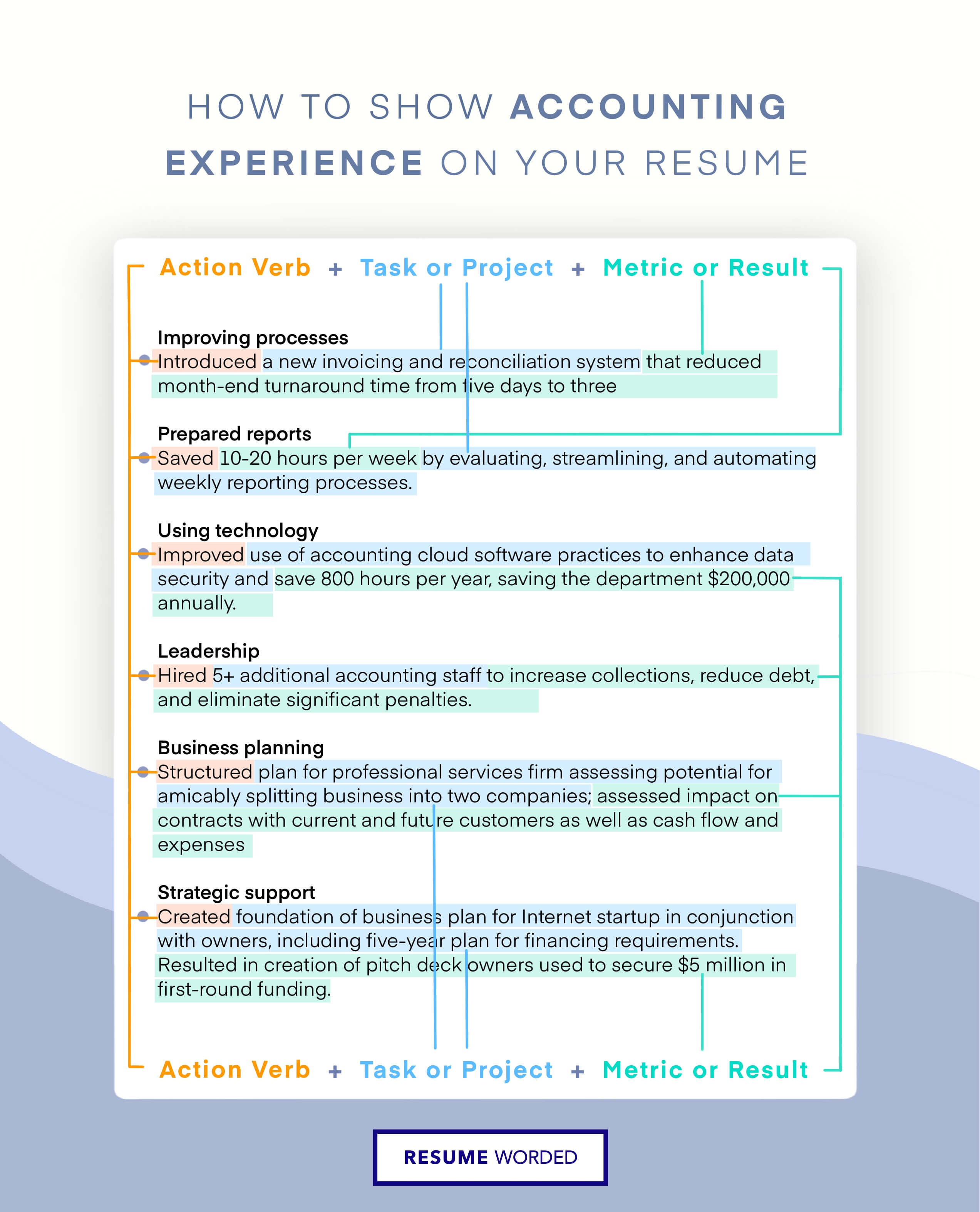

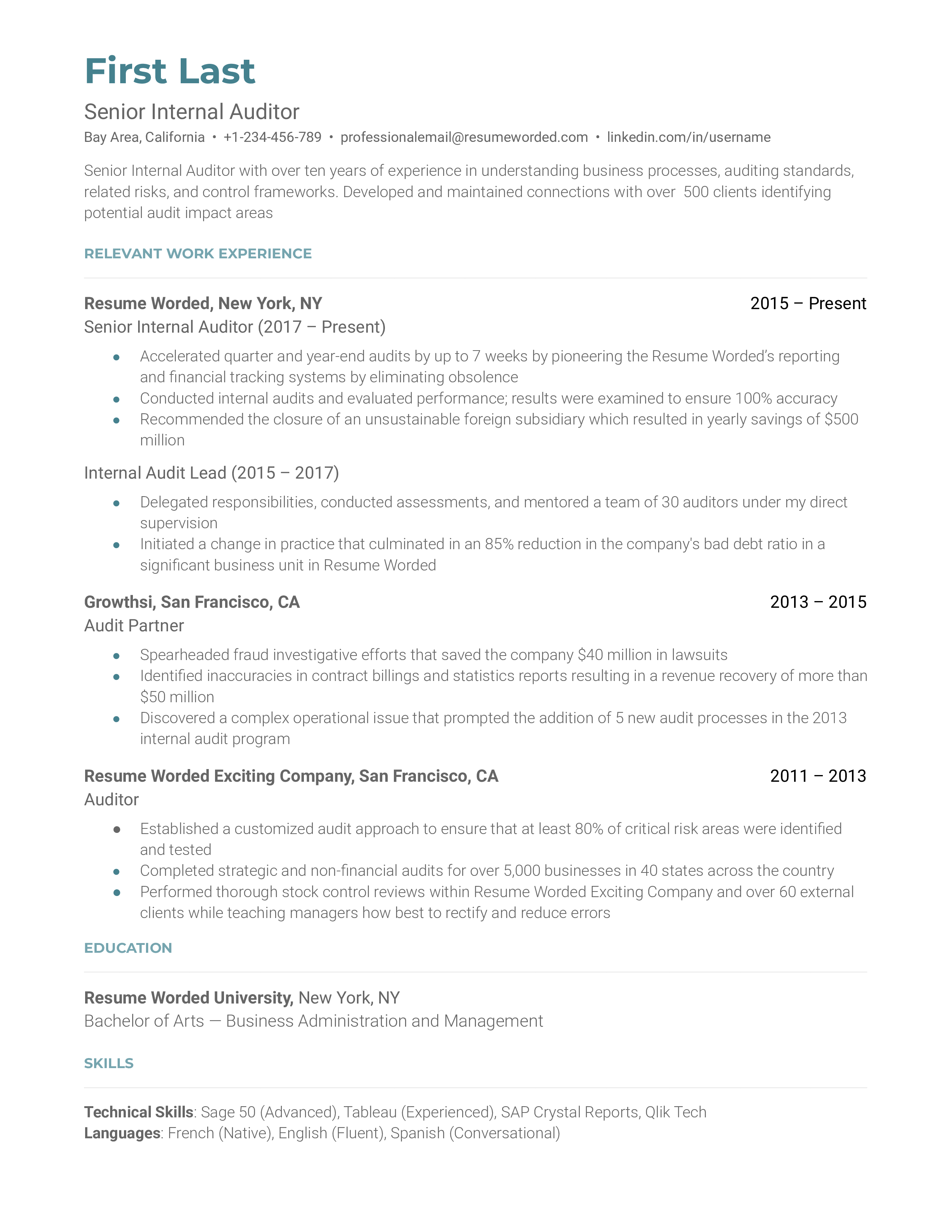

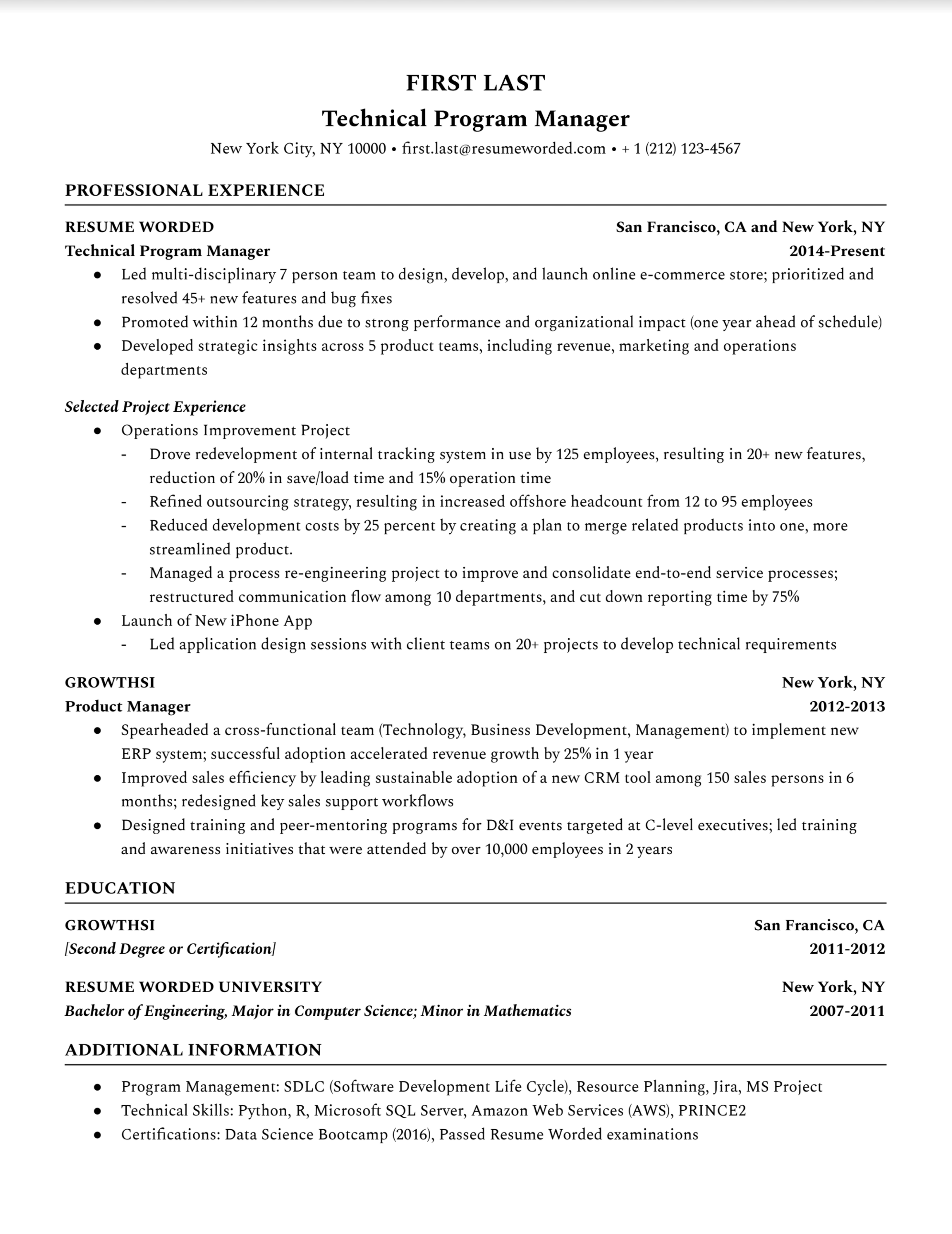

