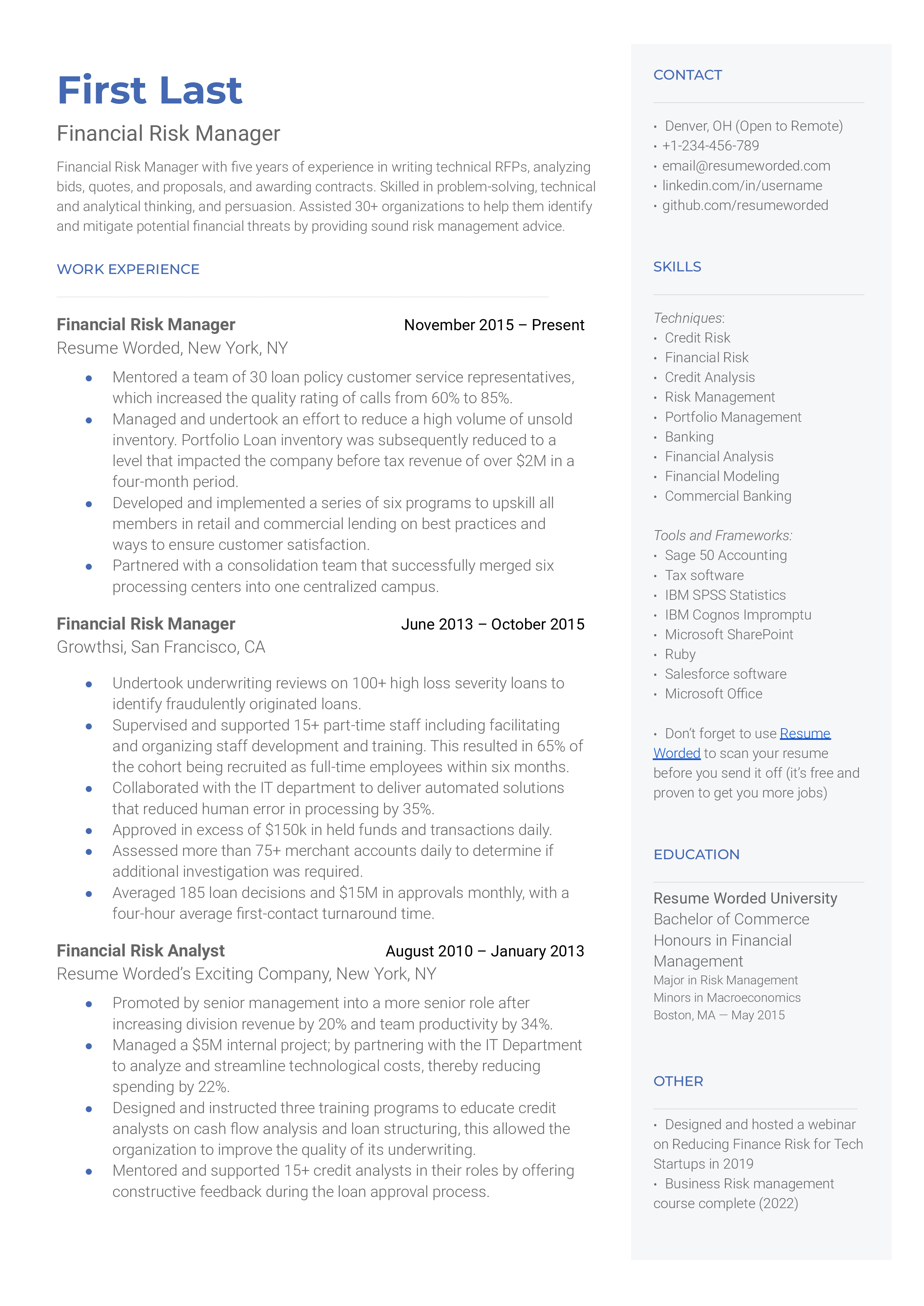

Highlight your education in the health industry.

It is essential for healthcare risk managers to have an in-depth knowledge of the health industry to do their job effectively. So if you have gone to medical school or have a degree in a health-related field, make sure it is well highlighted in your resume.