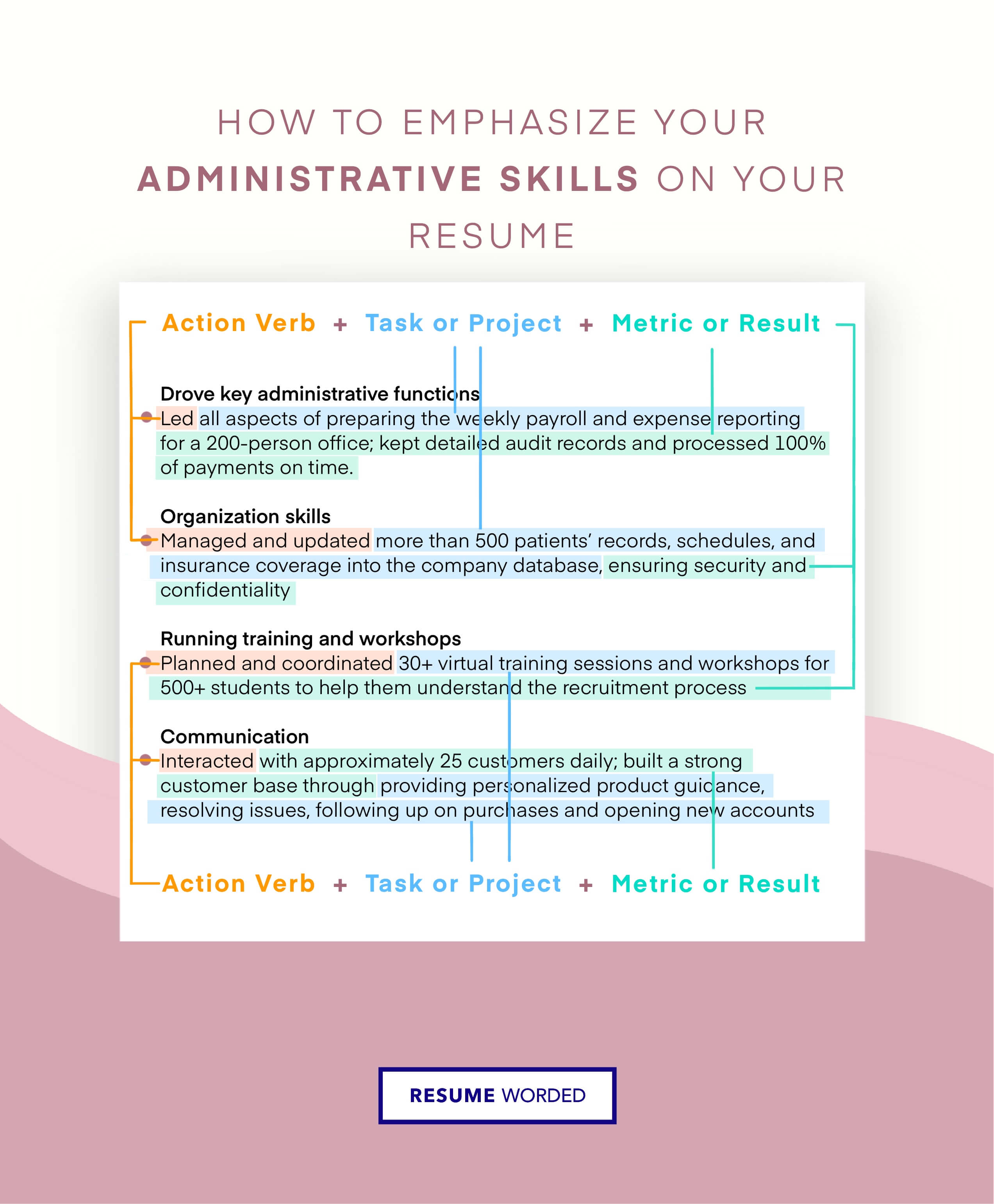

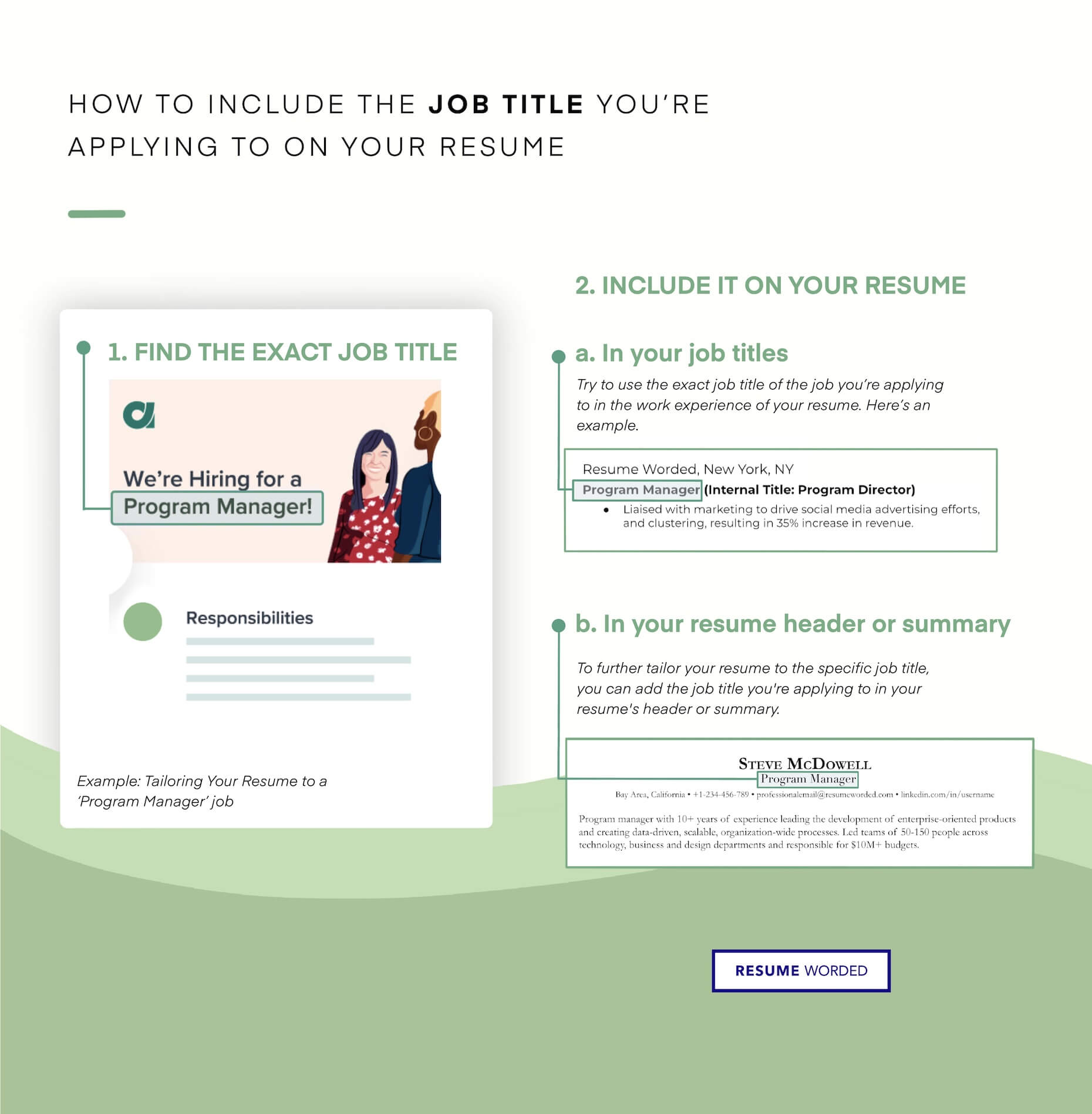

