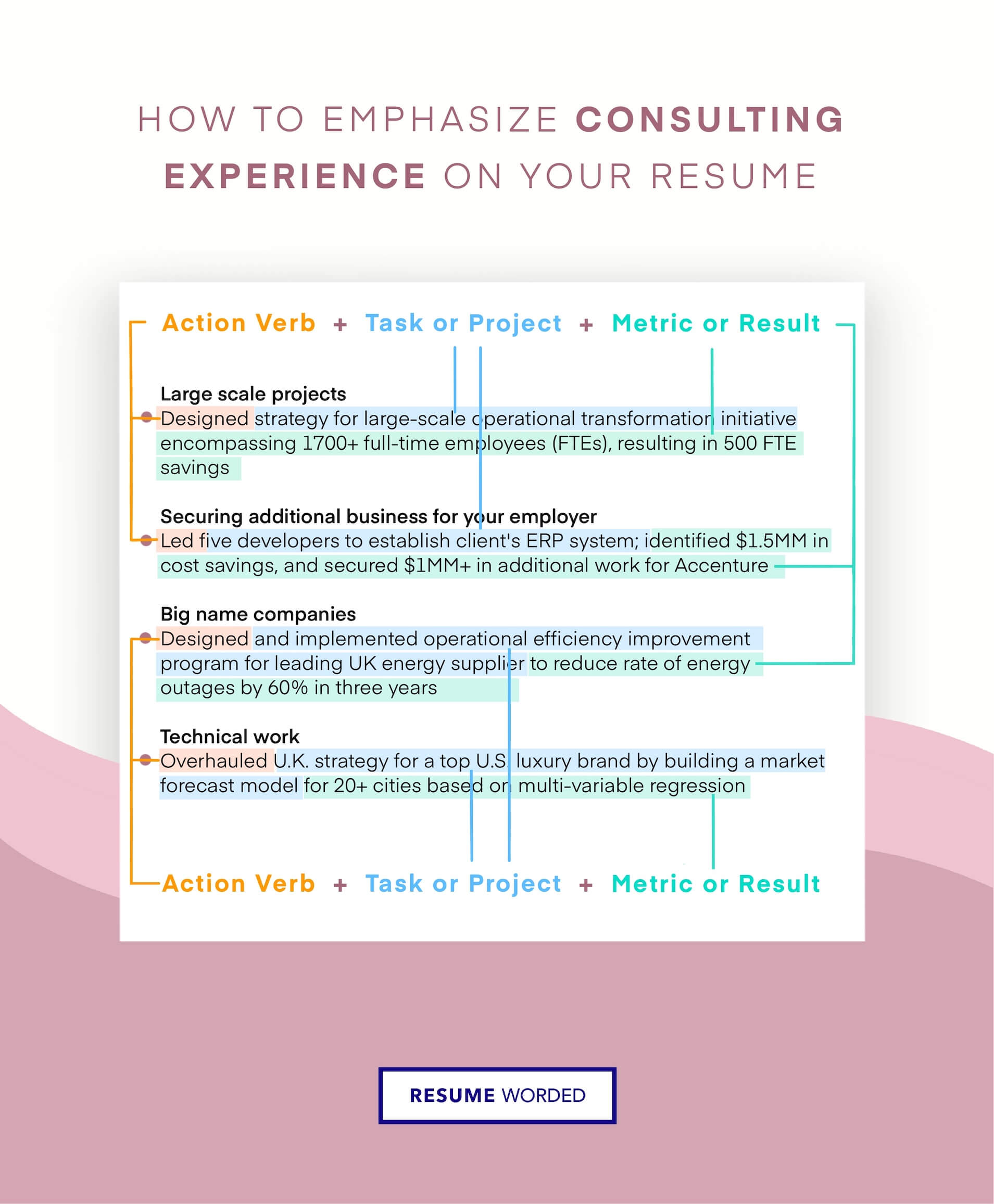

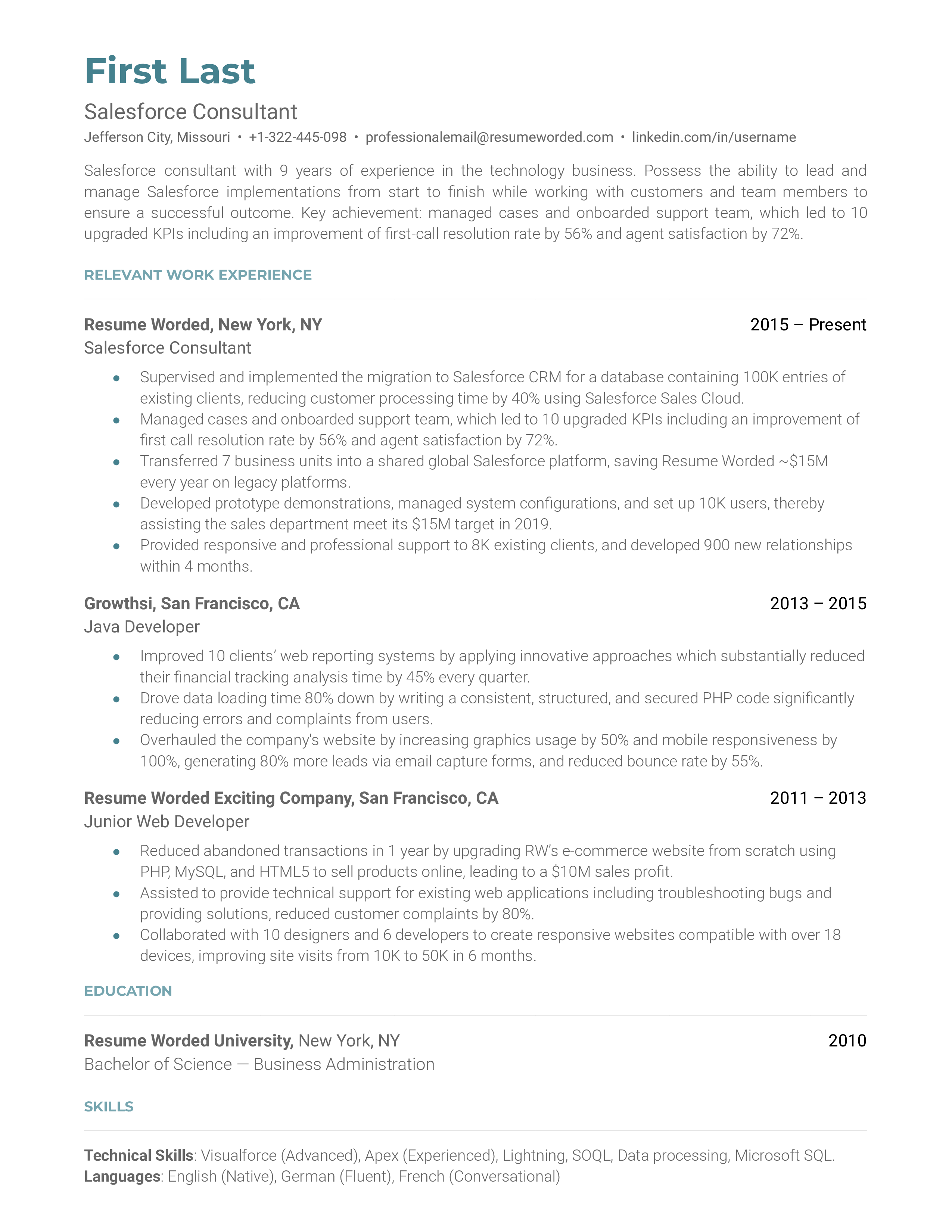

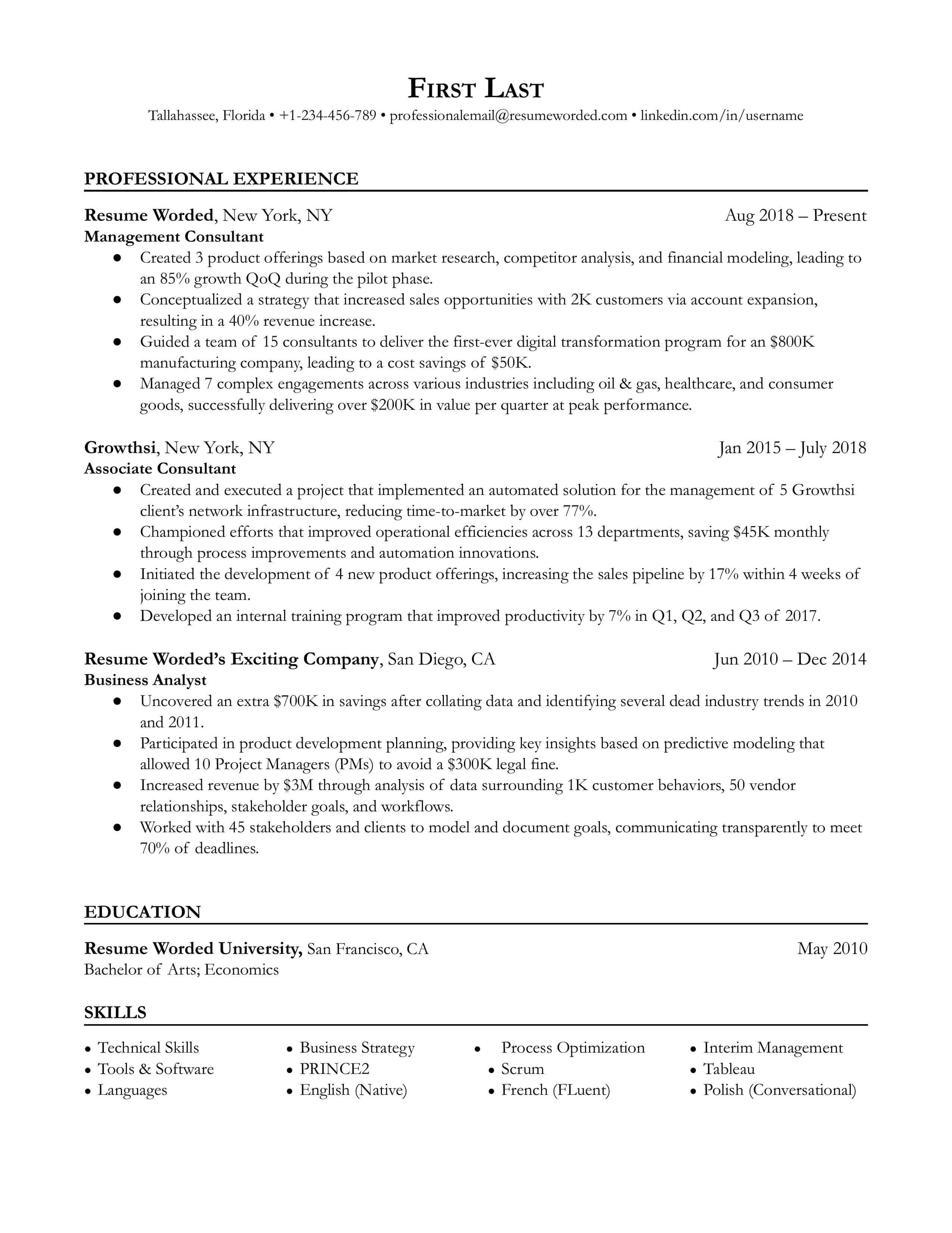

