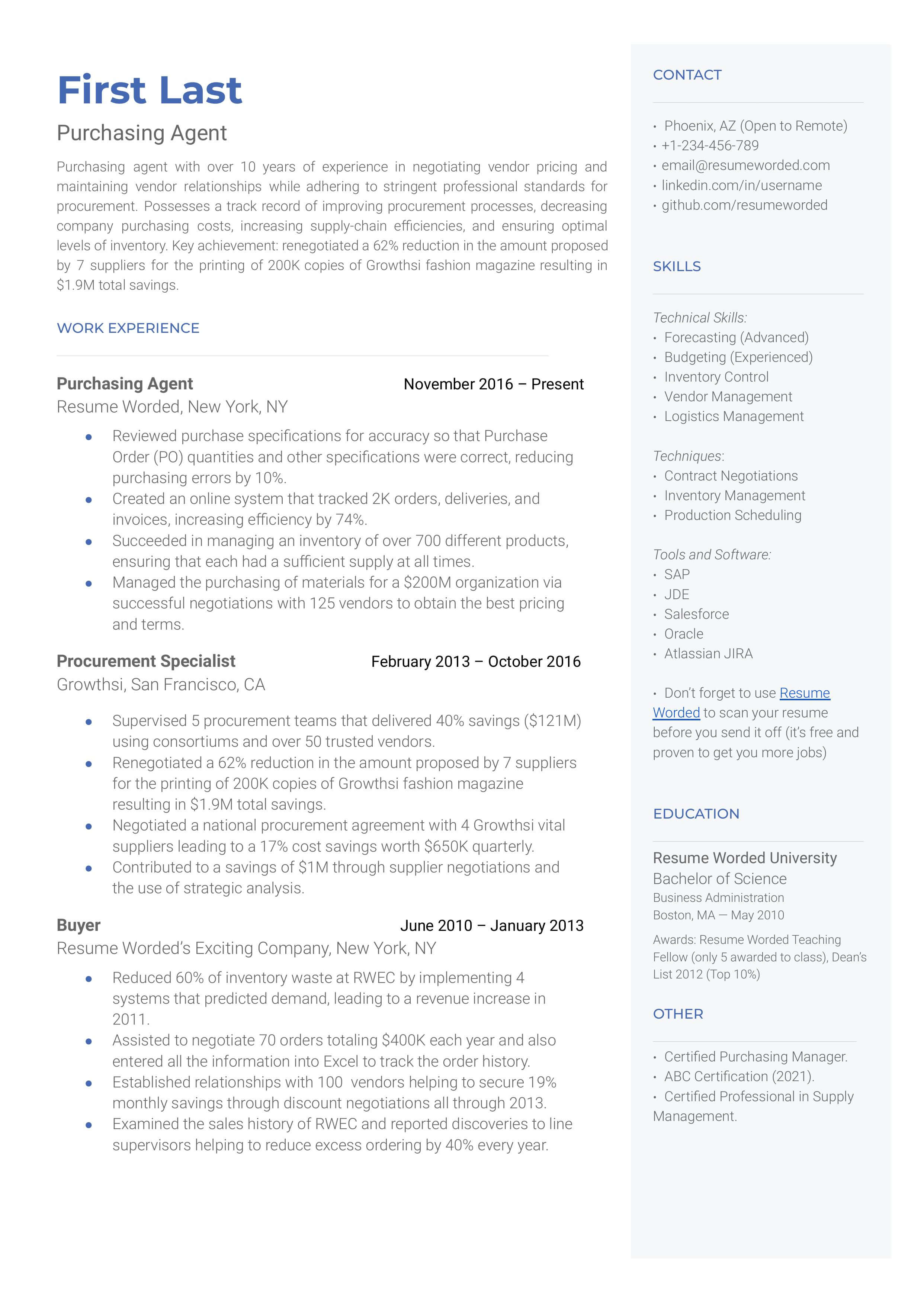

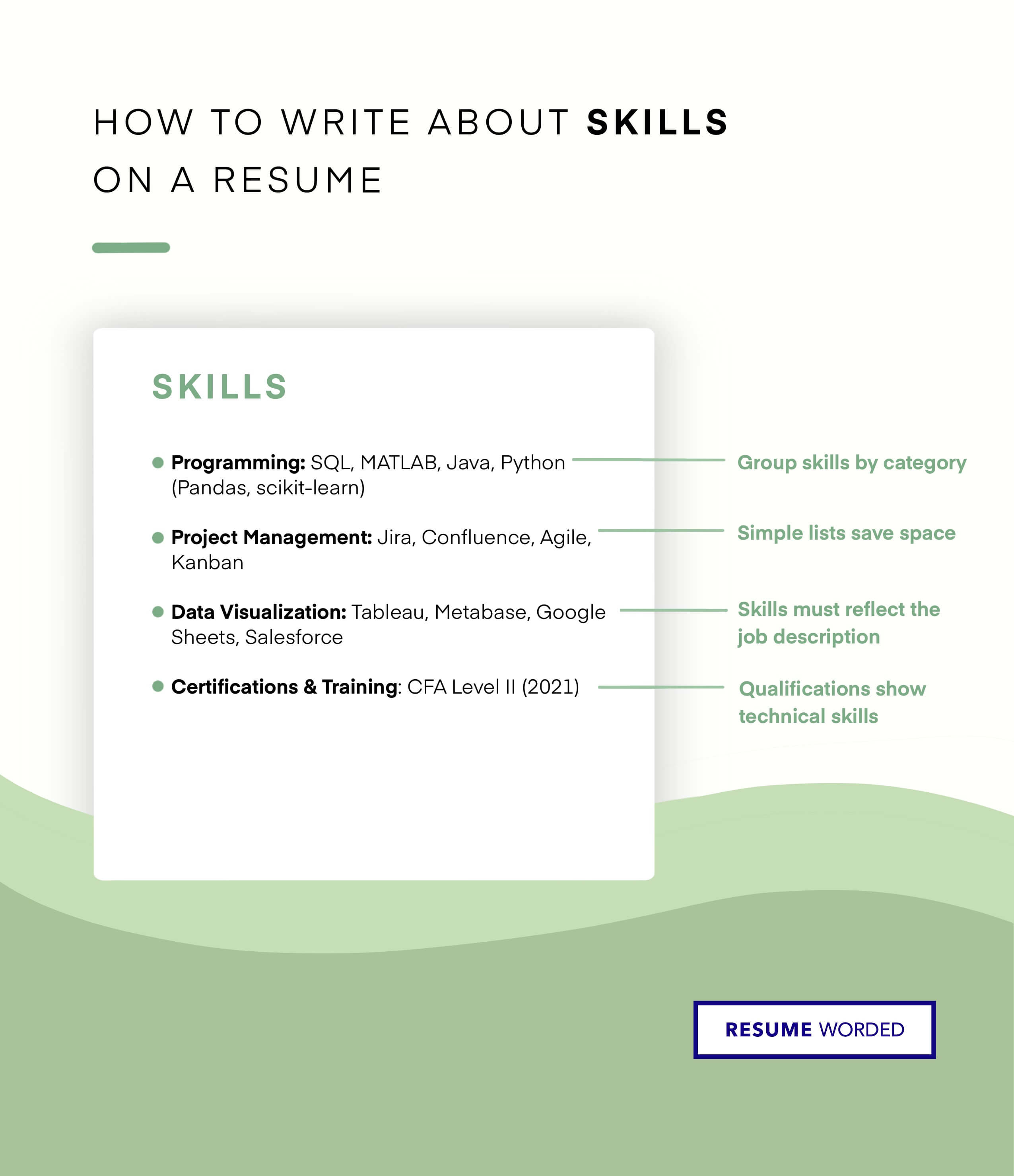

Indicate your ability to work with inventory management tools.

Purchasing agents must be familiar with inventory management systems because they are responsible for monitoring inventory items. They must also trace orders and identify incongruencies. Therefore, it is crucial to mention your familiarity with these tools.