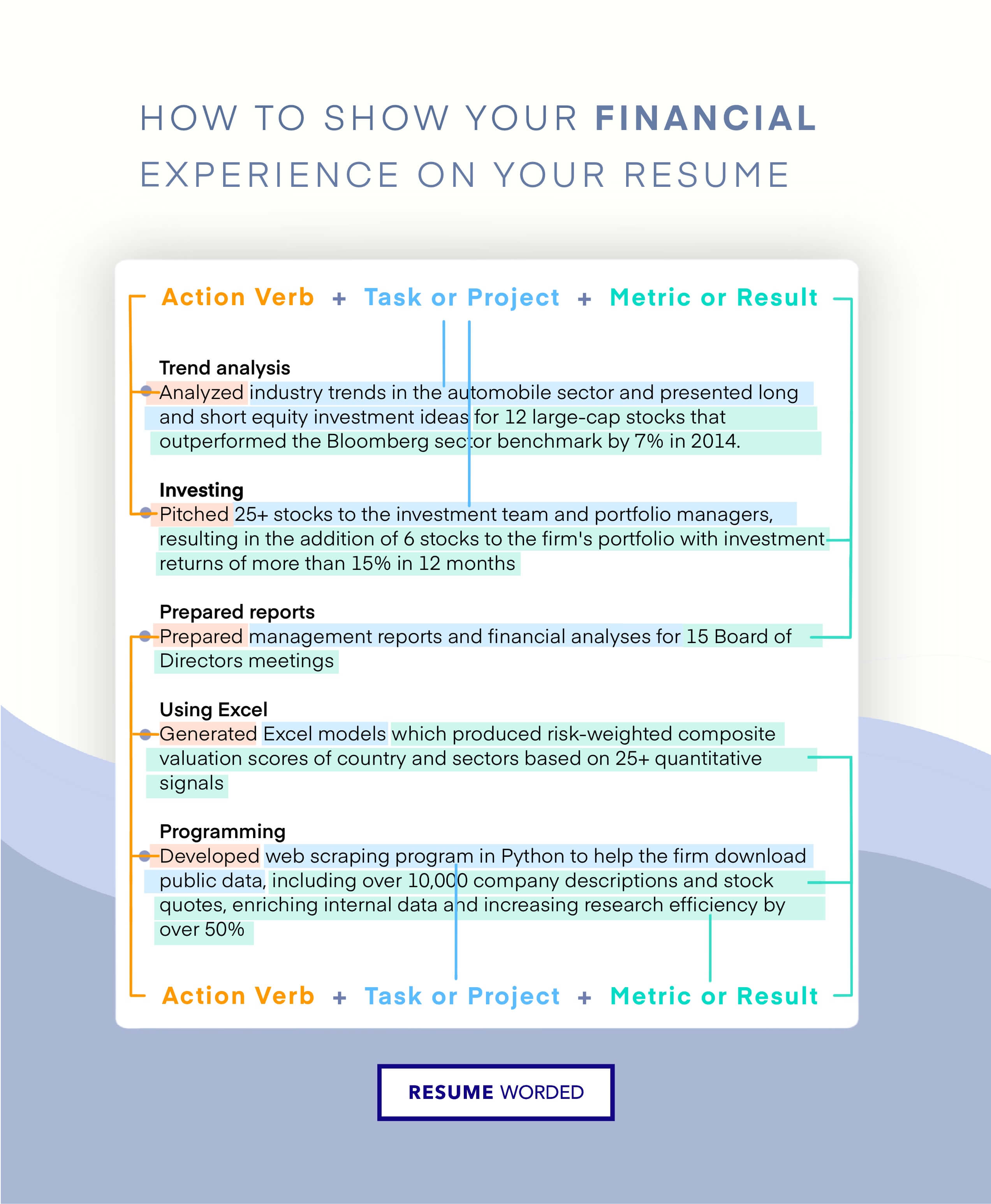

To become a senior financial analyst, you’ll typically need several years of experience in finance-related positions. Focus your resume on jobs you’ve held that are directly relevant, and make sure to also highlight your achievements in these roles so hiring managers can see proof of your skills.