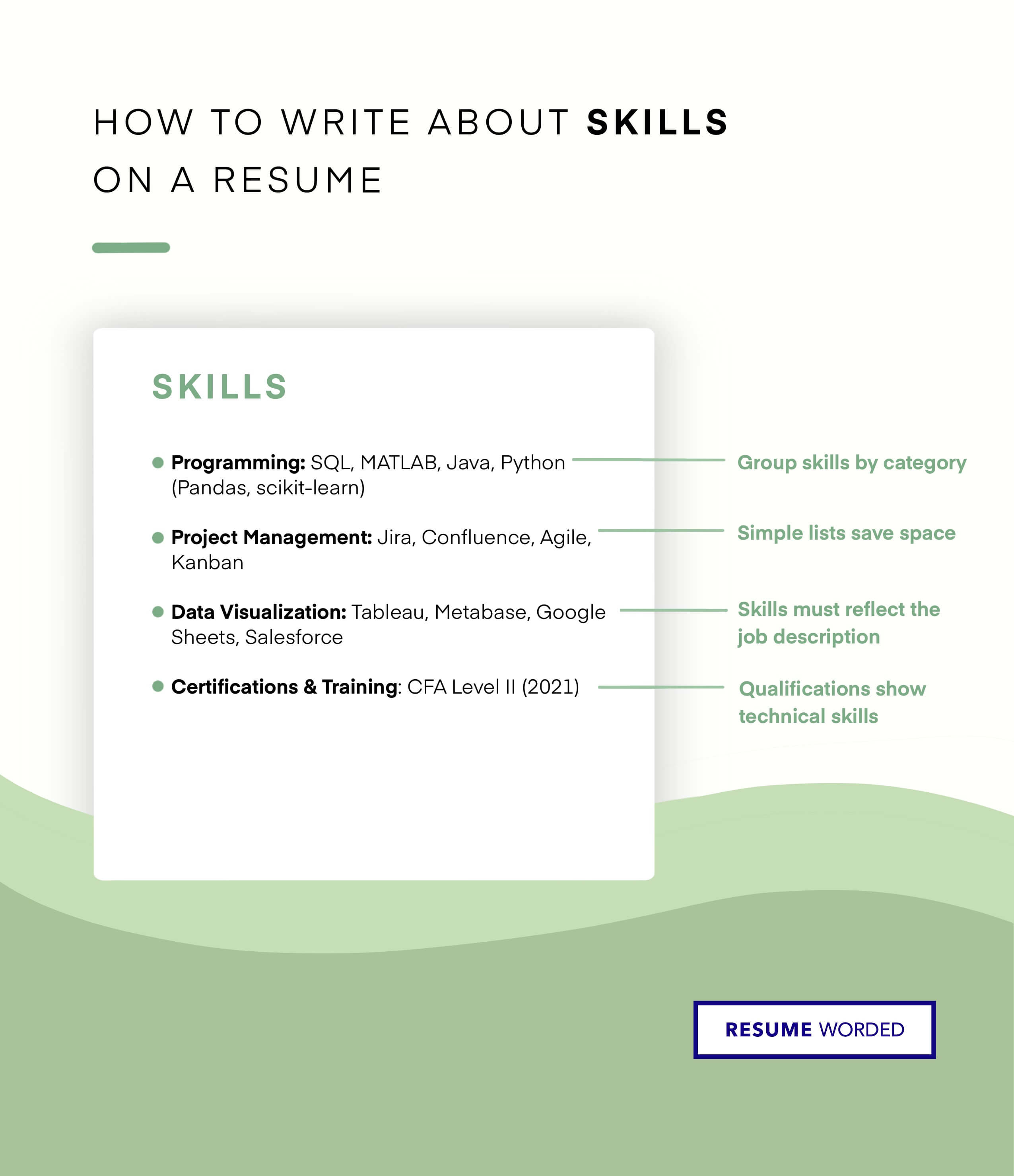

Showcase your project management skills.

As a Salesforce consultant, you will be in charge of project management, so it’s important to emphasize this competency. You must be able to design plans, translate stakeholders’ goals into technical requirements, and make sure everyone follows the required business standards. This often involves budgeting, setting deadlines, and ensuring everyone are on track.