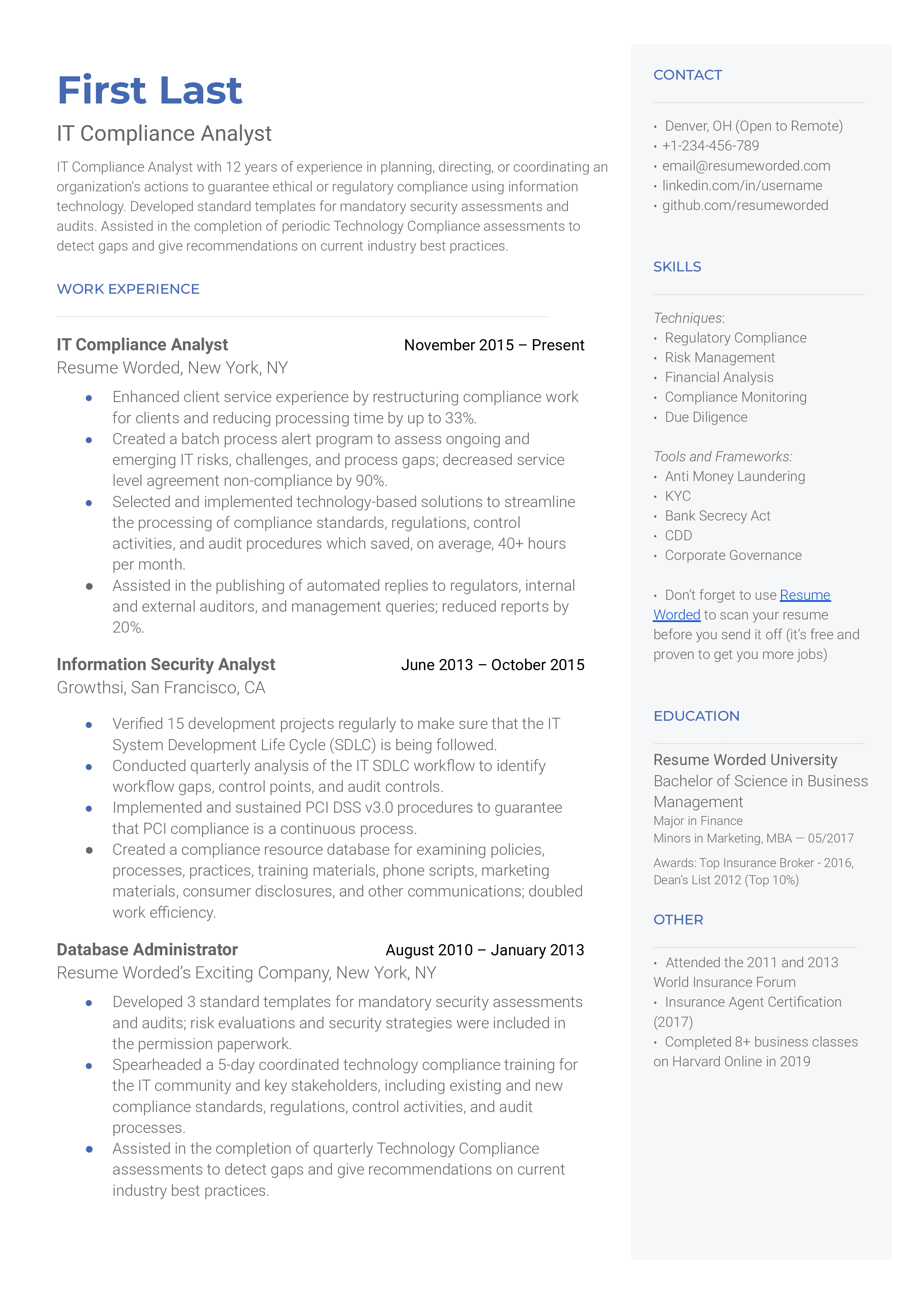

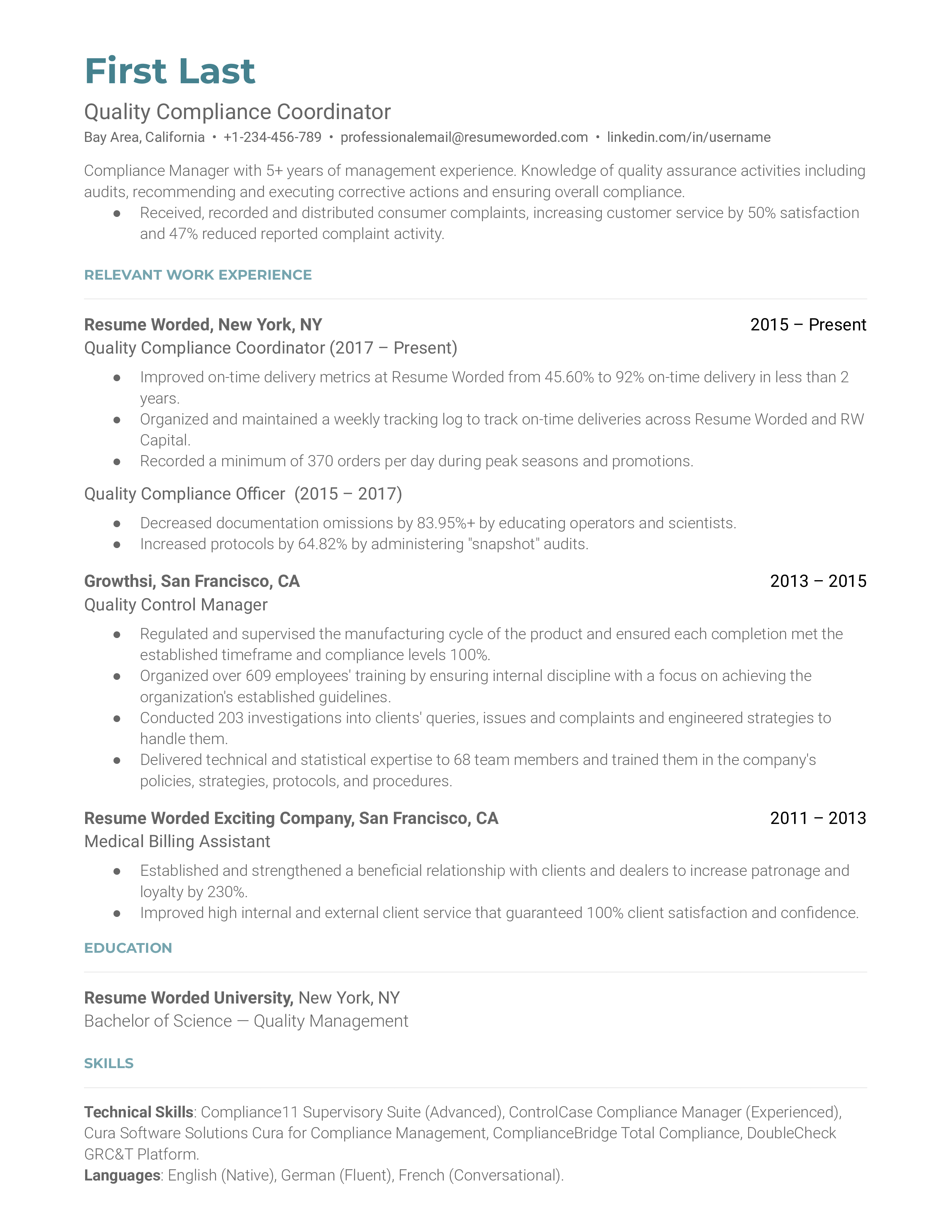

Add IT management certifications or diplomas

Considering this is such a technical role, adding certifications to demonstrate your skills would be relevant. This will validate your capacity to handle data management tools, cyber security software, etc.