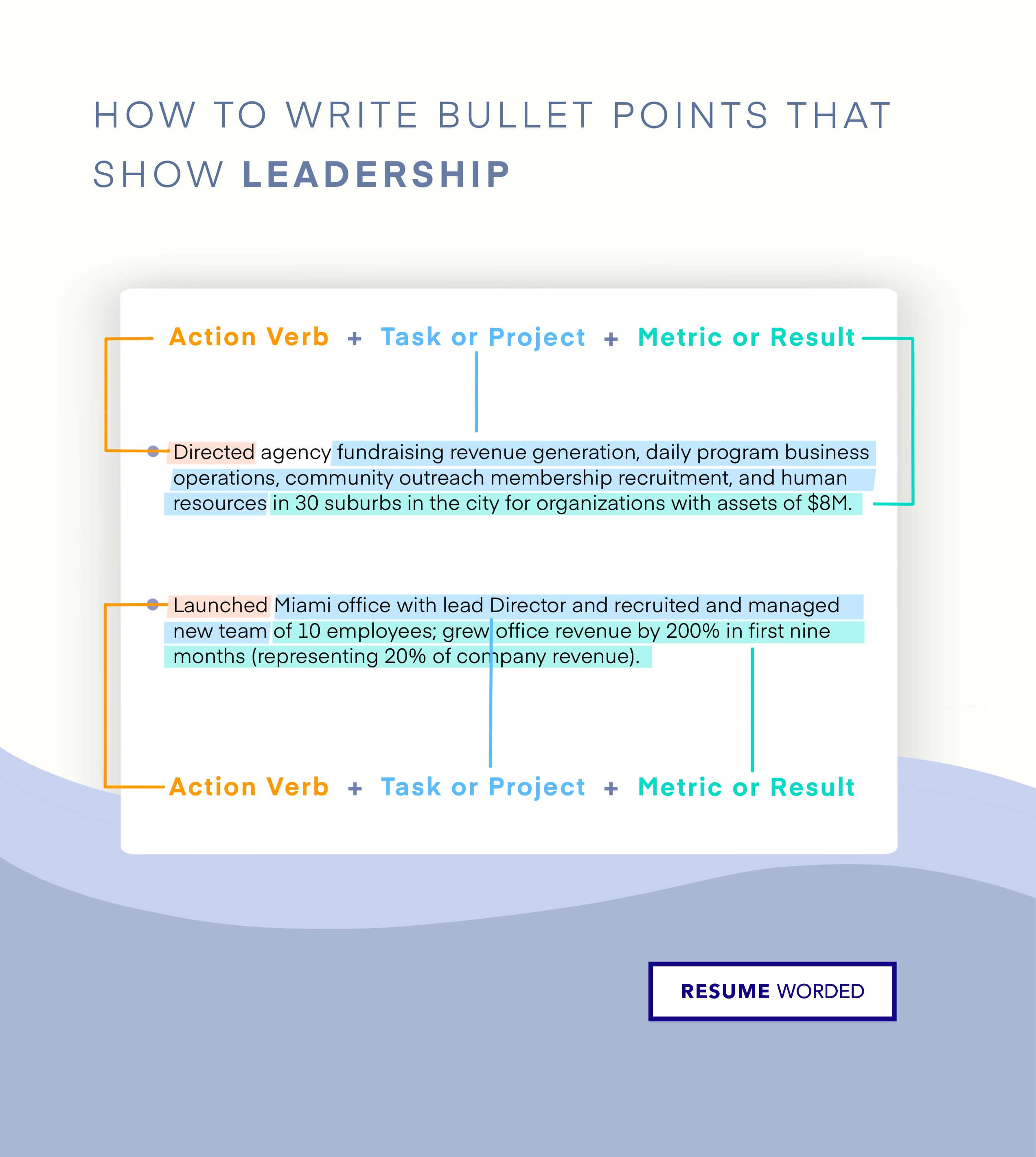

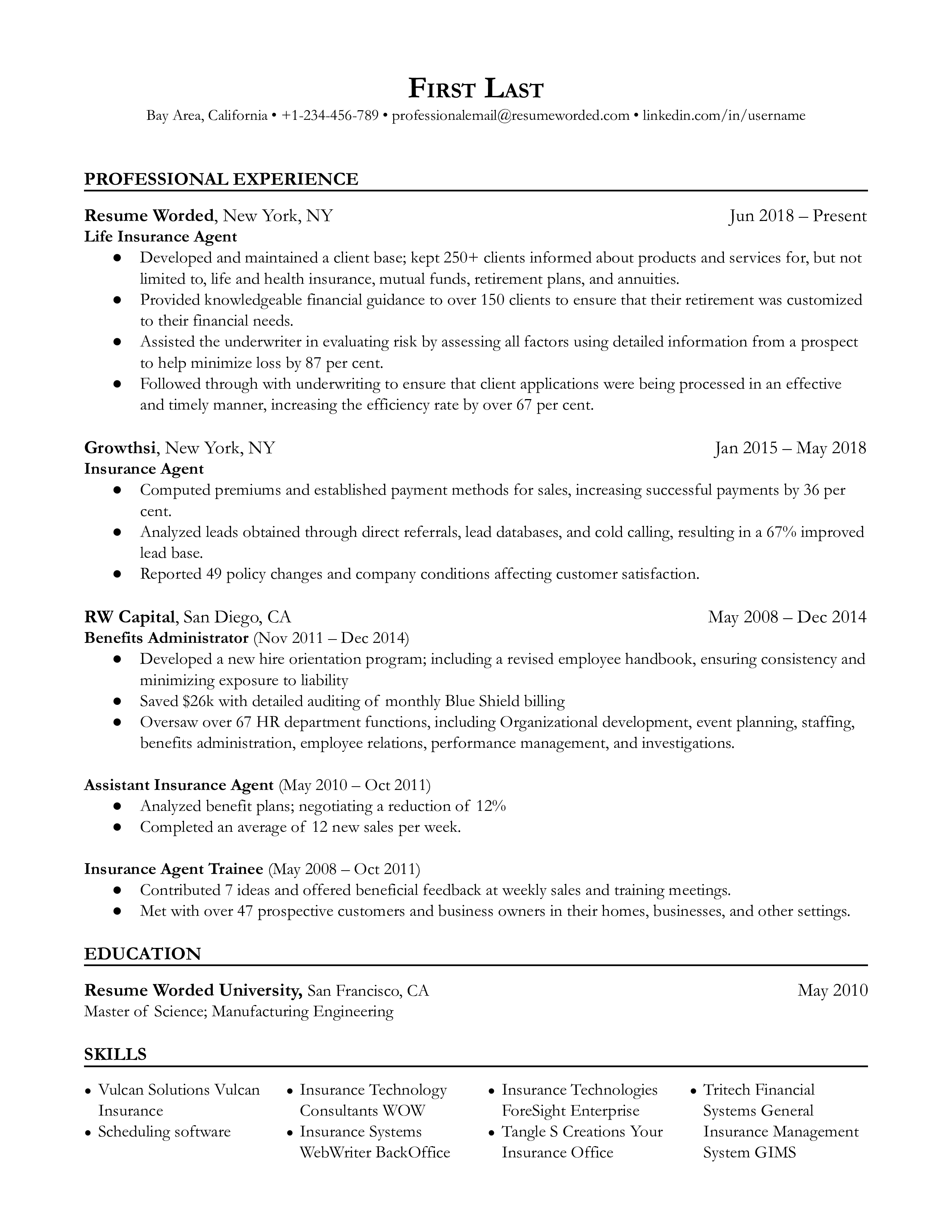

