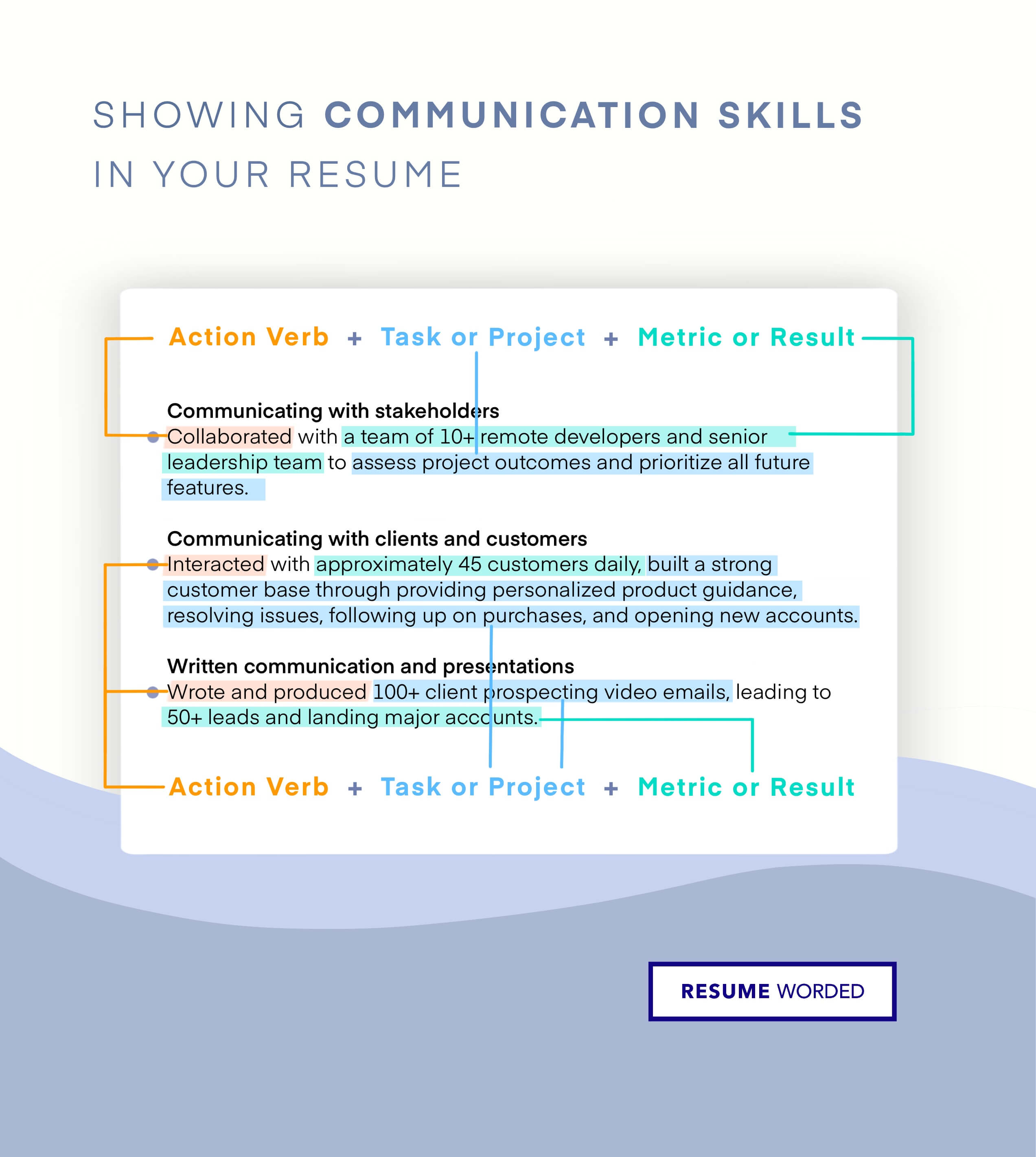

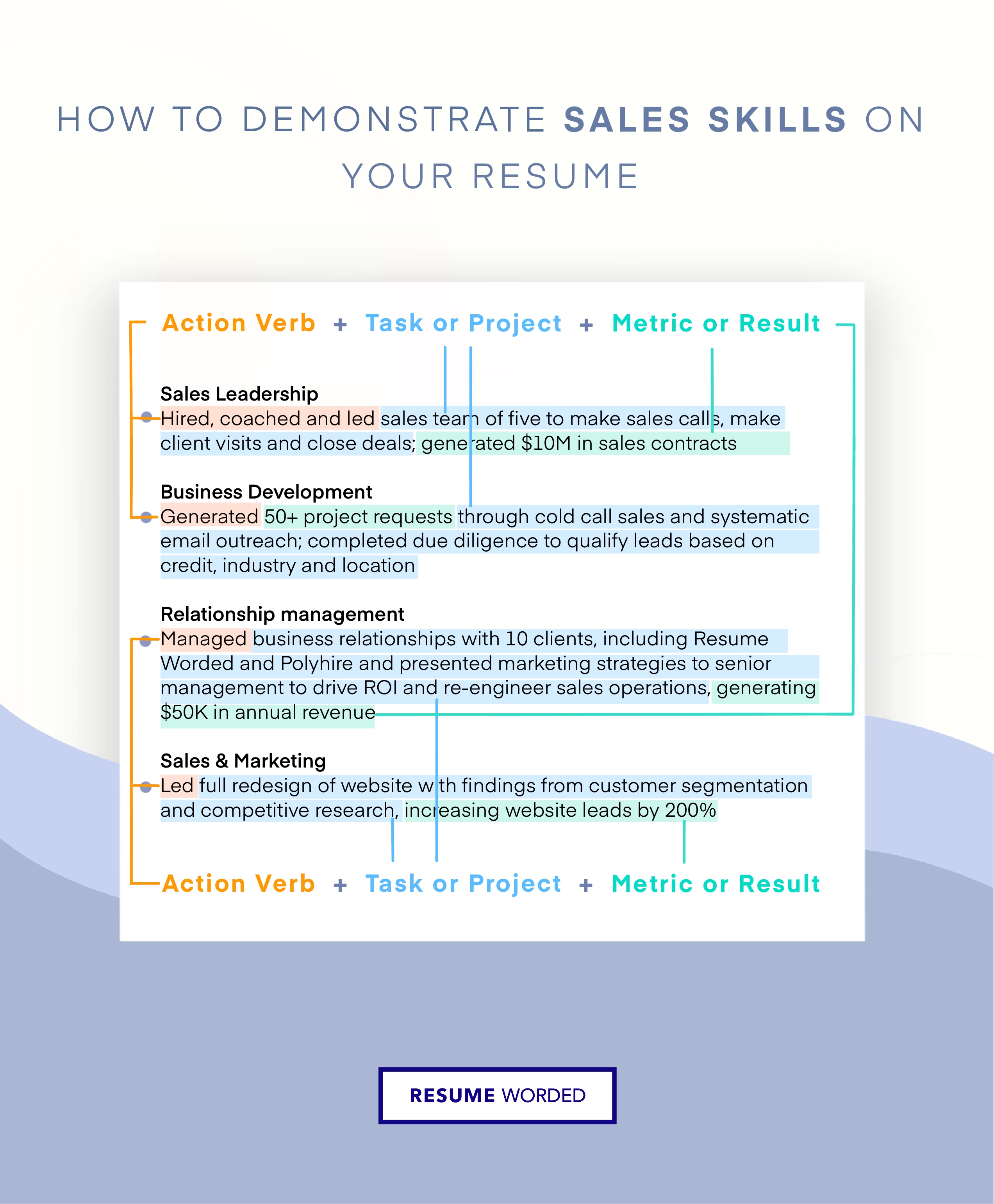

