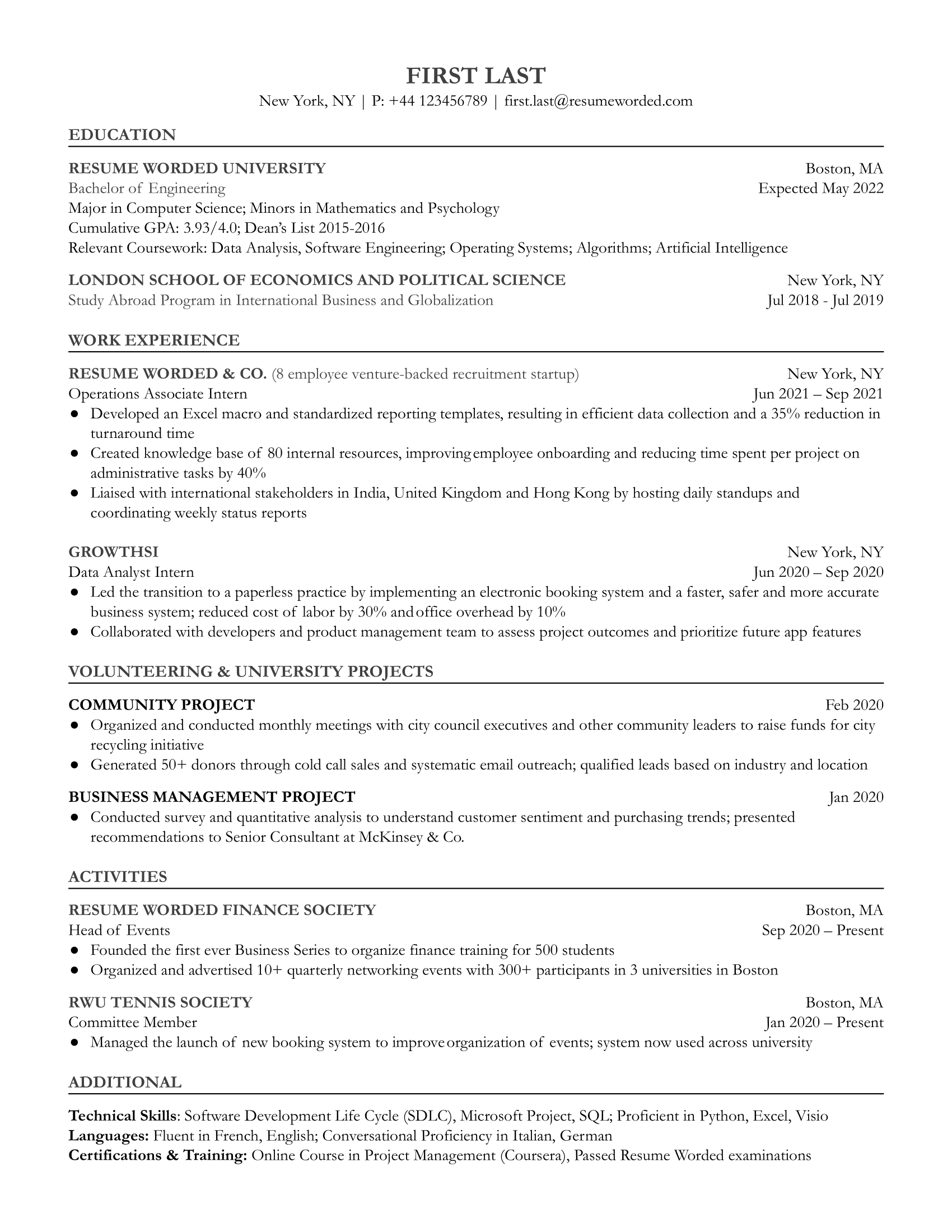

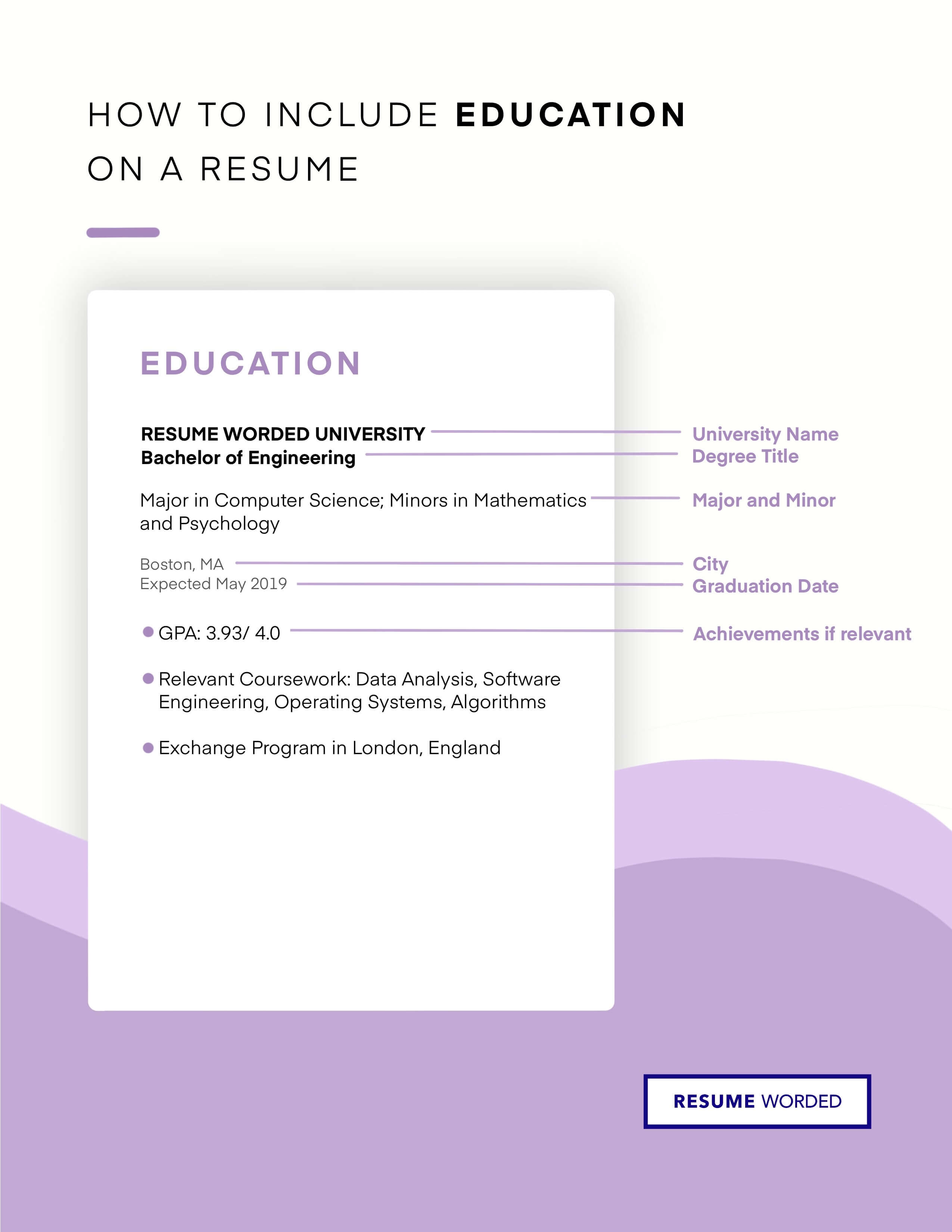

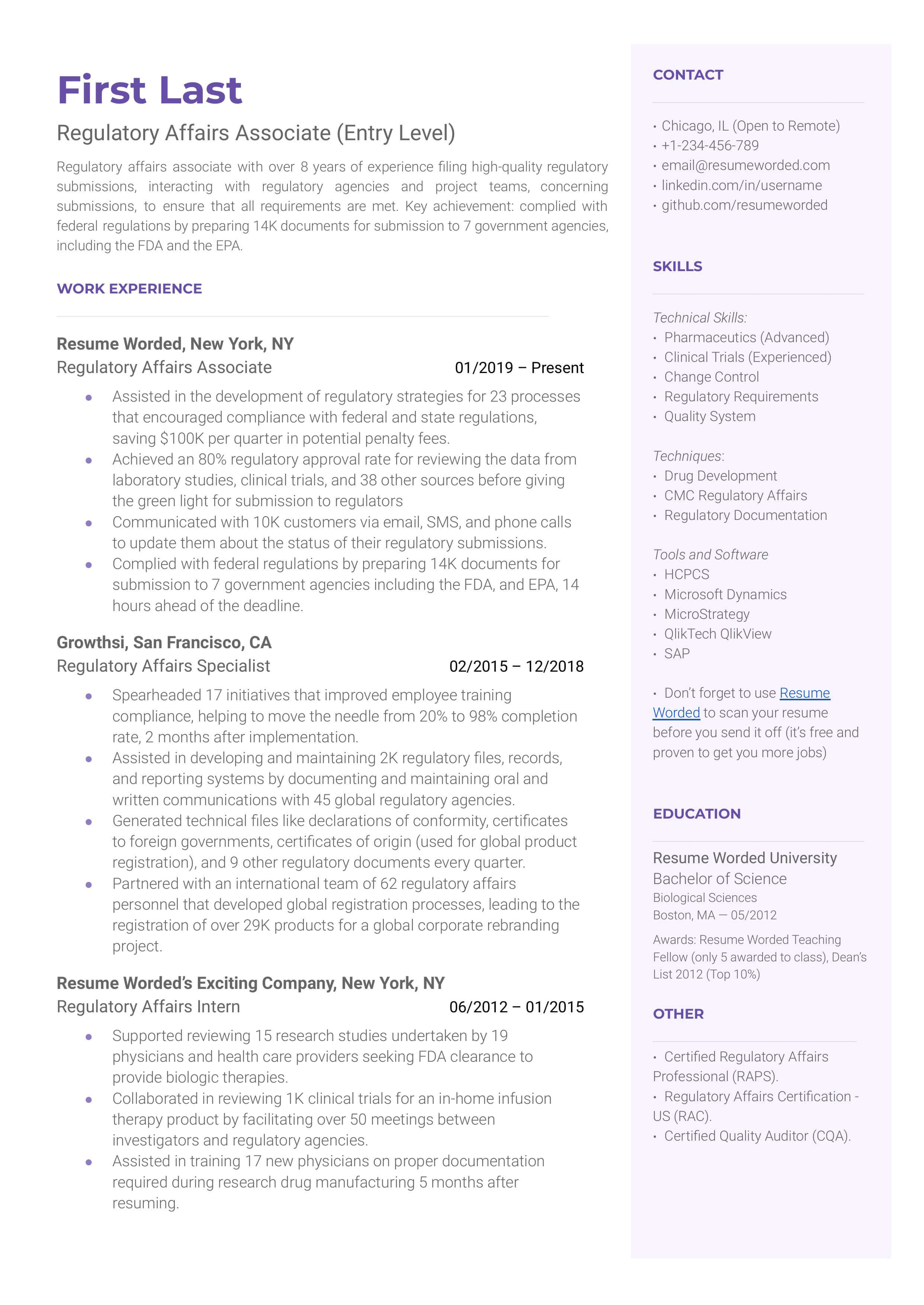