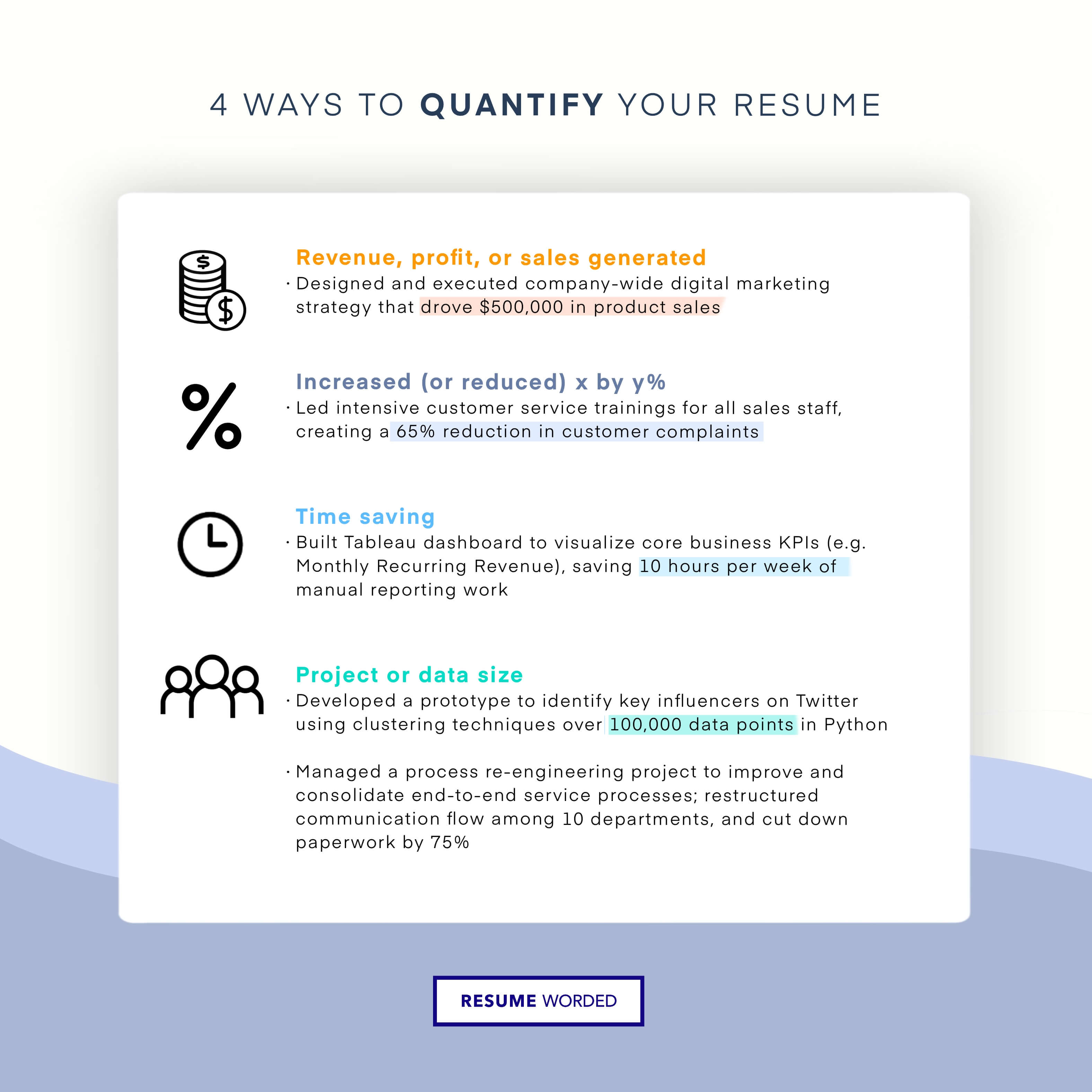

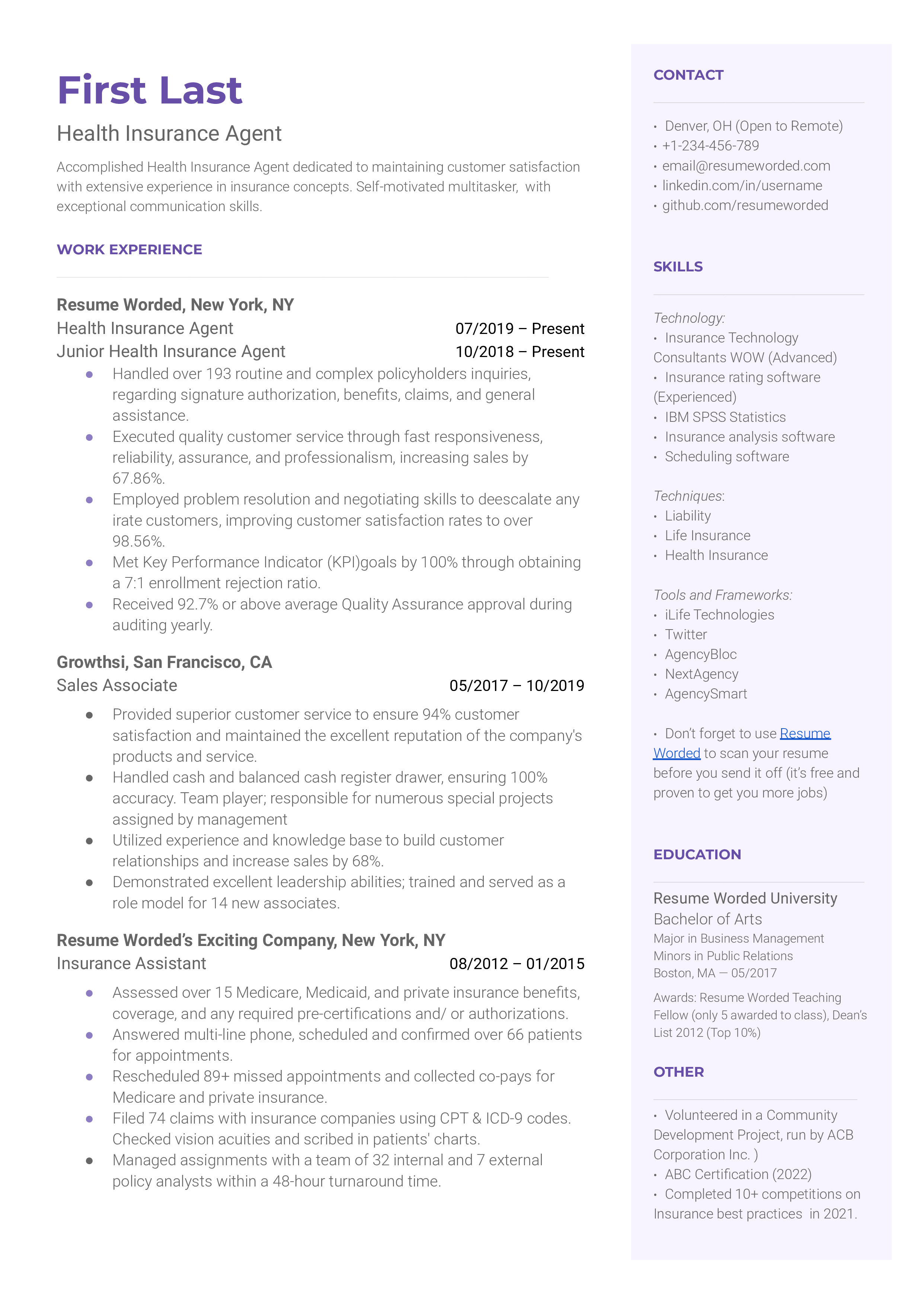

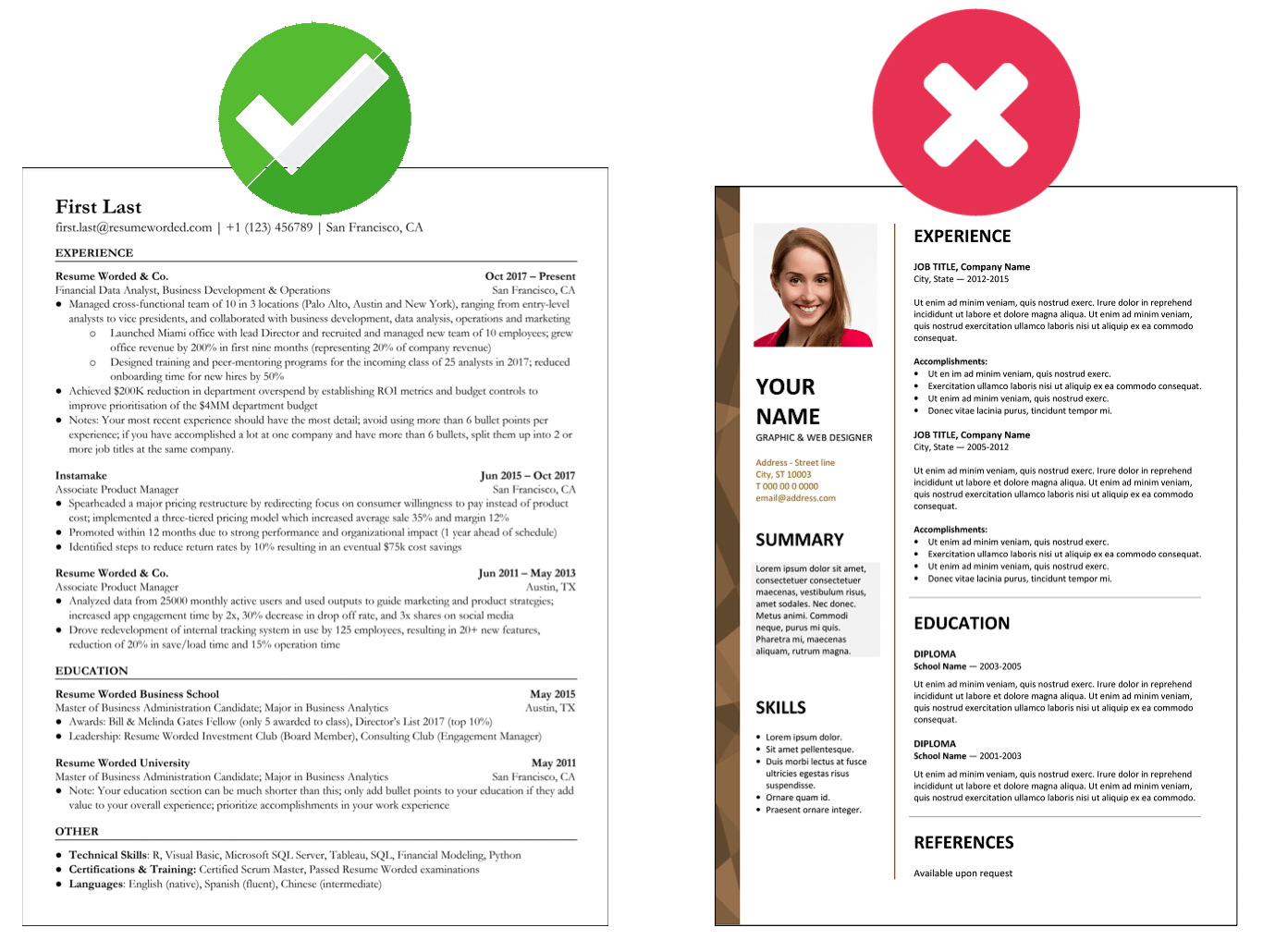