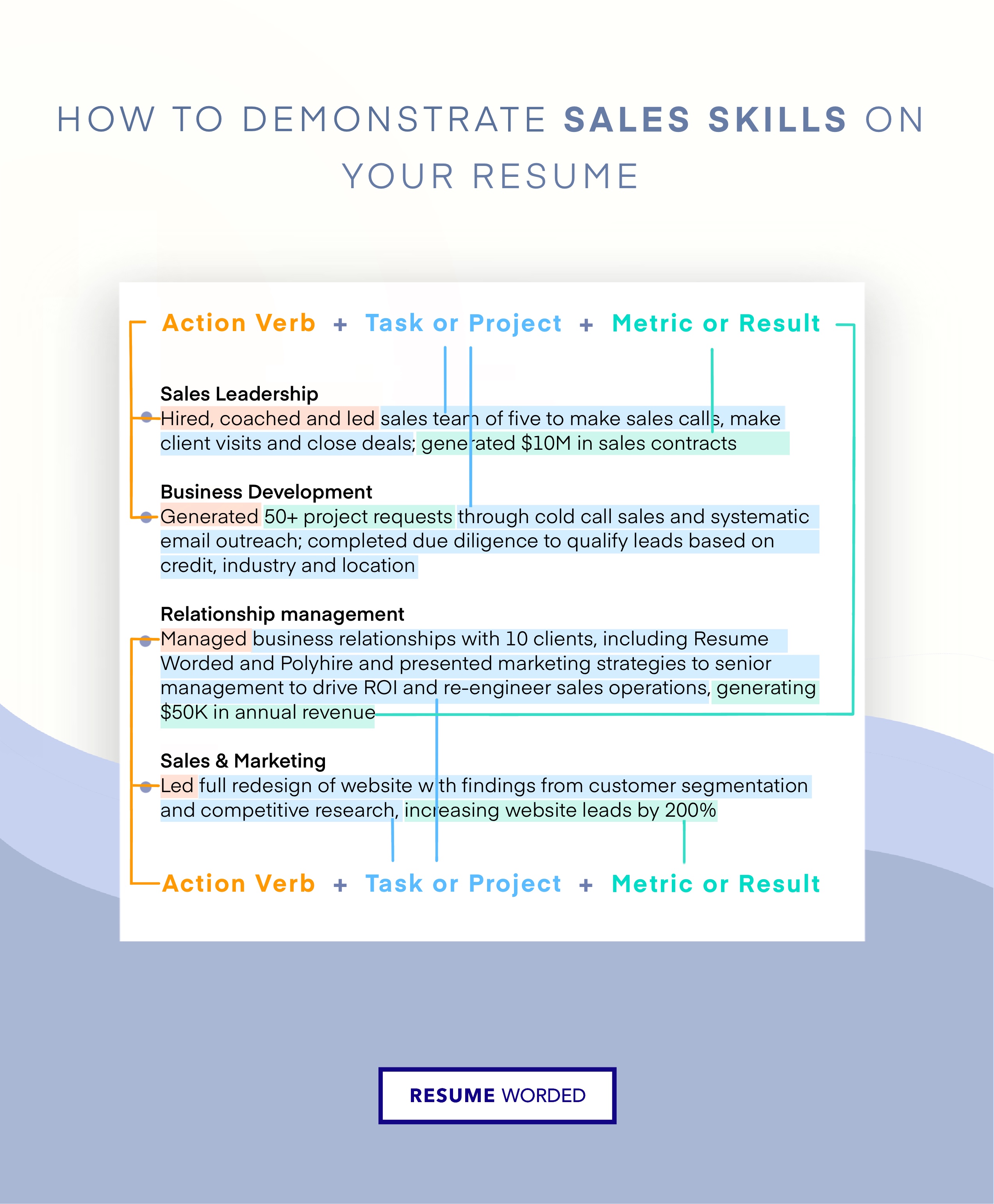

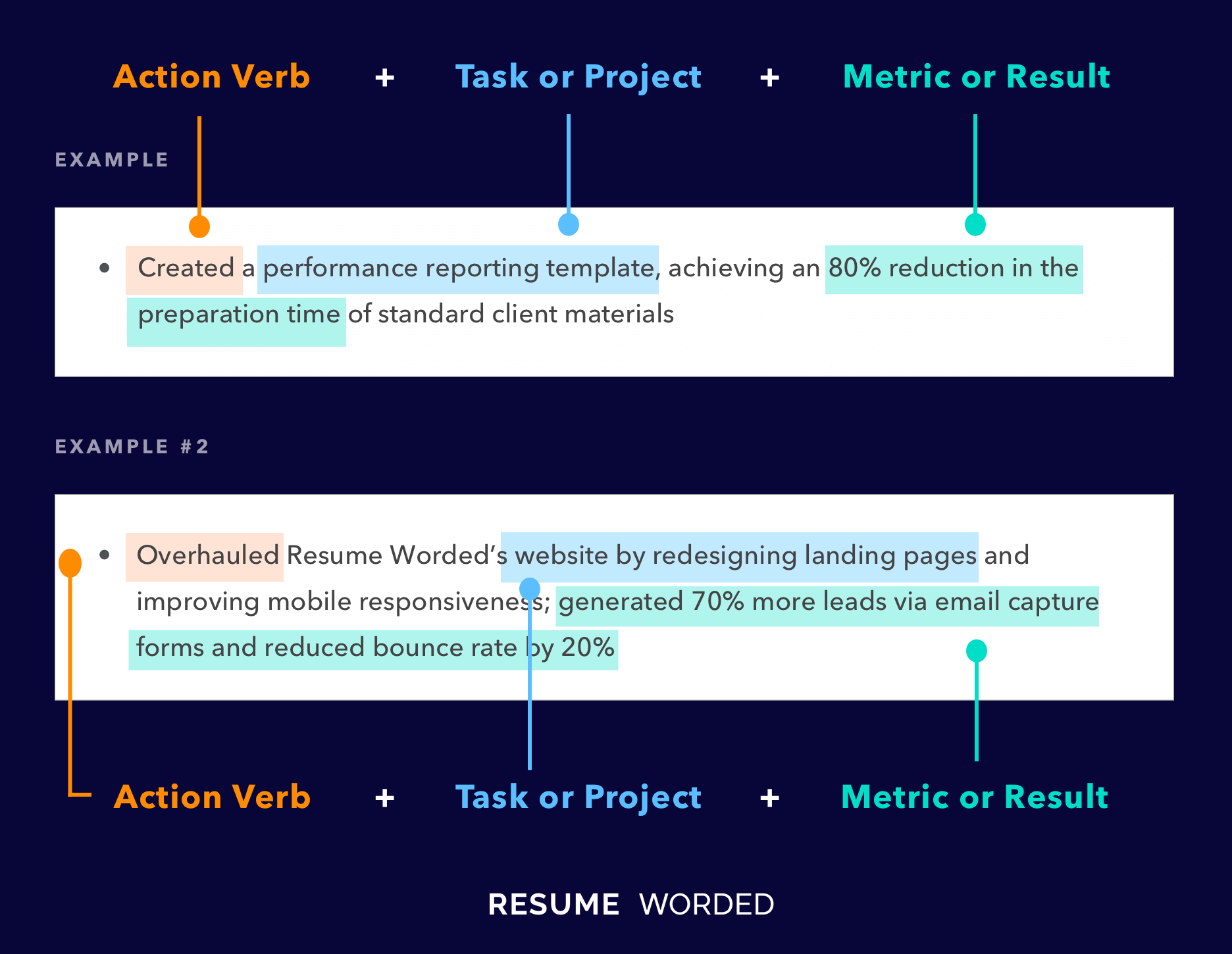

