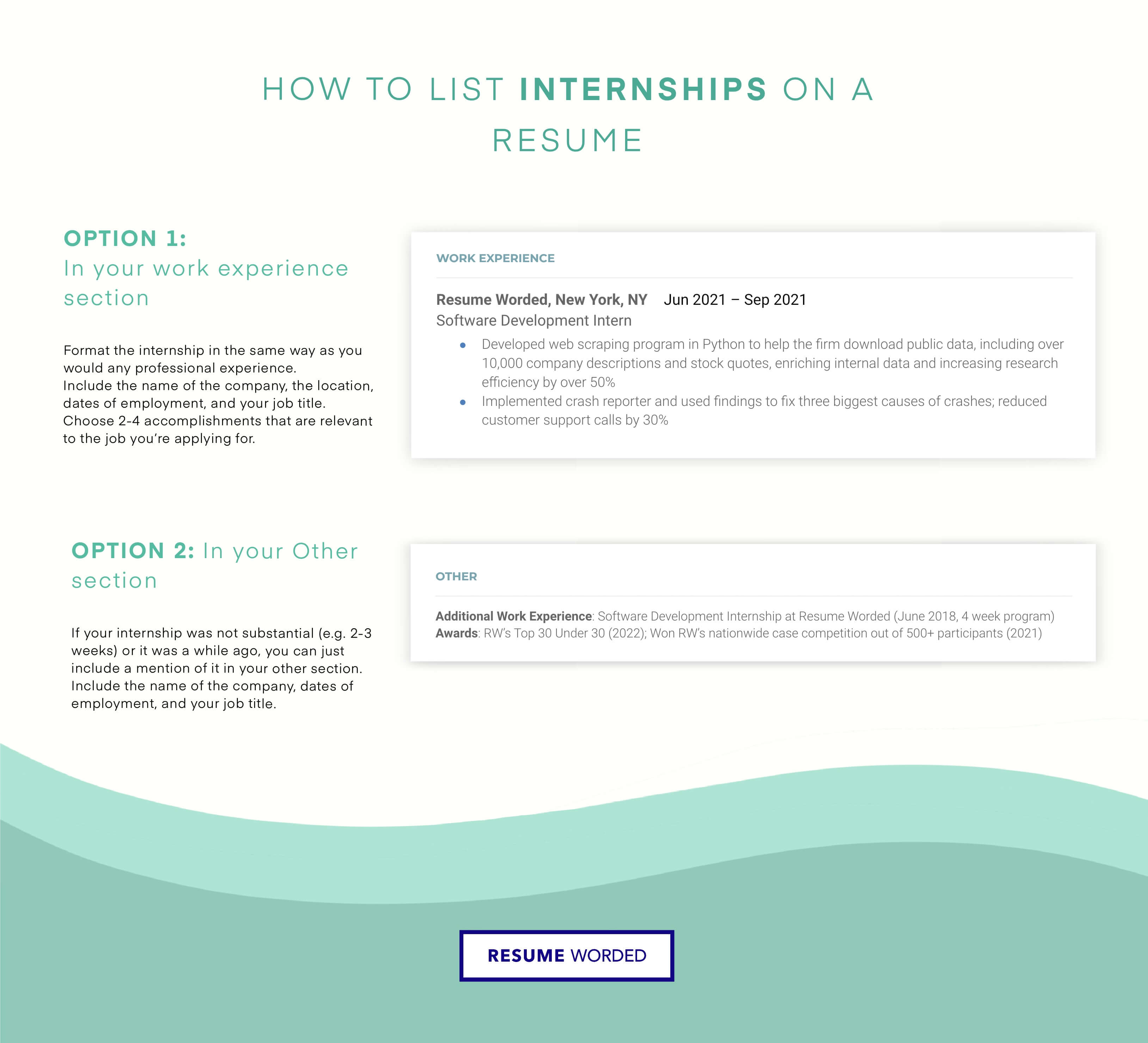

Pursue investment banking internships while on campus and beyond.

Internships are an excellent way to get your foot in the door in this highly competitive industry. So apply for these internships while you are still in school so you have it on your resume by graduation. We also recommend you continue to apply for internships even as you apply for analyst positions. Taking a few months to do an internship may significantly improve your chances of getting an analyst position if you are having trouble securing one.