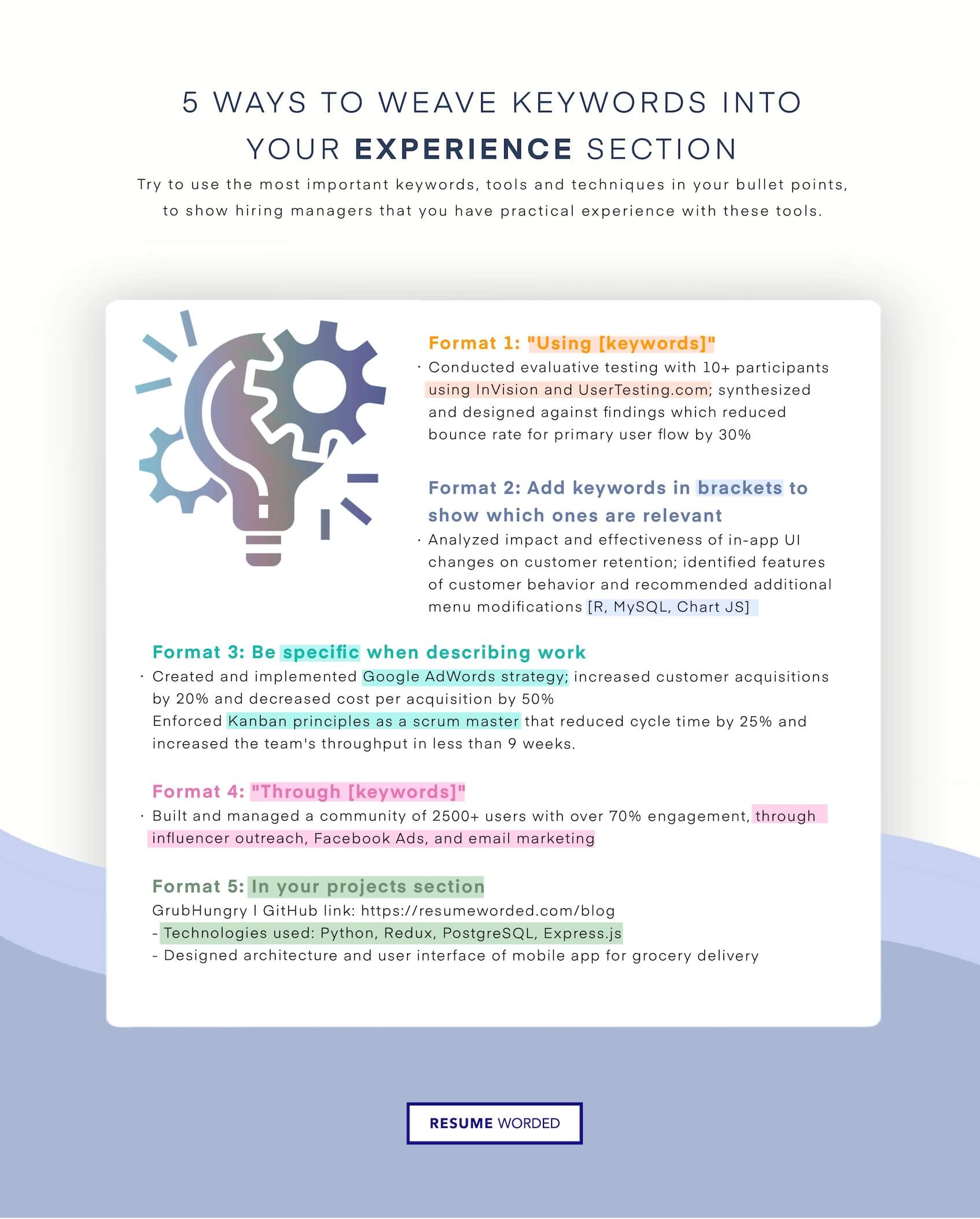

Use numbers, like your success rate as an agent.

To survive in this profession you have to make sales. To put yourself above the multitudes of other applicants, highlight your success rate if you have been particularly successful thus far. How much money did you bring in for your previous employer? How many sales on average did you make per month?