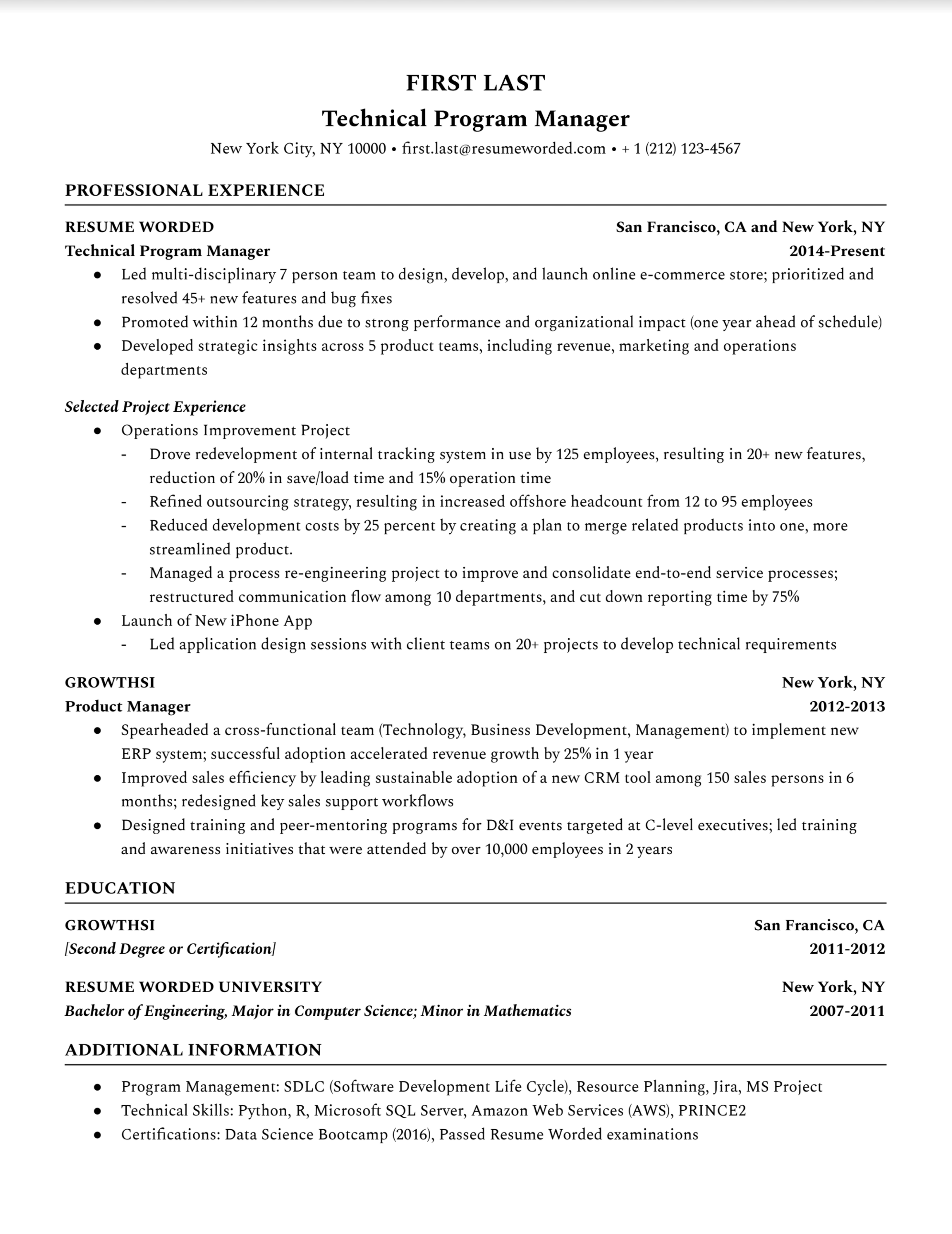

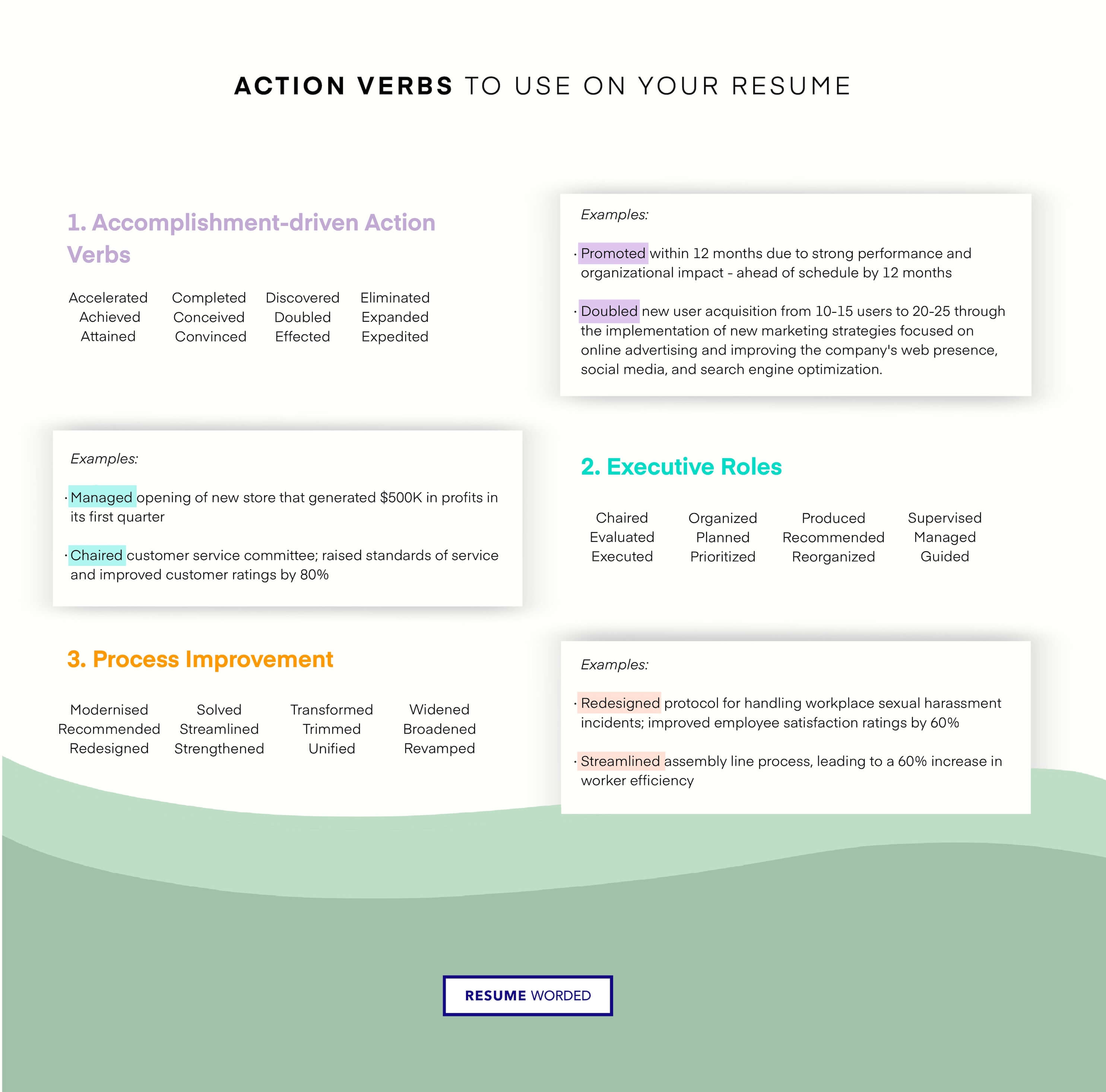

