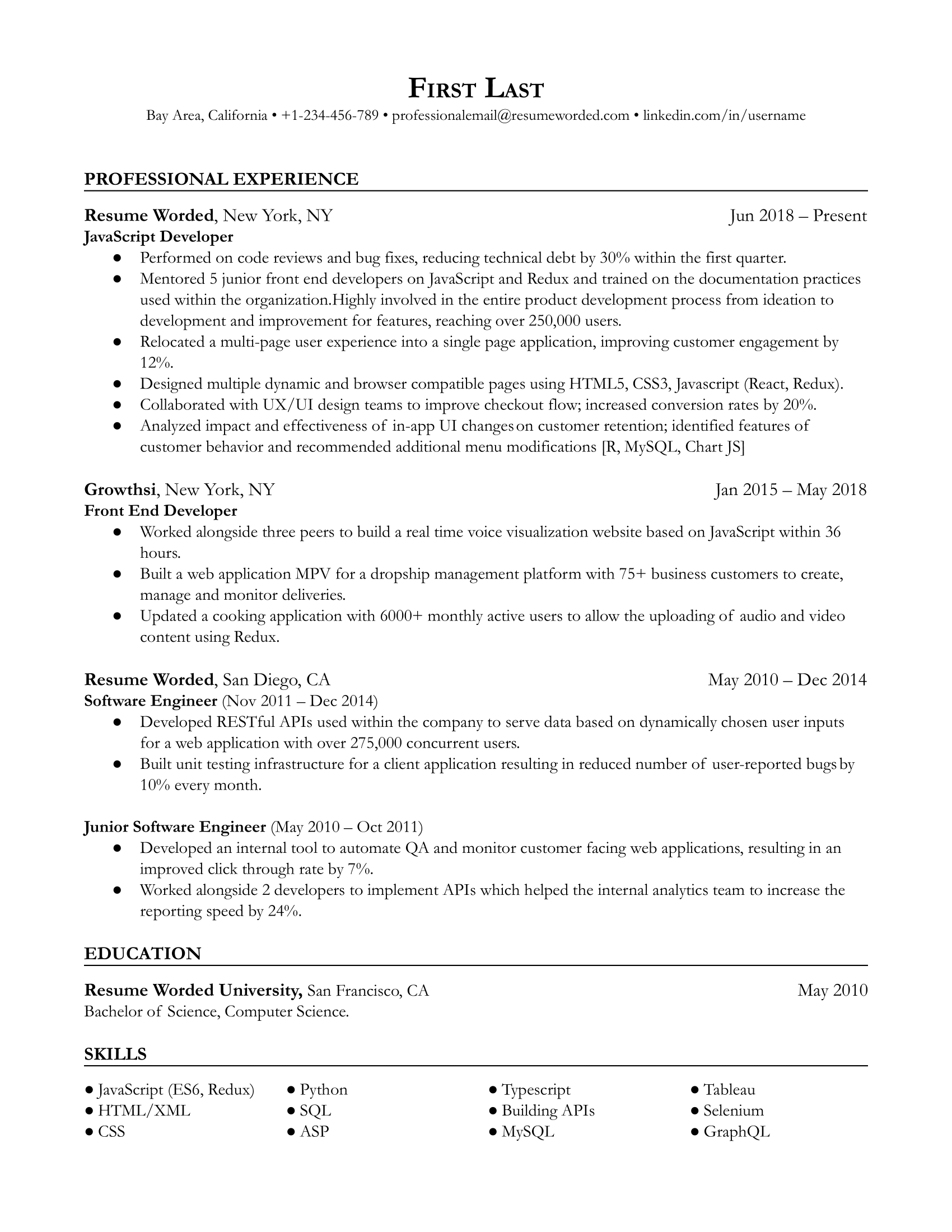

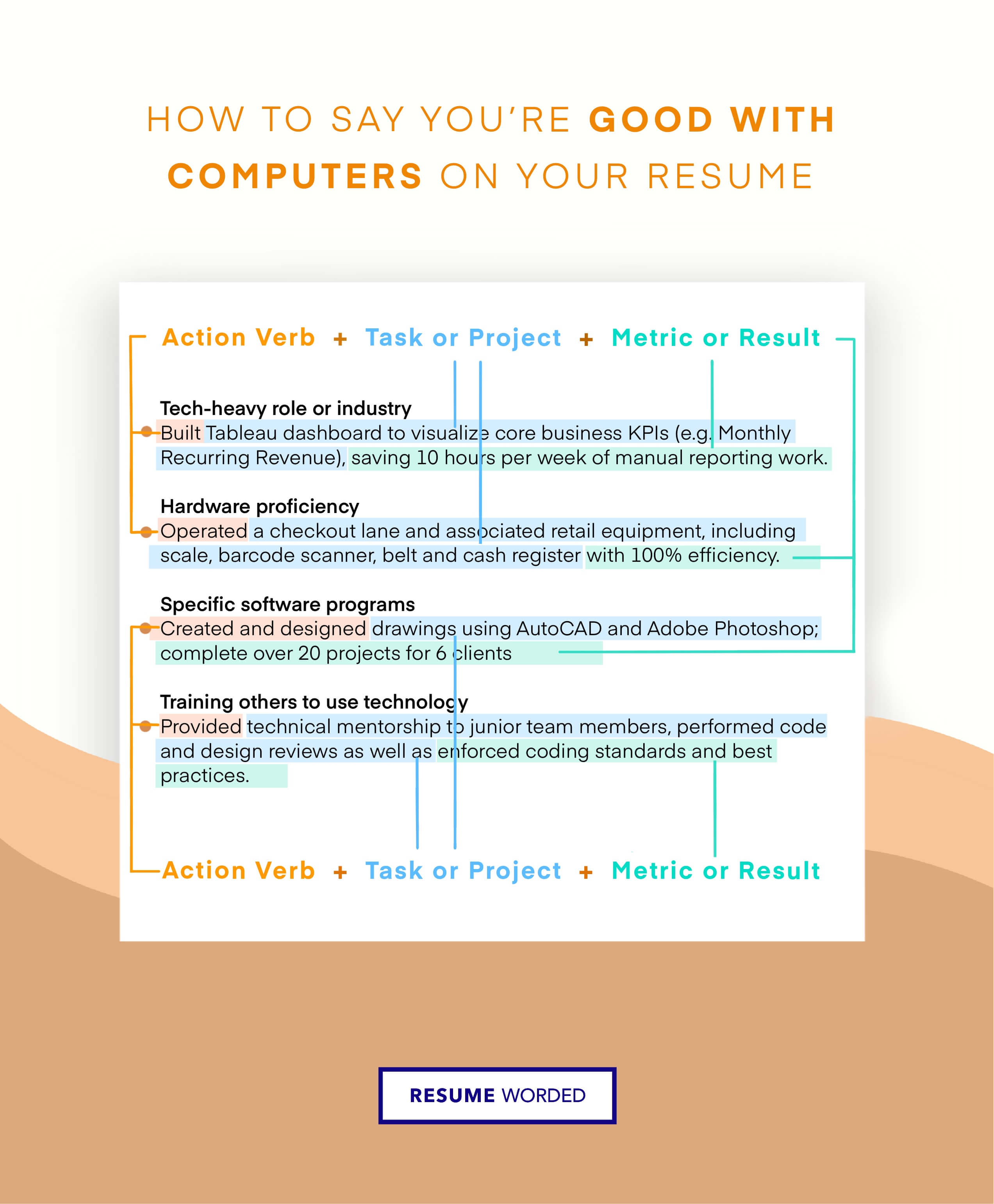

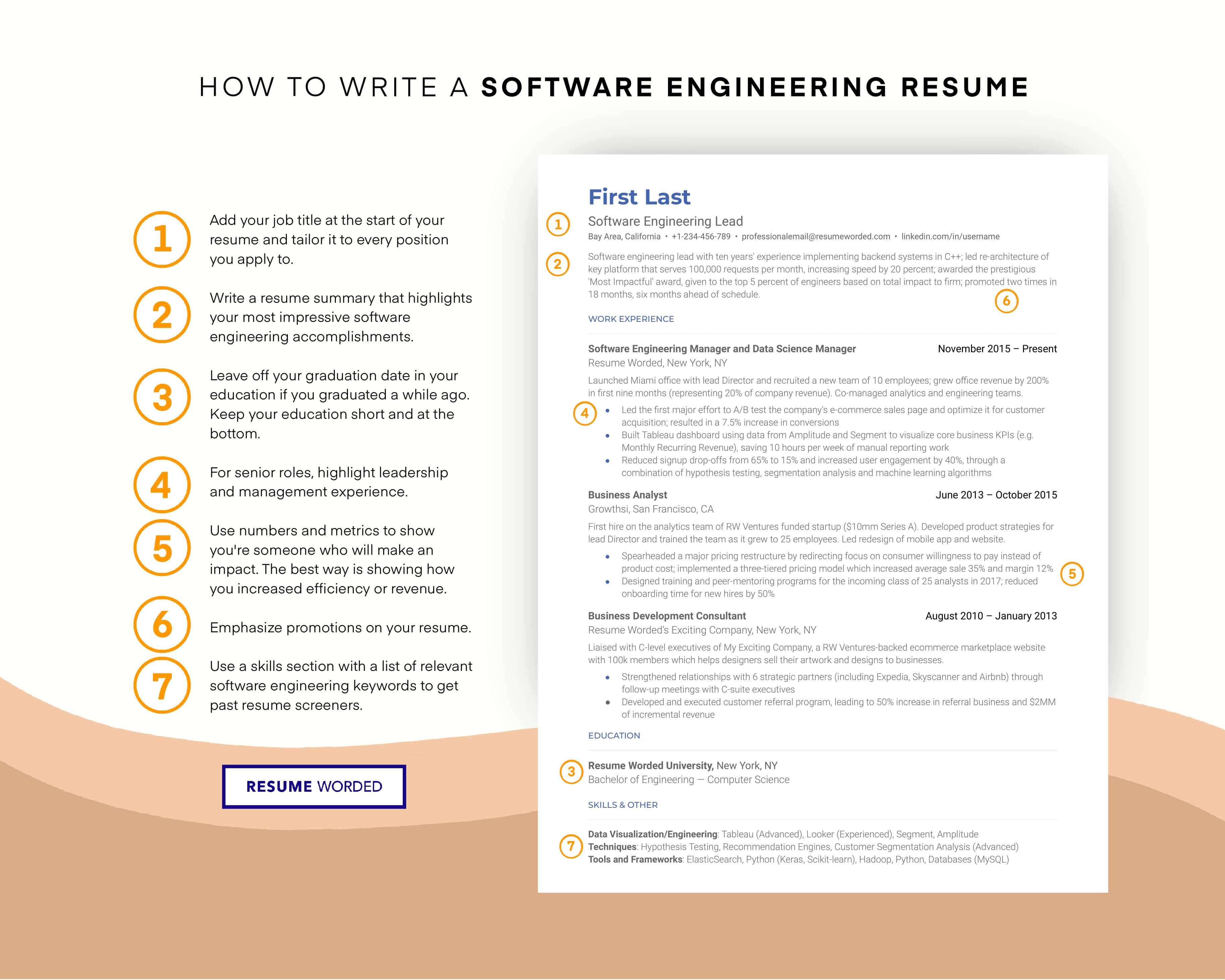

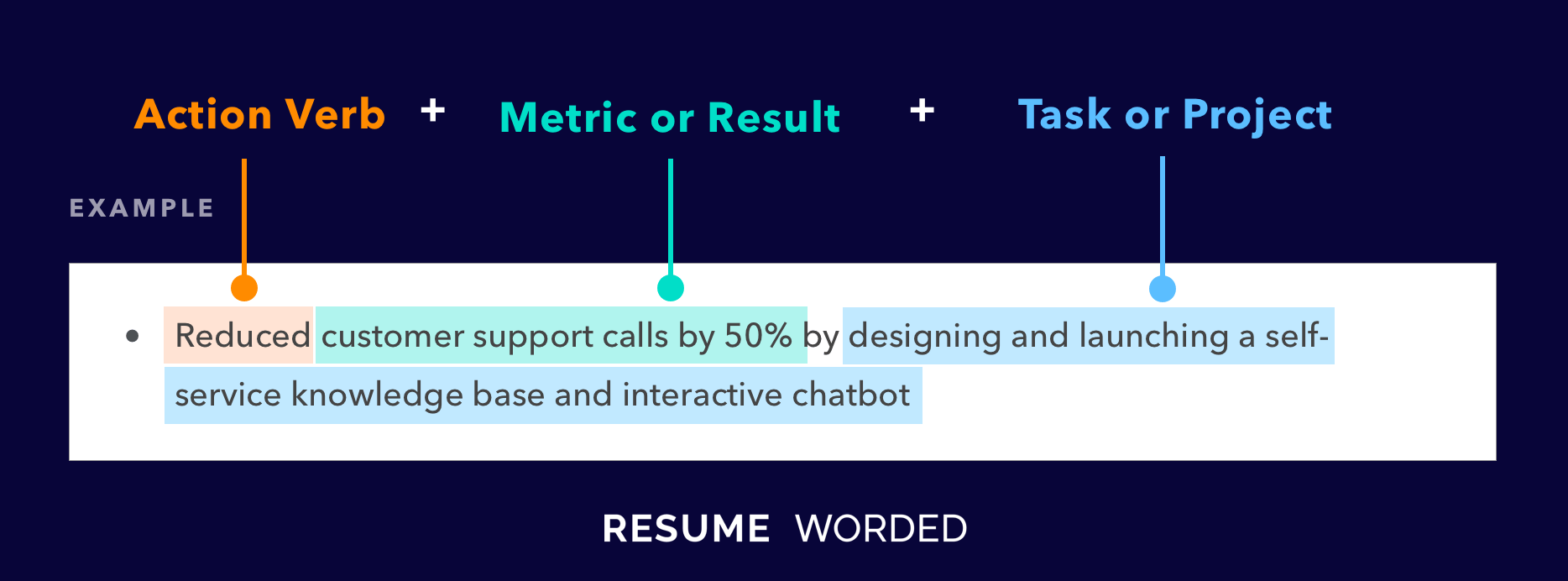

Demonstrated Javascript expertise

A hiring manager recruiting for a JavaScript developer would like to see expertise that pertains specifically to the language. When detailing your work experience, focus on such projects and contributions that demonstrate your mastery of JavaScript. For example, in this candidate’s section as a front end developer, they note their experience in building a website based on JavaScript and show that they had the expertise and collaborative skills to work with a team to build one within 36 hours.