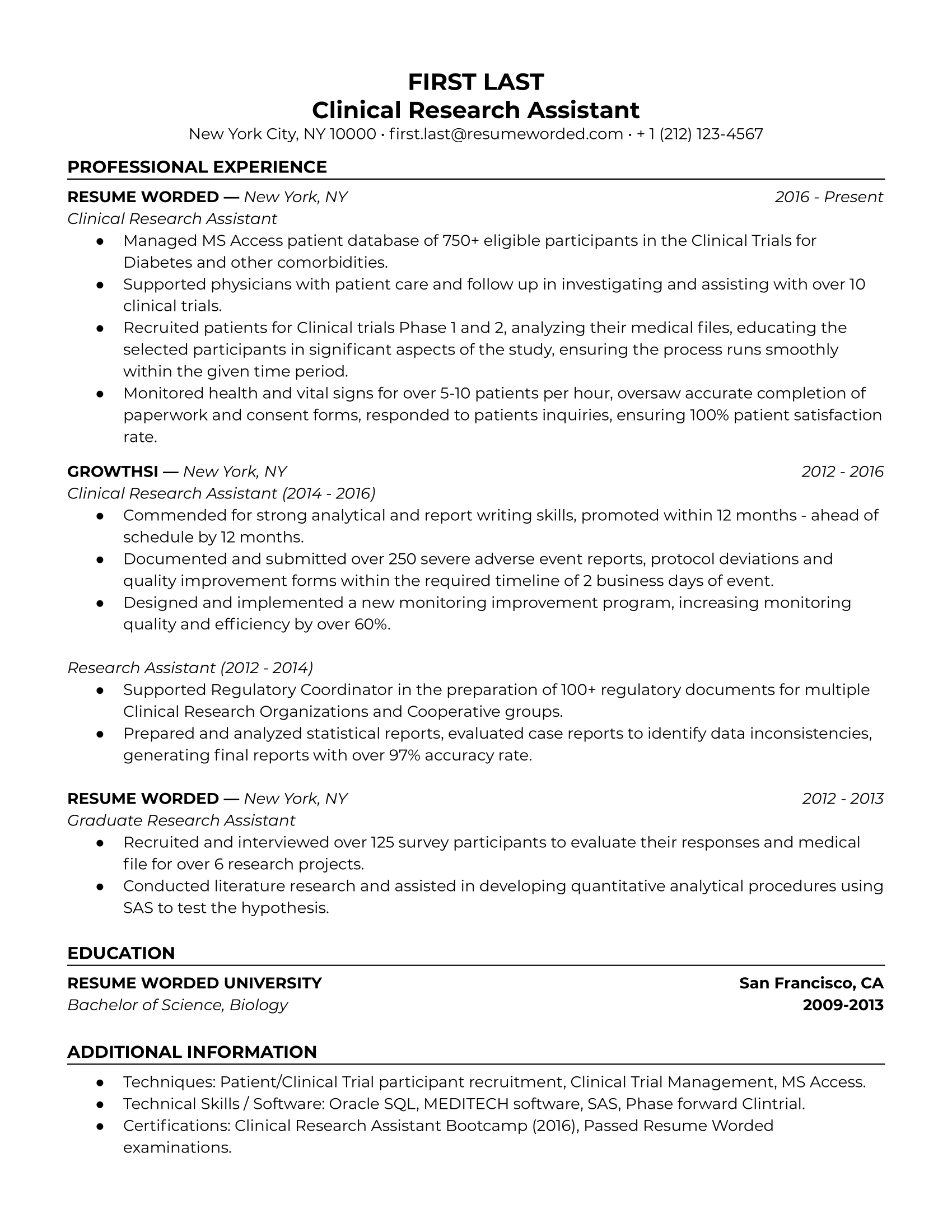

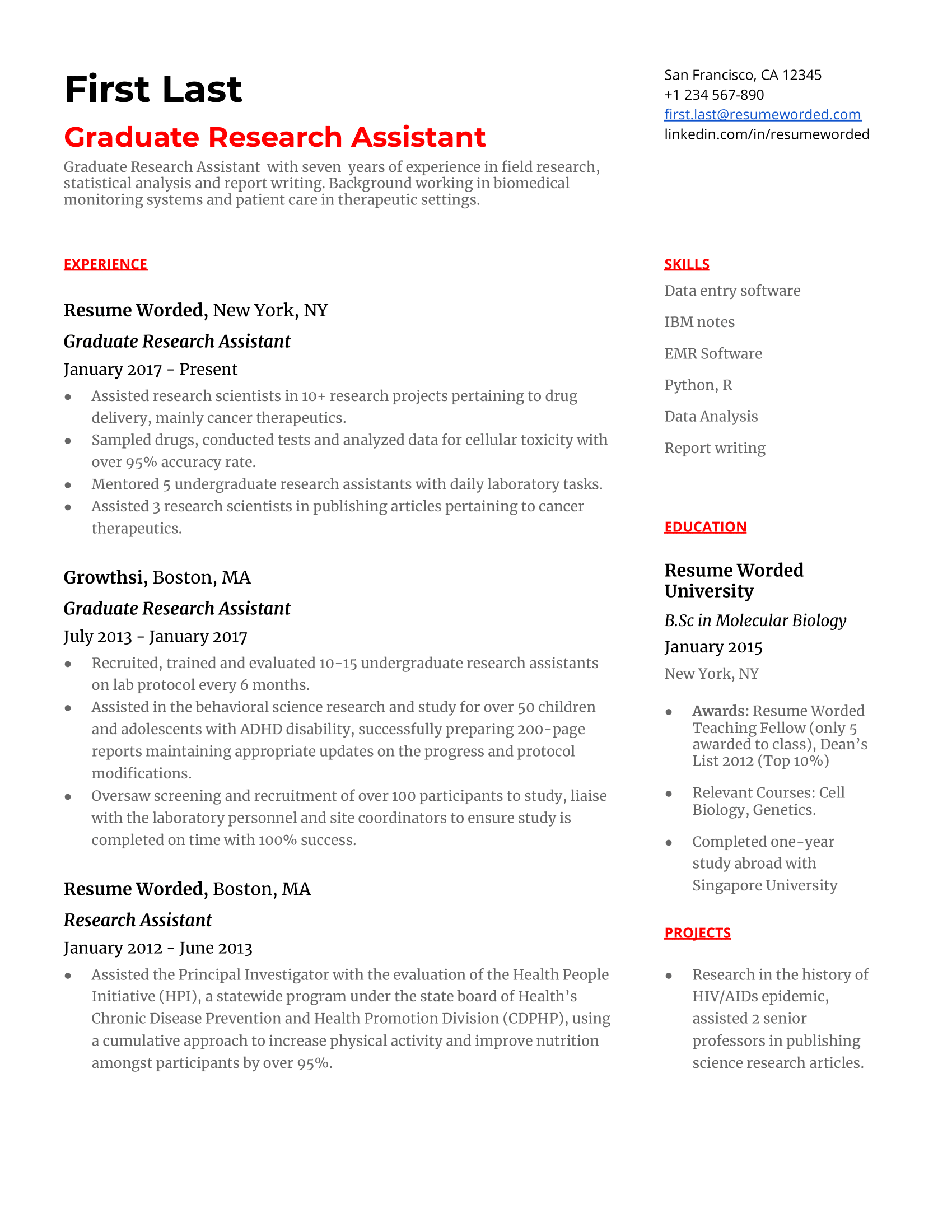

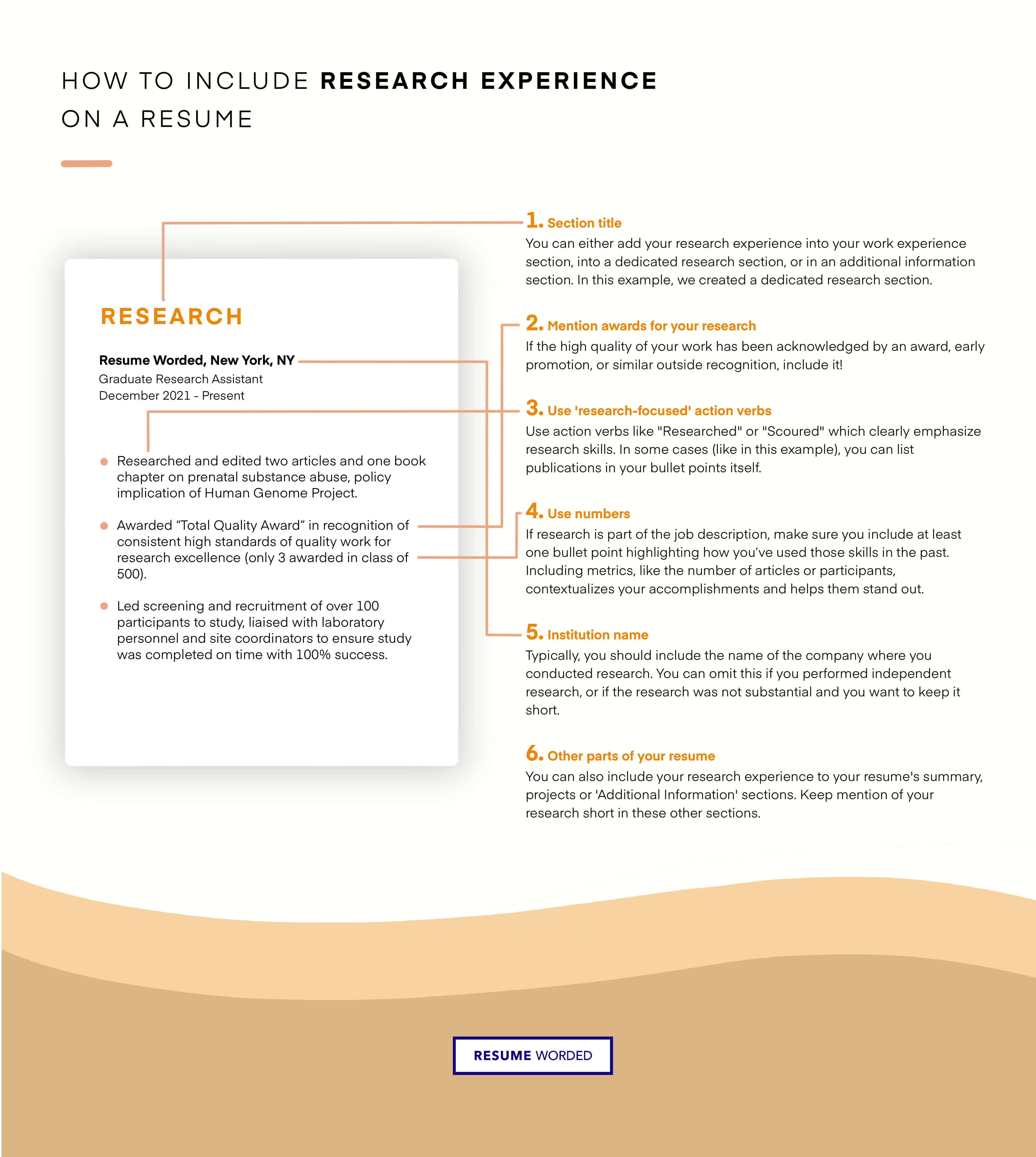

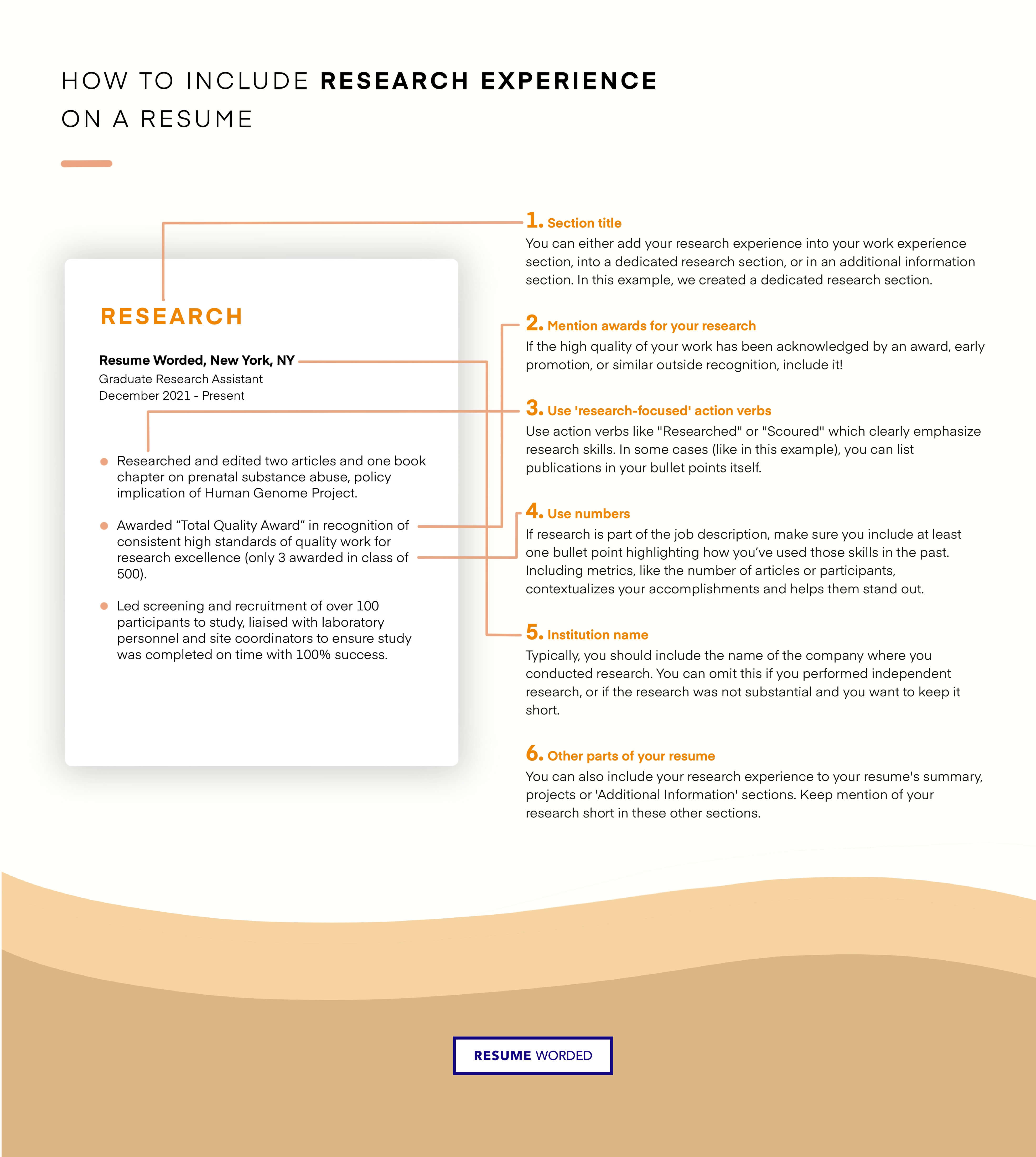

Focused on clinical research

When applying for a more specialized position like clinical research assistant, you want to keep your resume as tightly focused as possible. That means prioritizing clinical research experience. It’s fine to include general research experience, but try to tailor your bullet points by including accomplishments relevant to clinical research, like preparing regulatory documents and conducting medical research.