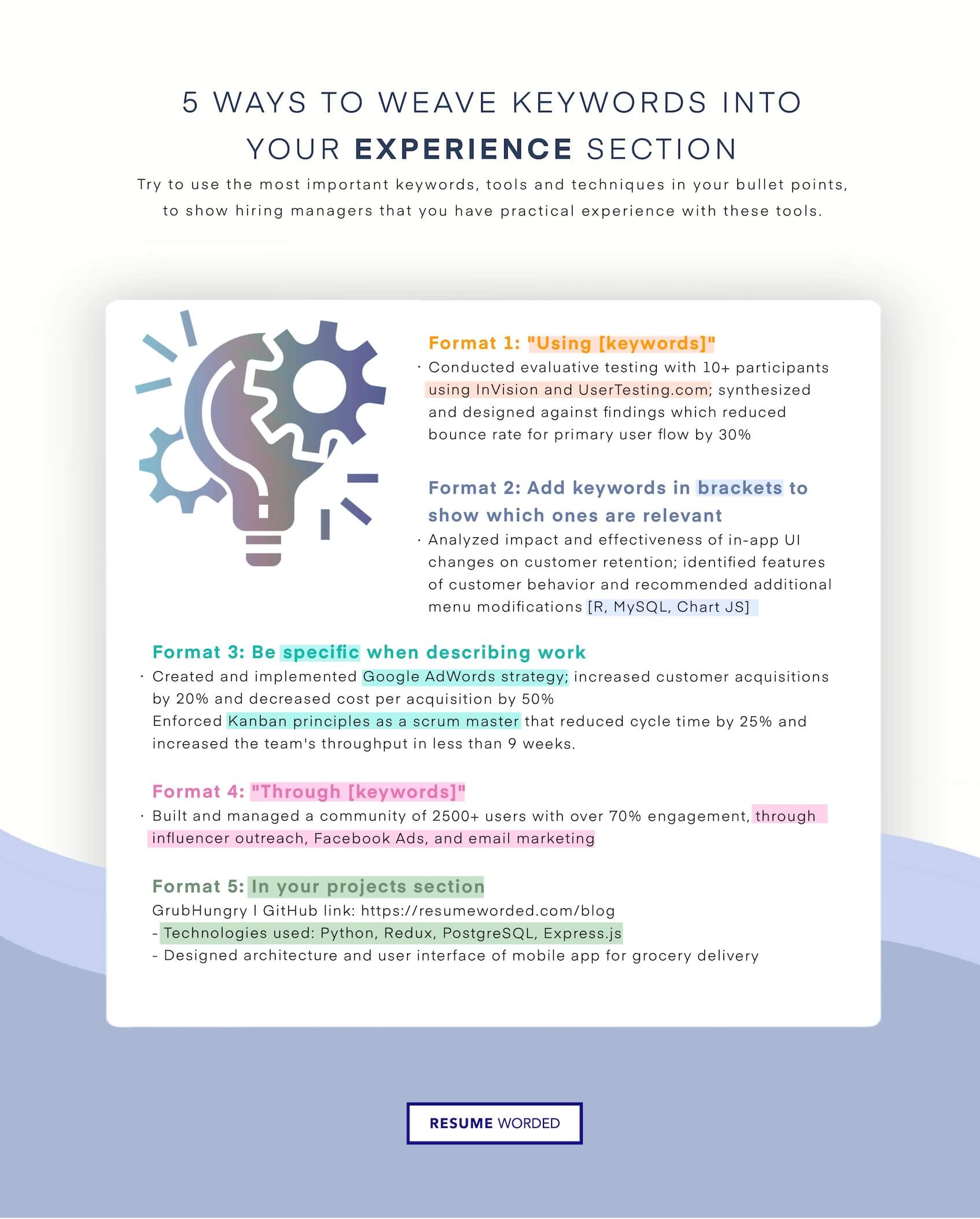

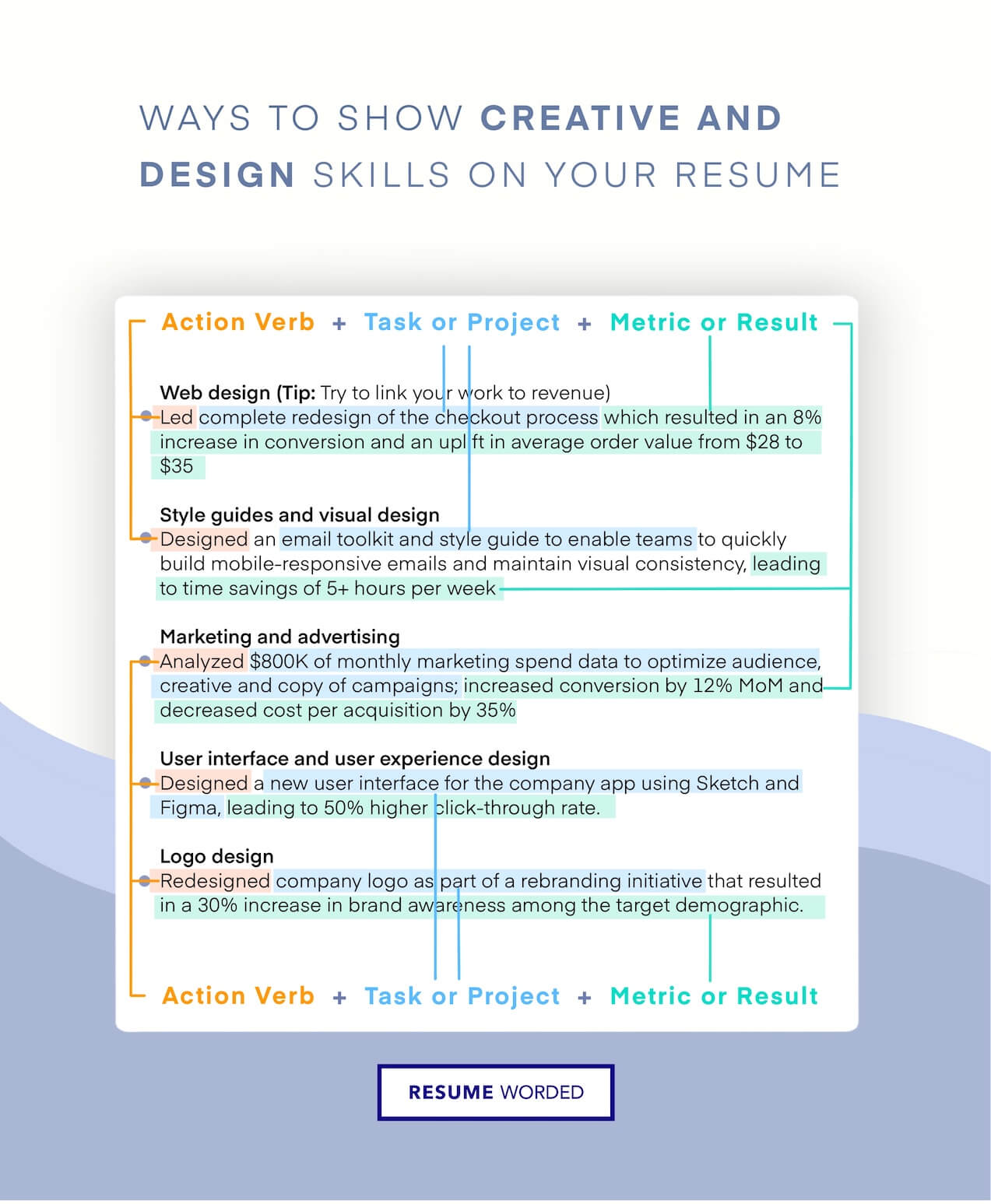

State your achievements and the corresponding sales skillset

You should state how you reached a sales milestone, surpassed a KPI, or recorded an achievement. It's important to show recruiters how that happened because it proves you know your onions. Besides, you're already way ahead of other inside sales representatives who do not do that.