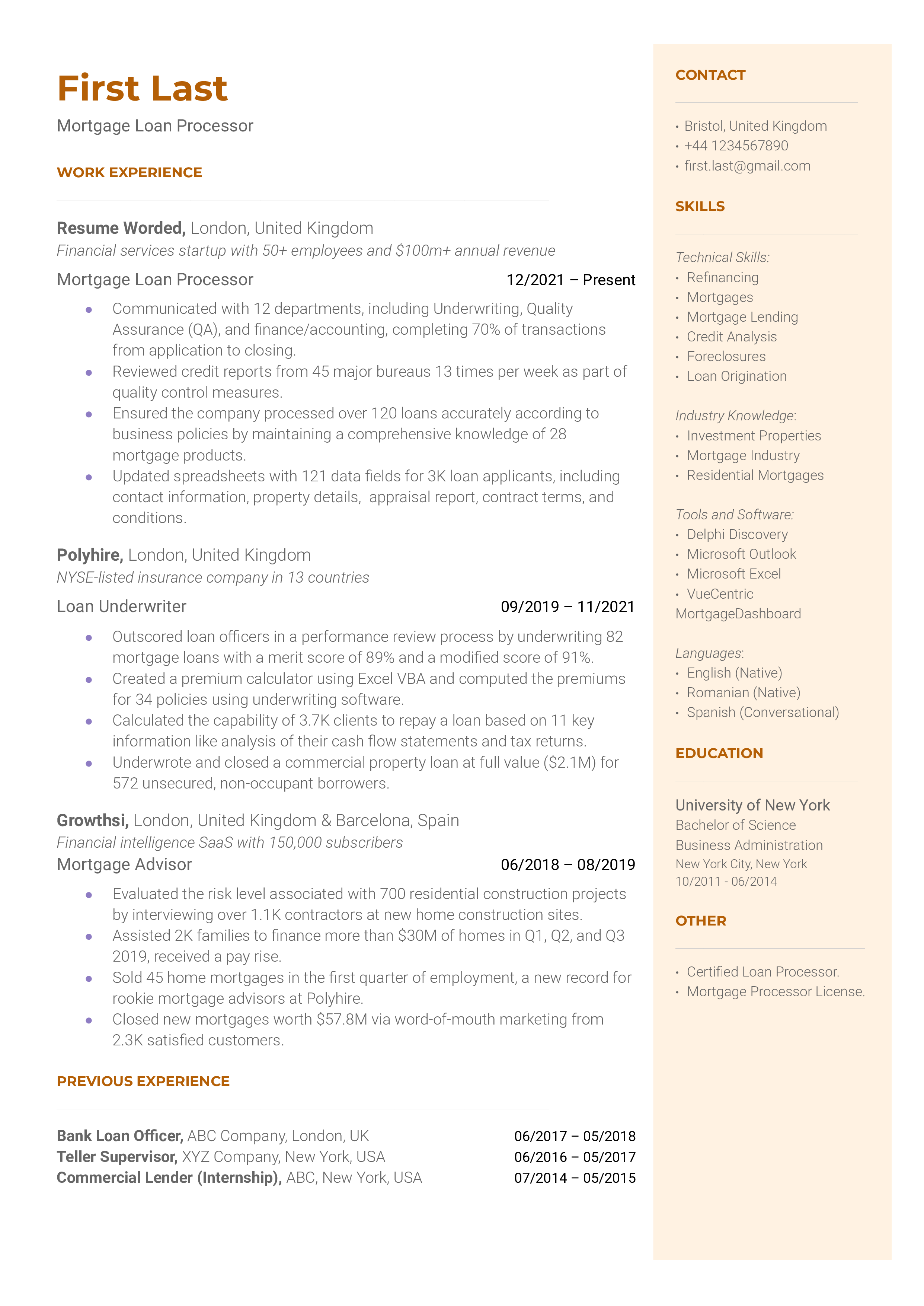

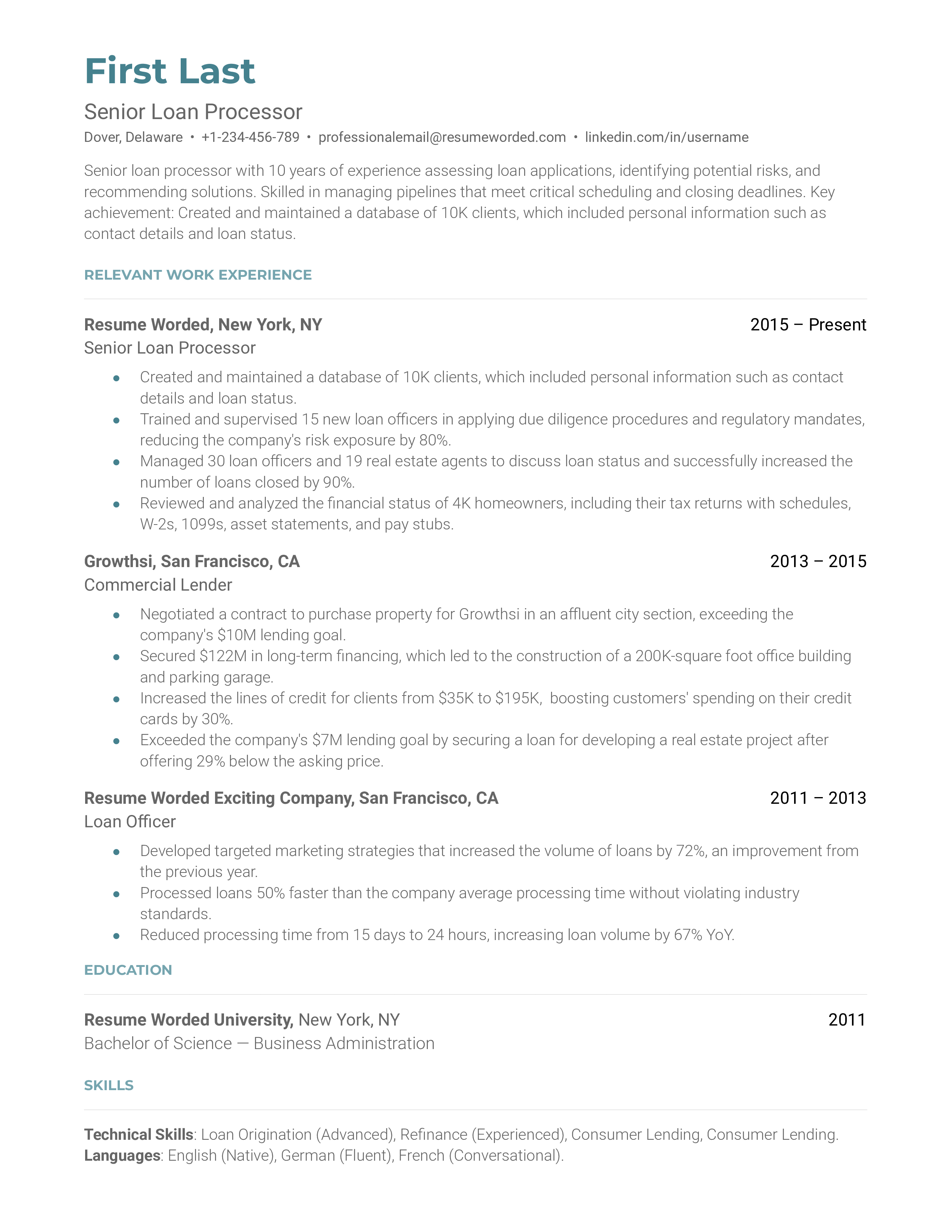

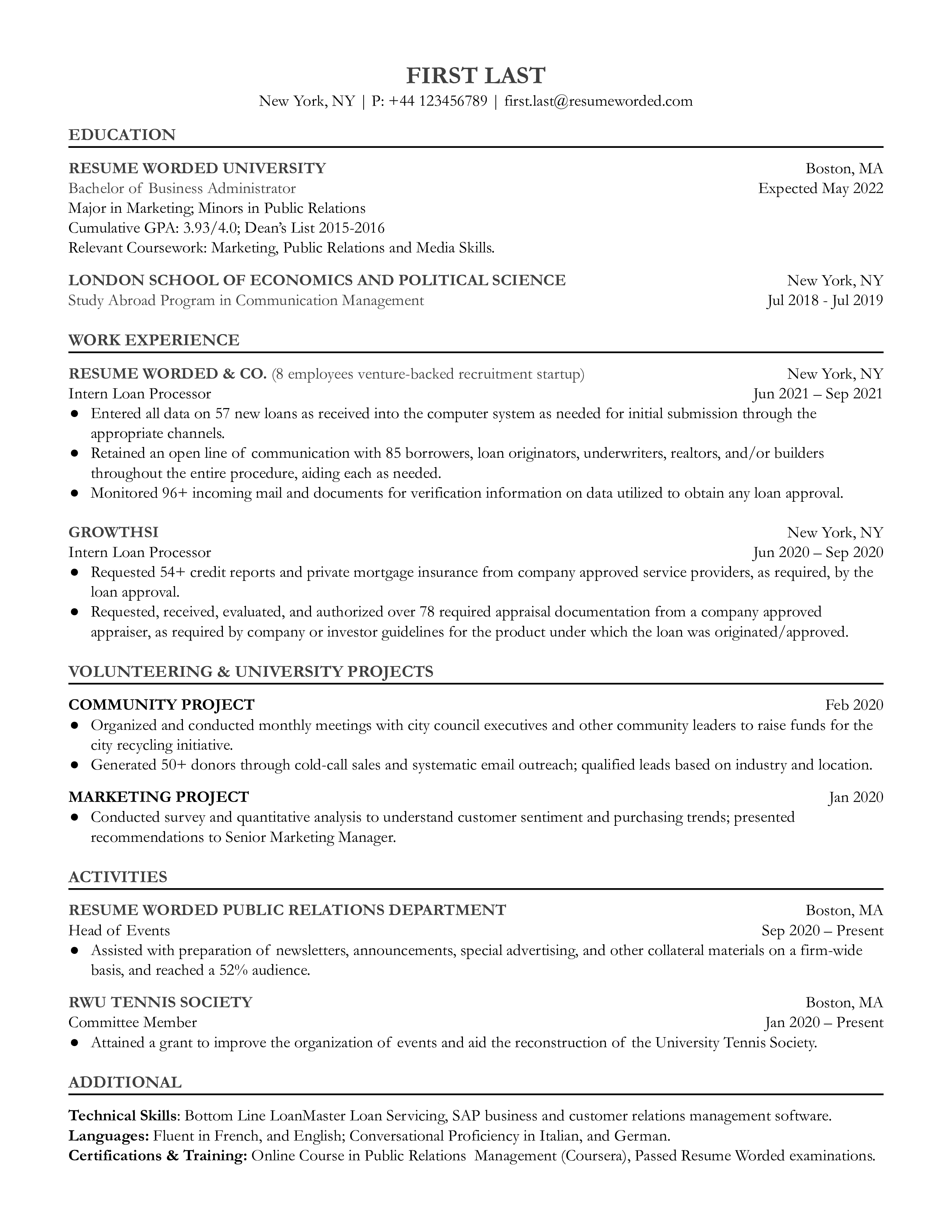

