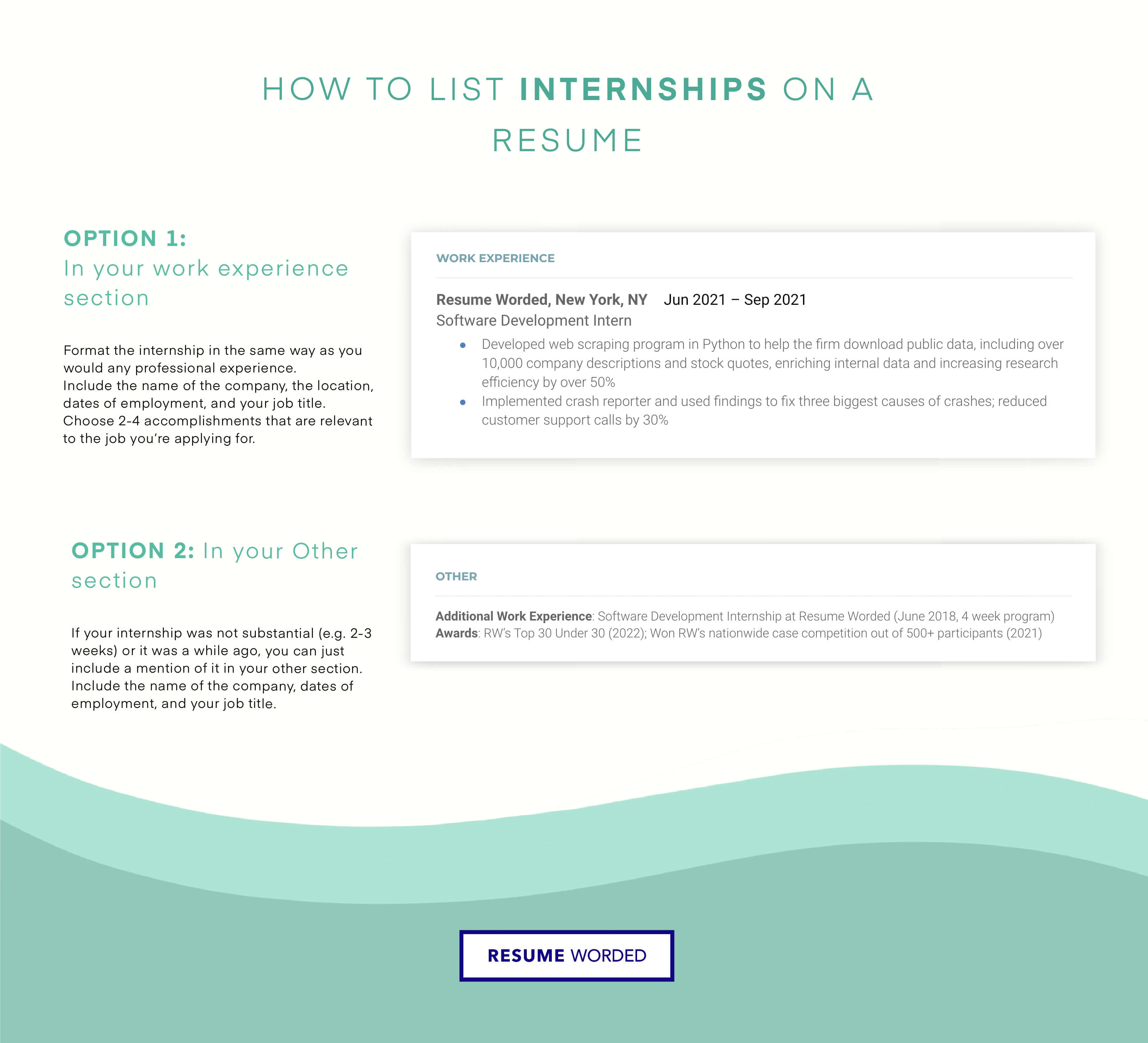

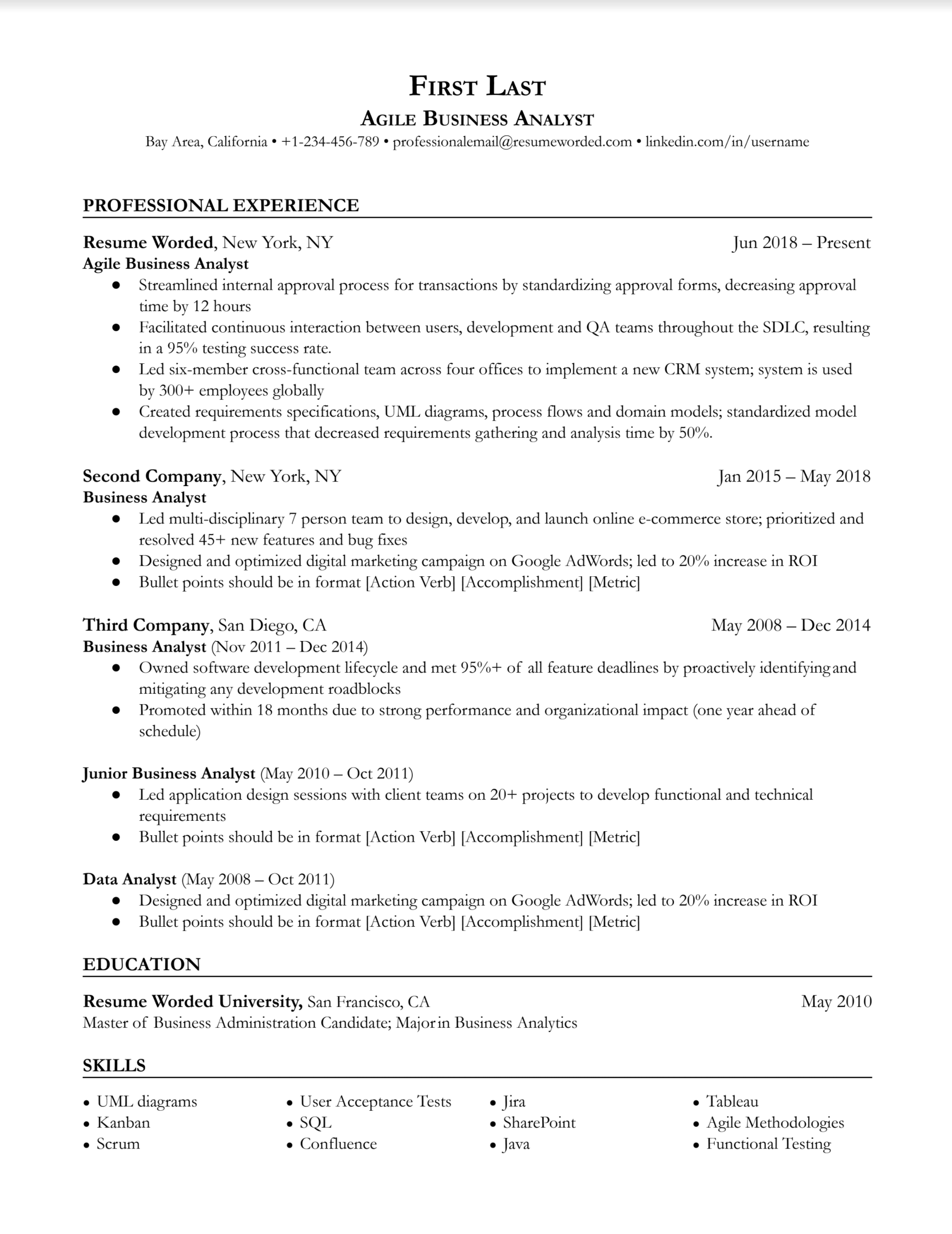

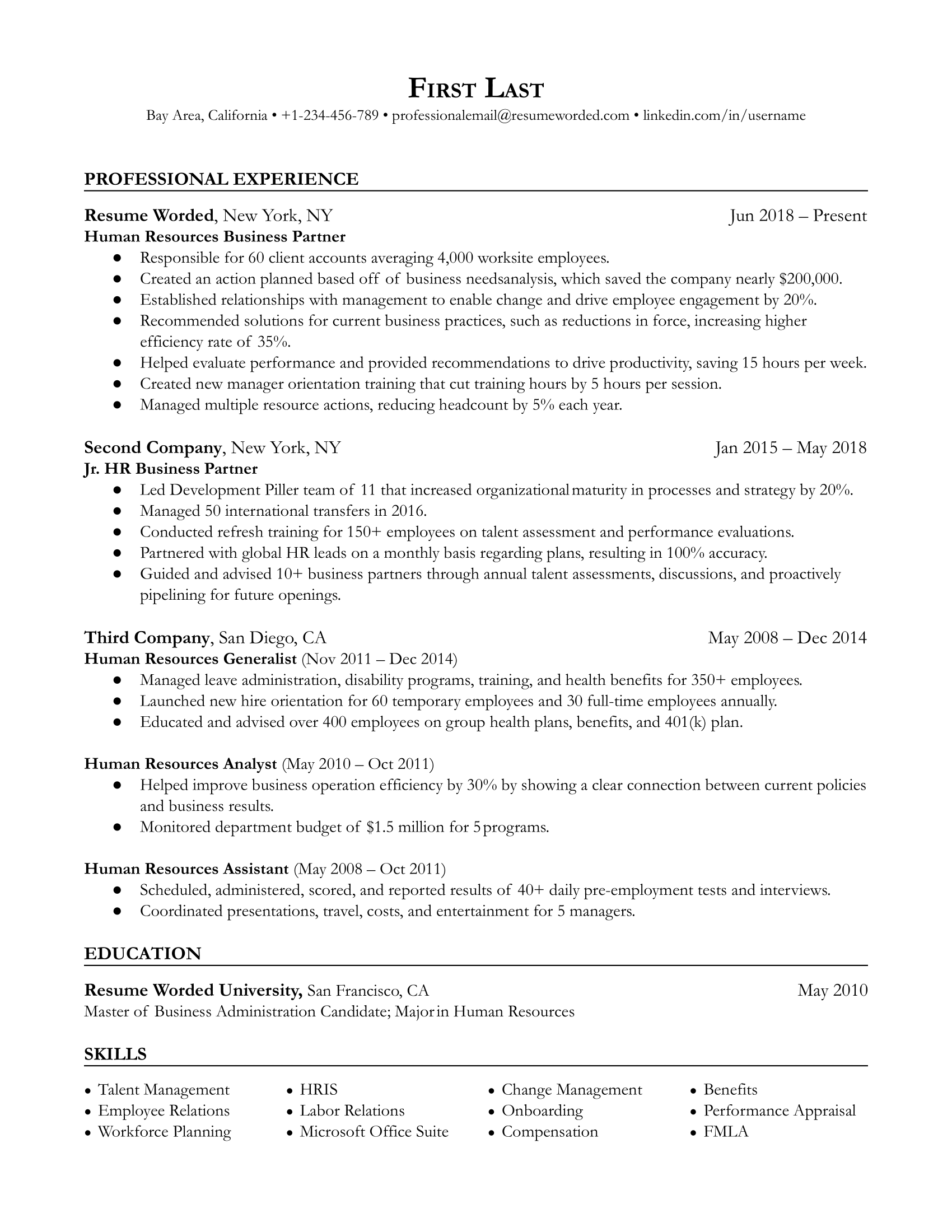