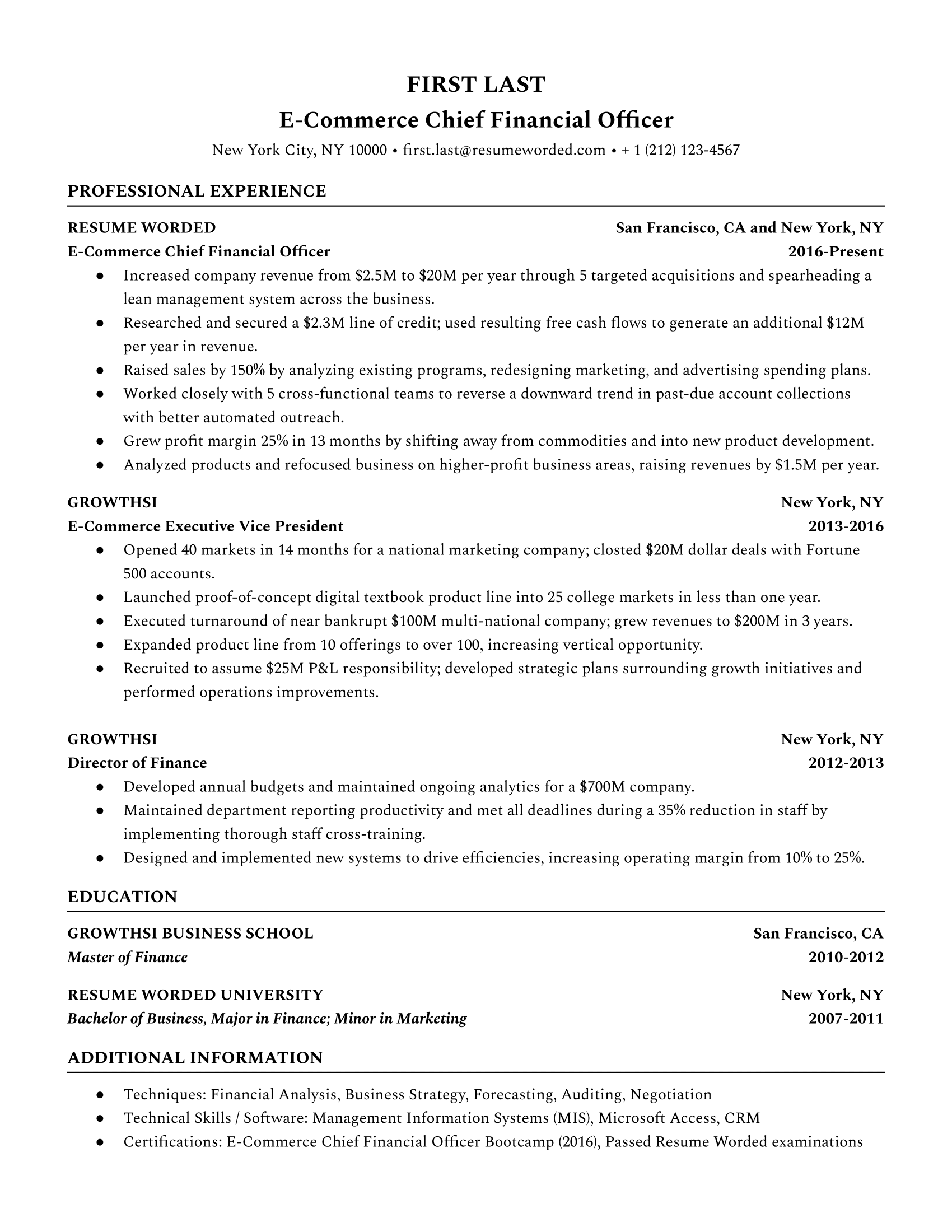

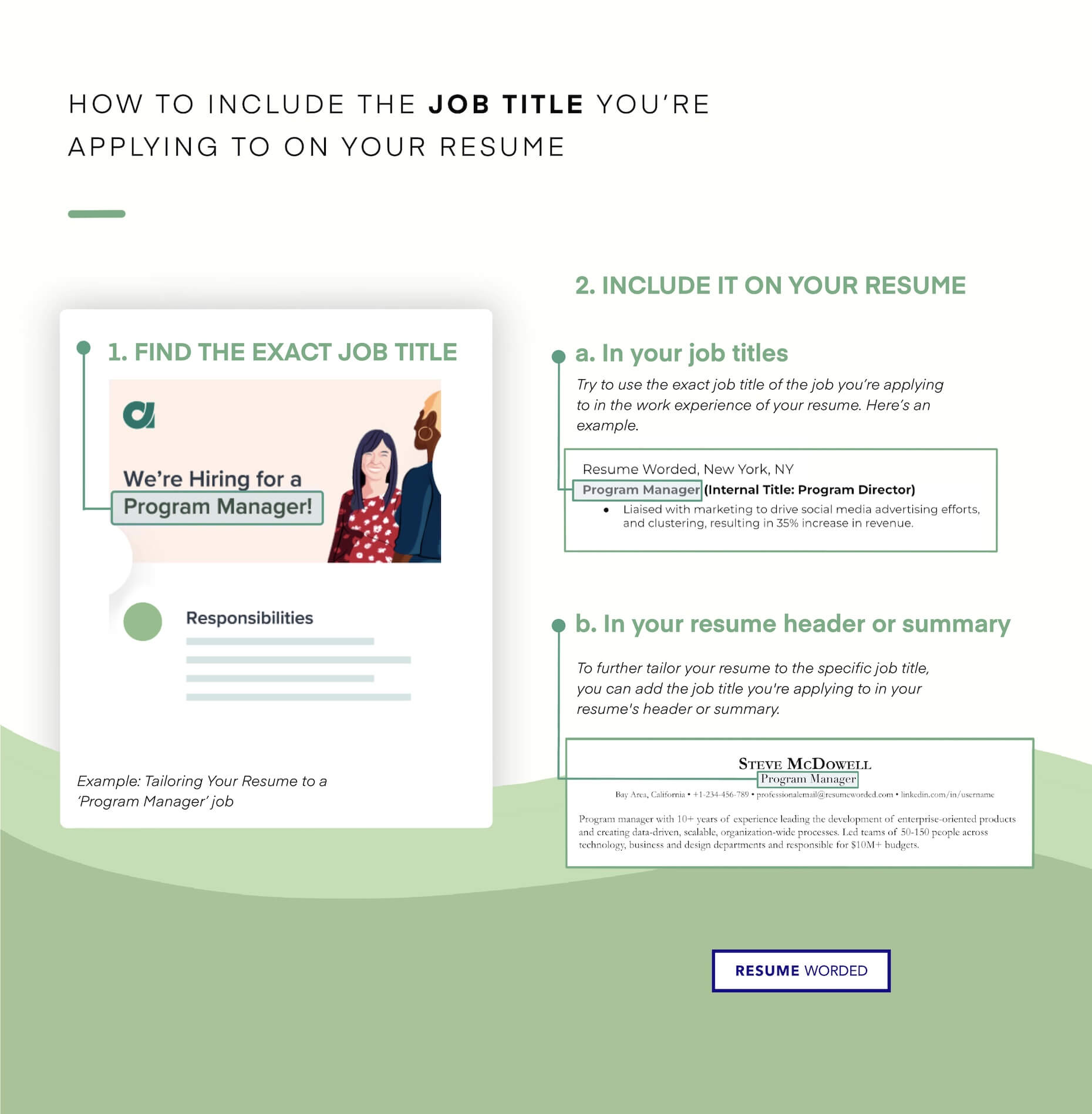

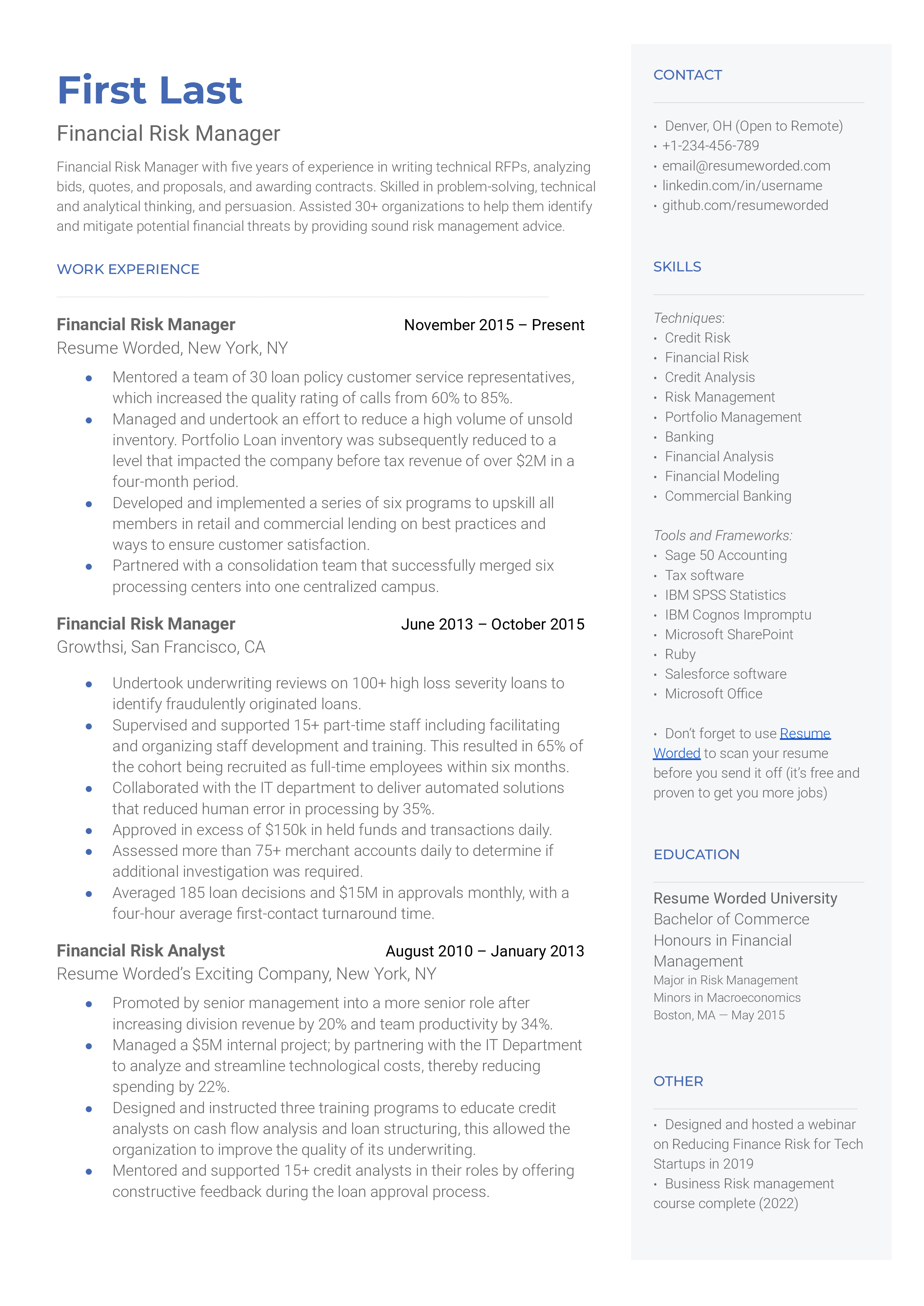