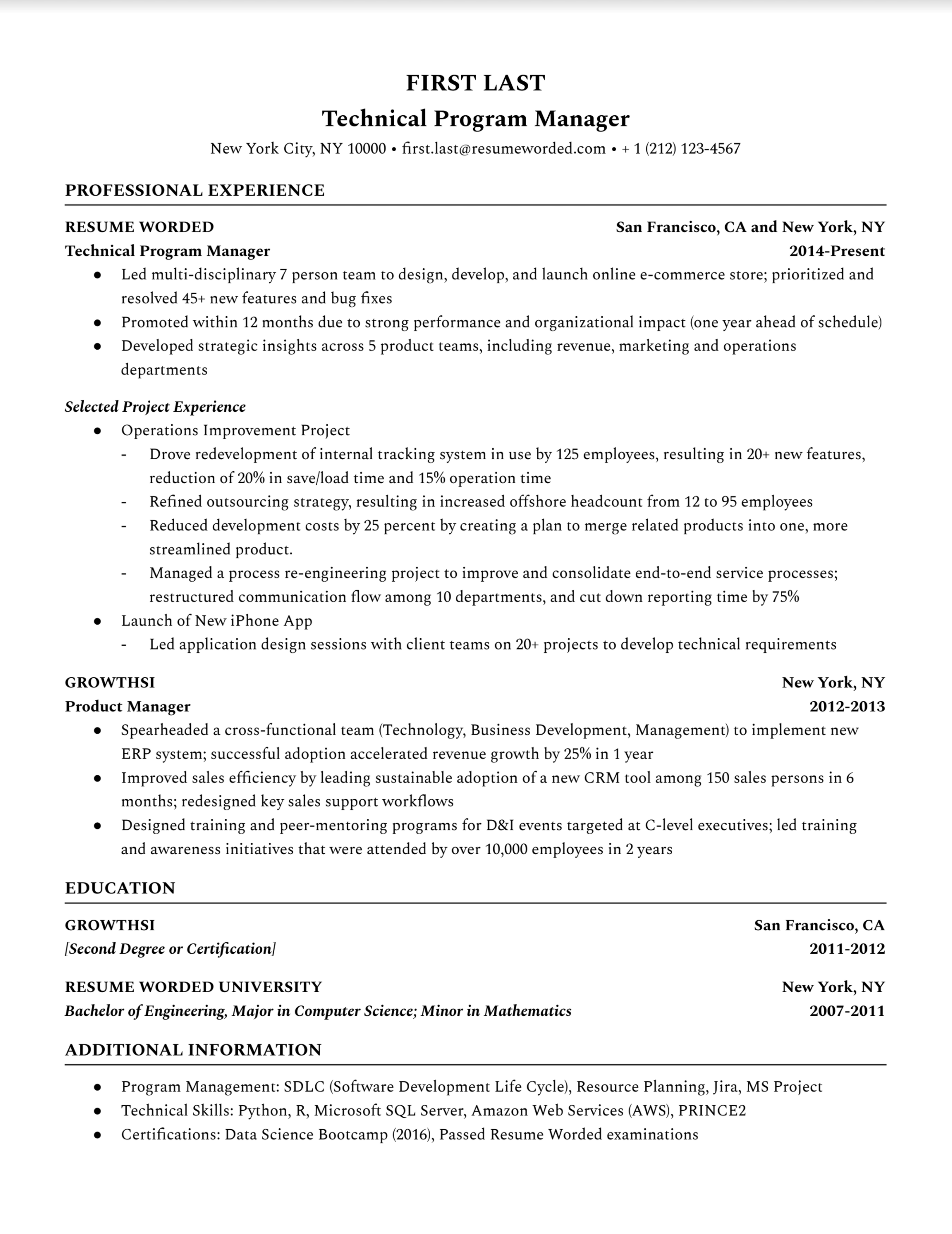

Concentrate on your mortgage loan experience.

Even if you have had other positions in the loan department apart from loan processing (this applicant was a loan underwriter and mortgage advisor) try to highlight any experience you had working with mortgages in these other positions. This applicant has done that successfully.