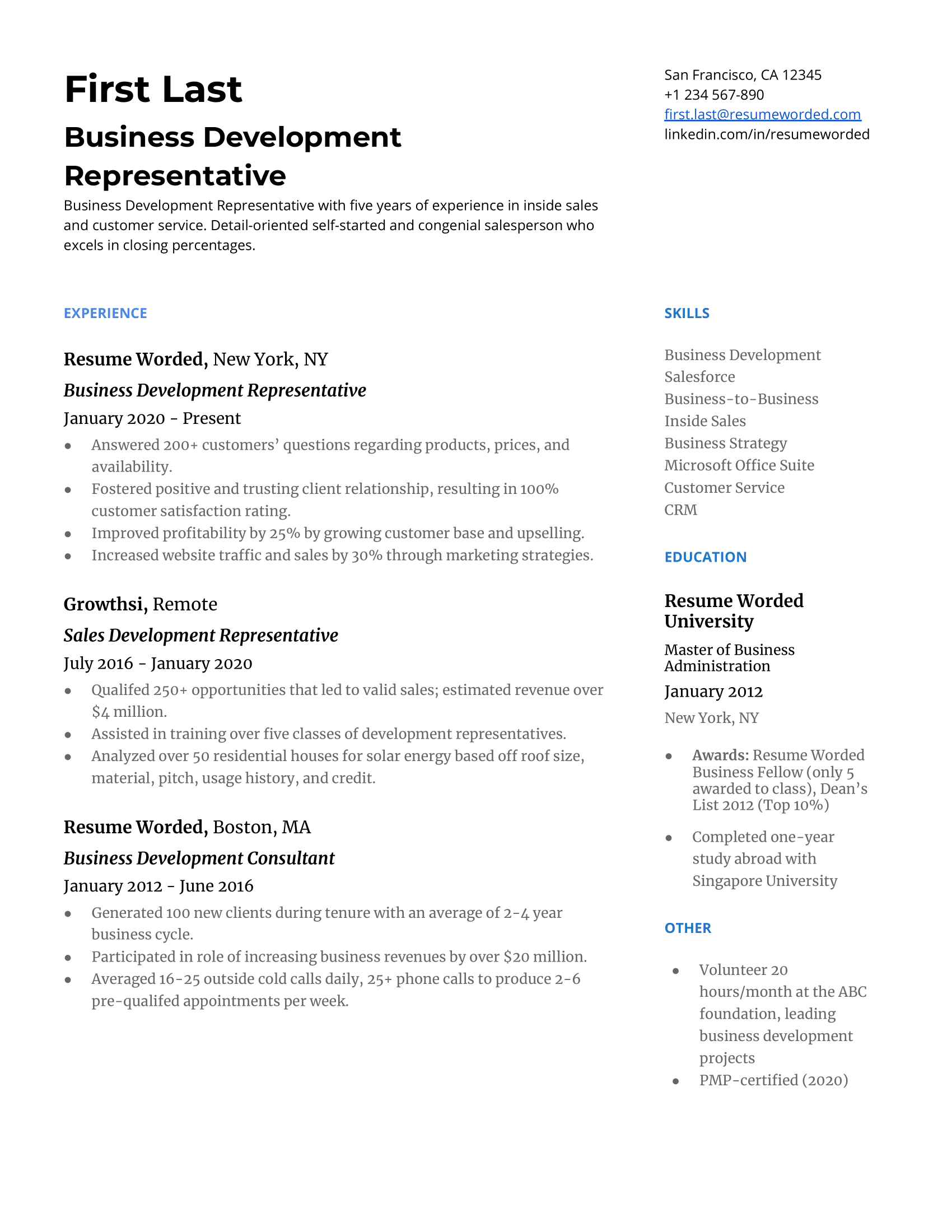

Focuses on education and internship experience

As an entry-level job applicant, you’re not expected to have a lengthy record of past jobs. A resume like this one puts the focus on relevant work the applicant has done at school or internships so that hiring managers can see evidence of their abilities.