Leads with educational experience

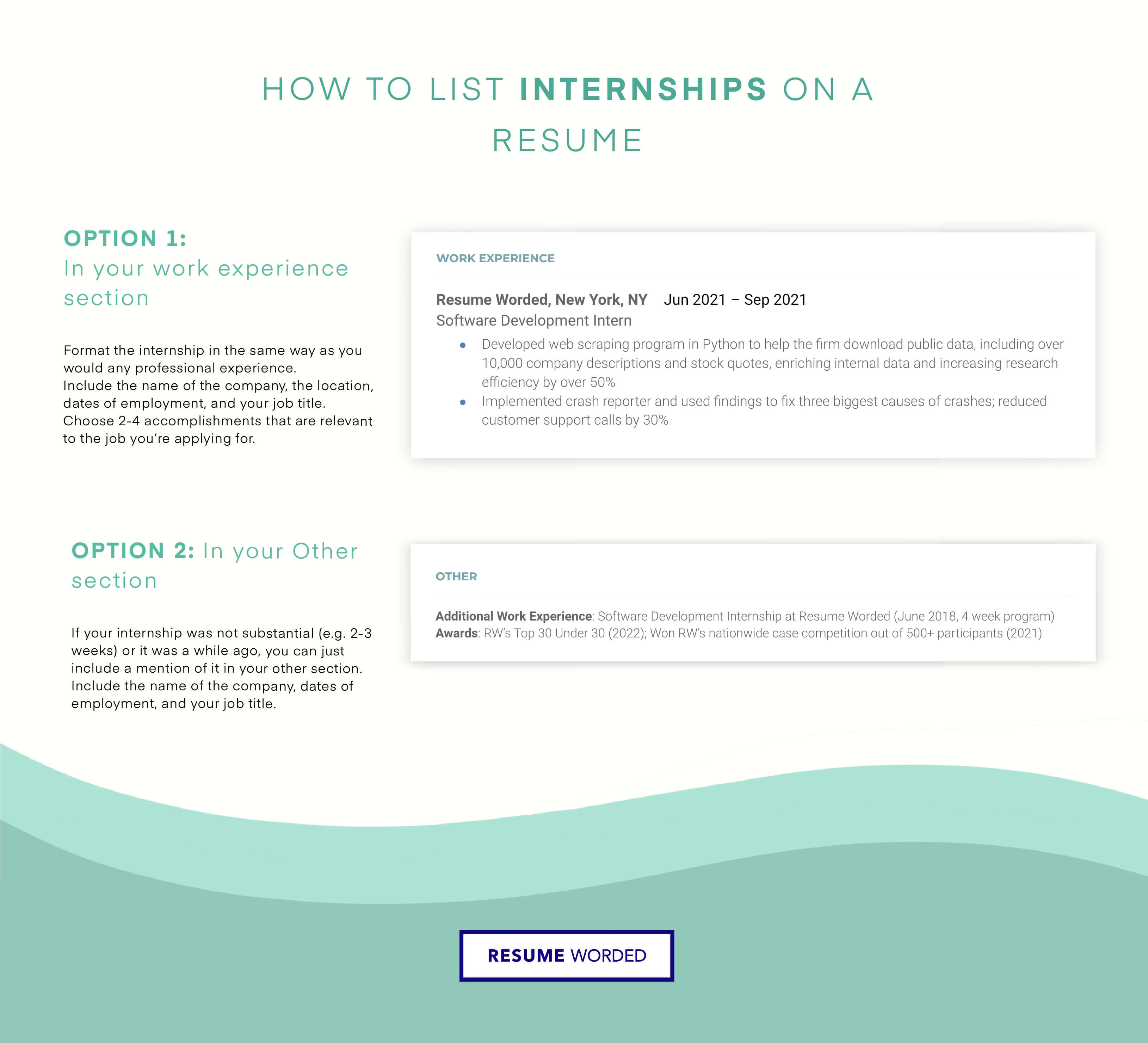

As an entry-level applicant, you won’t have a lot of work history to discuss -- so start your resume off with what you have accomplished in school and internship experience. If you’ve done coursework in relevant areas such as data analytics or operating systems, it’s great to mention that up-front.