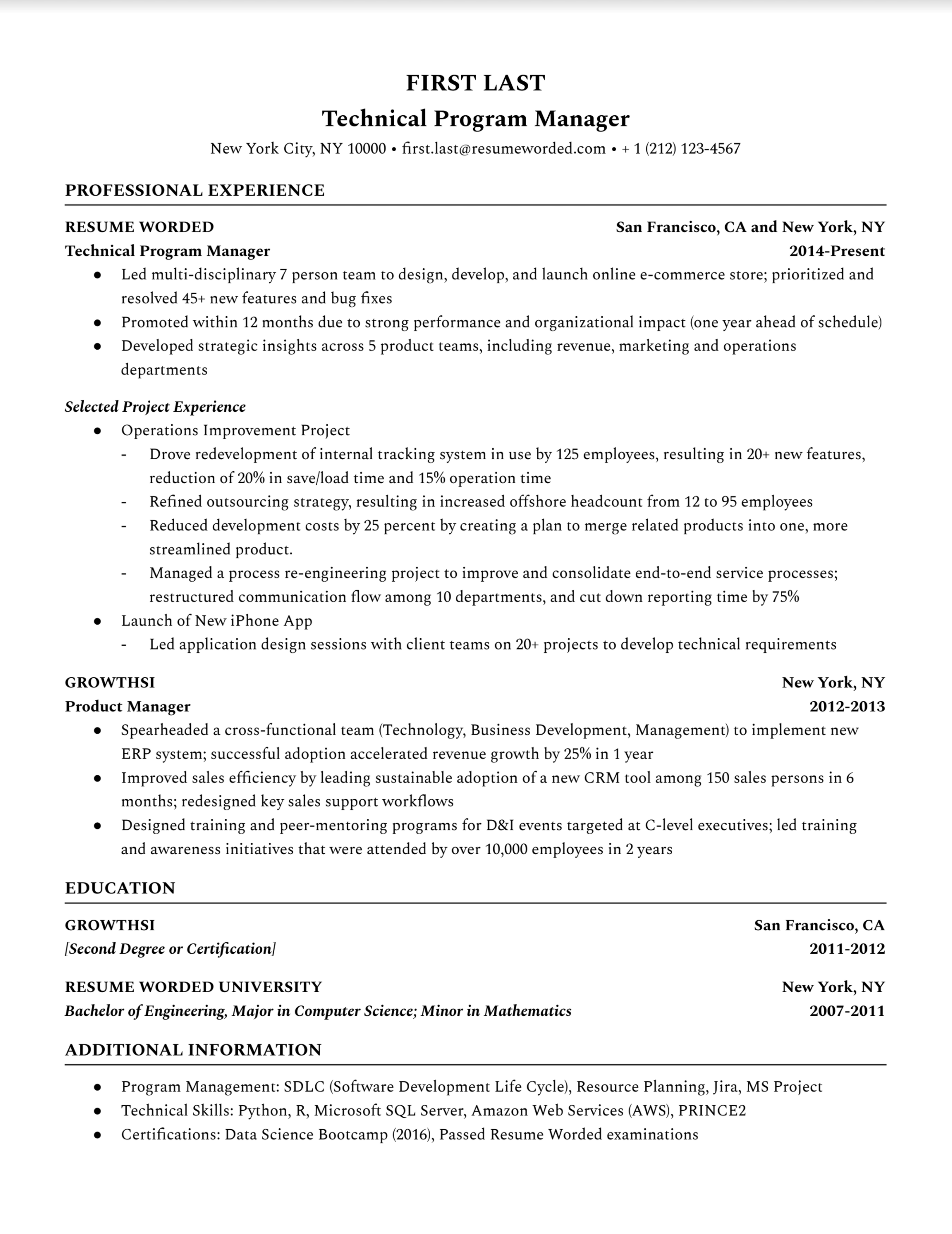

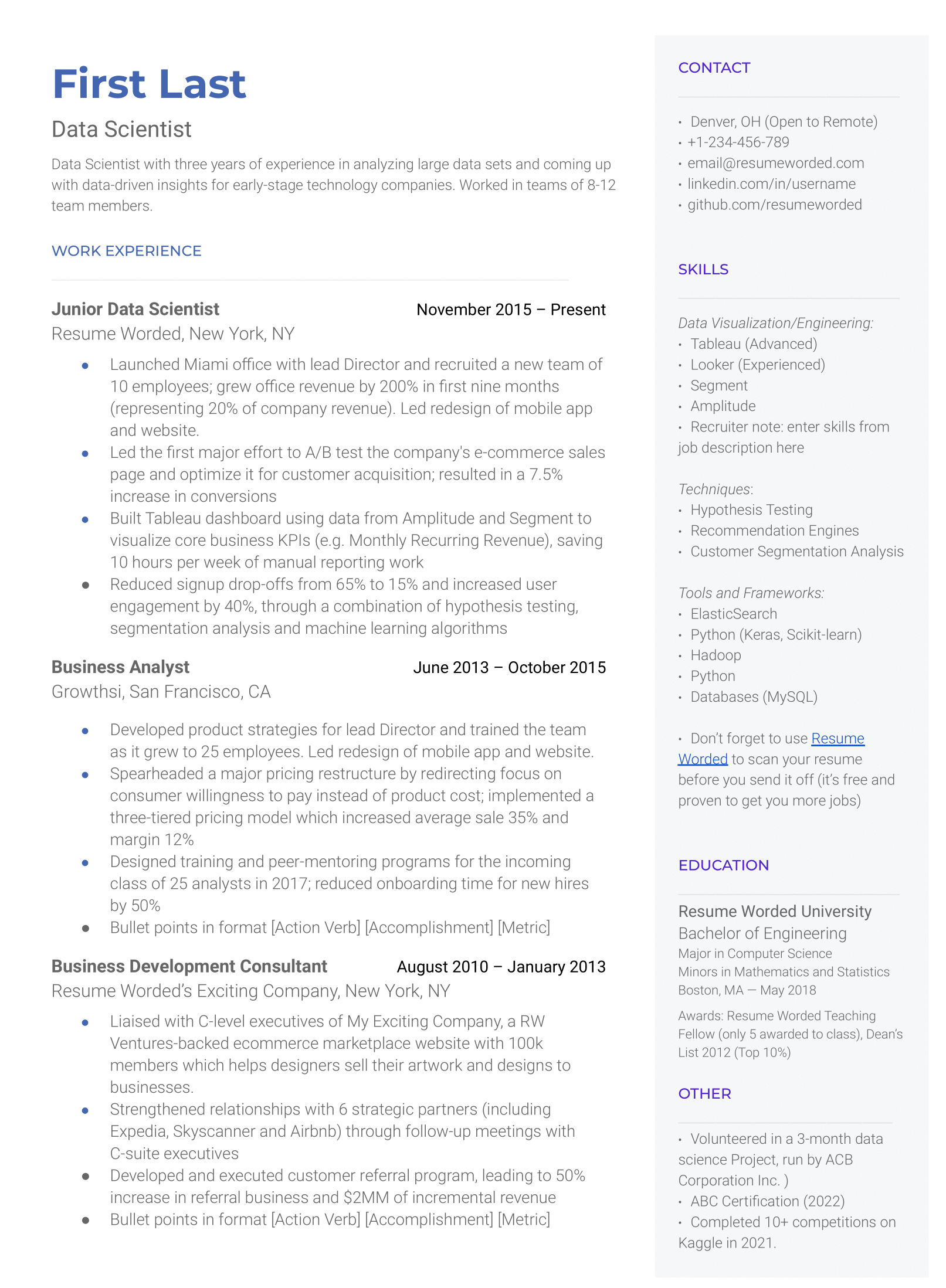

Use a resume title to tailor your resume to E-commerce roles

When applying for a job, it’s always a good idea to list the exact job title at the top of the resume. Where it’s applicable, list past job titles in the same format — for example, listing E-Commerce Chief Financial Officer or E-Commerce Executive Vice President rather than a slightly more generic job title.