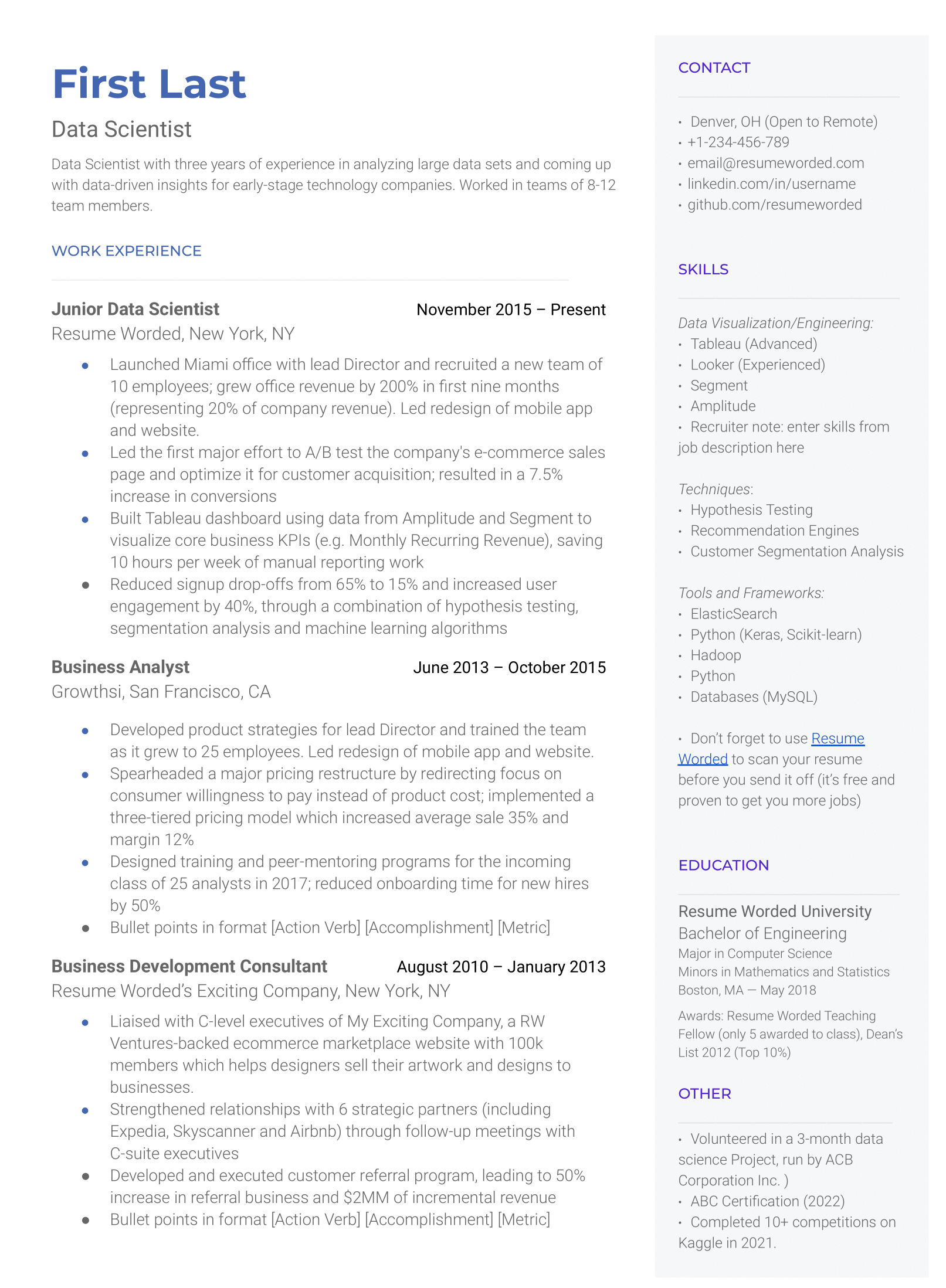

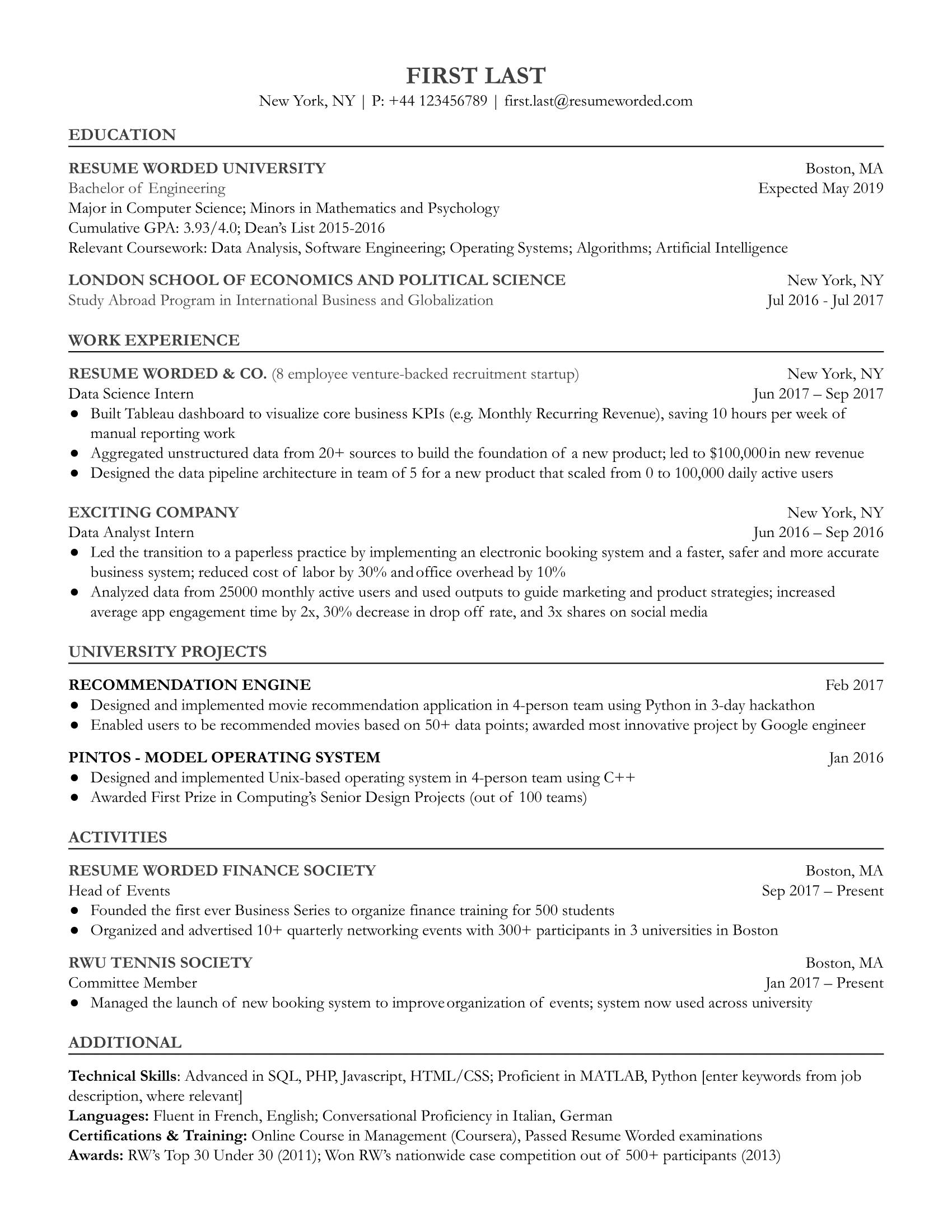

Highlight your work experience.

If you want to get a job as a senior internal auditor, you should accentuate your work experience. Recruiters seek experienced professionals with excellent technical skills. That’s why it’s essential to prioritize achievements you’ve had as an auditor, such as improving financial operations or identifying issues in internal control mechanisms.