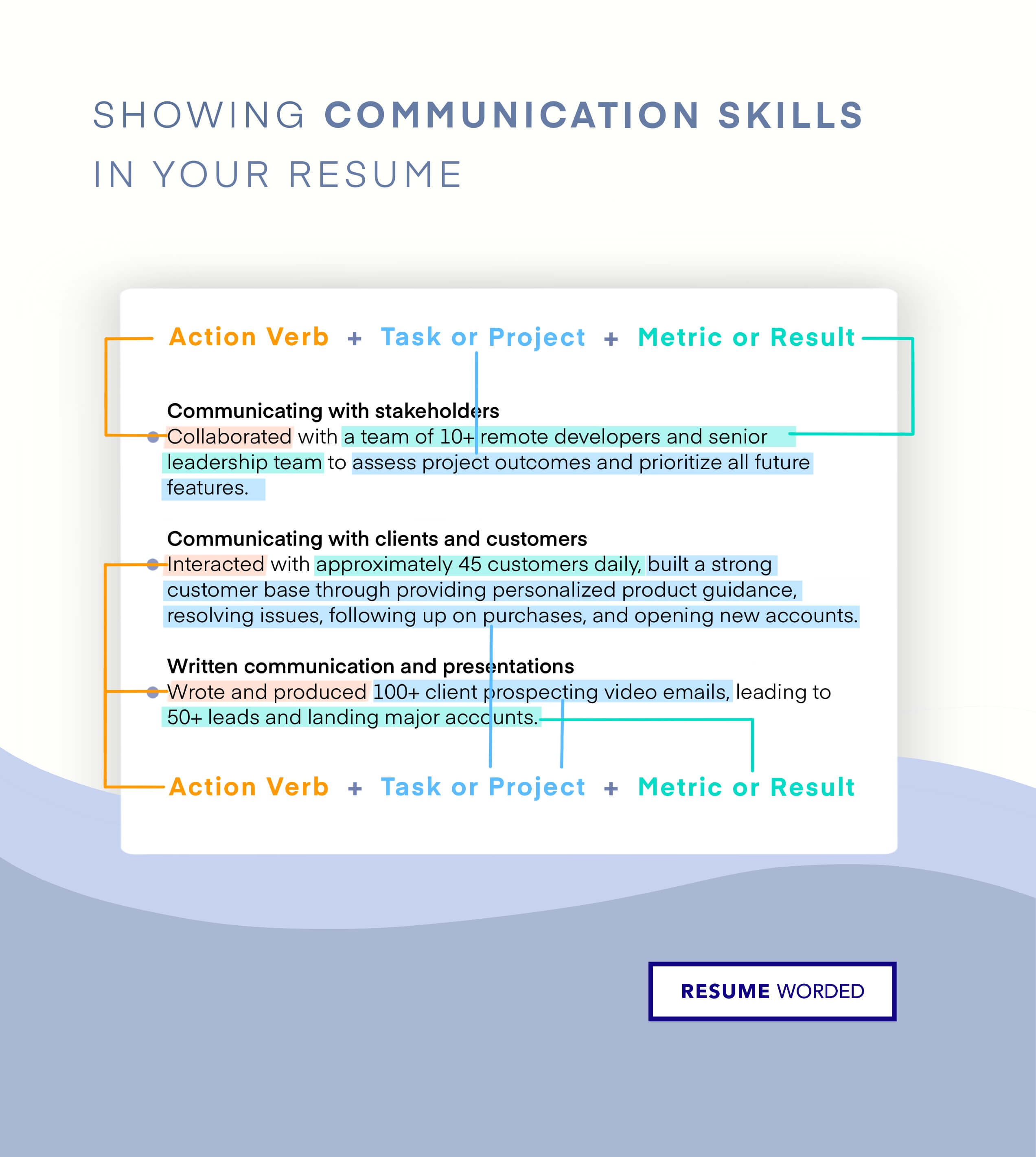

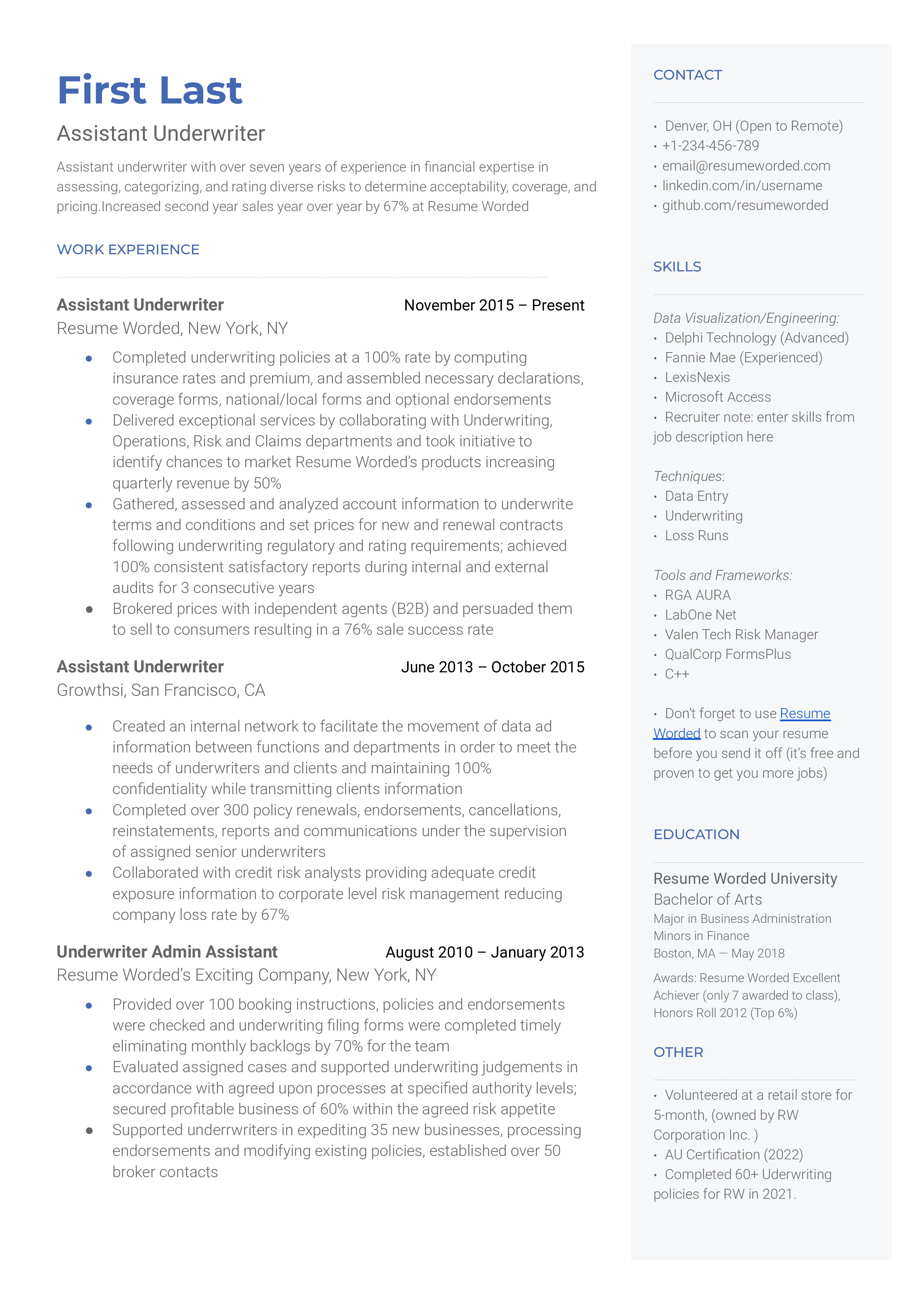

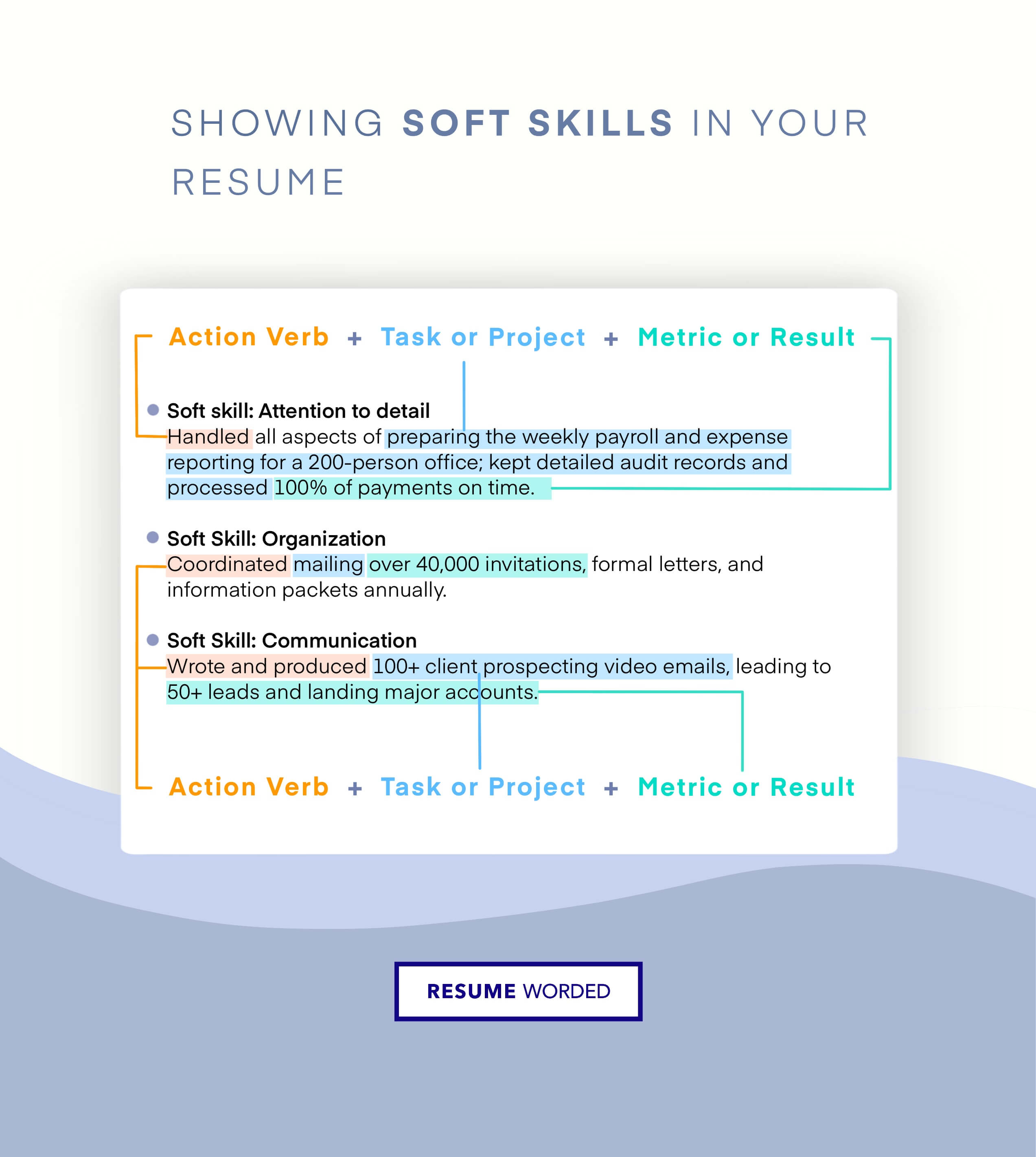

Mention your assistant underwriter's strengths

It is advisable to highlight your strengths in assisting in your resume if you don't have a lot of experience to your name. These can involve highlighting your capacity for multitasking or communication as well as your sense of teamwork.