Tax Specialist Resume Keywords and Skills (Hard Skills)

Here are the keywords and skills that appear most frequently on recent Tax Specialist job postings. In other words, these are the most sought after skills by recruiters and hiring managers. Go to Sample Templates ↓ below to see how to include them on your resume.

Remember that every job is different. Instead of including all keywords on your resume, identify those that are most relevant to the job you're applying to. Use the free Targeted Resume tool to help with this.

- Tax

- Income Tax

- Accounting

- Corporate Tax

- Tax Advisory

- Financial Accounting

- Financial Reporting

- Find out what your resume's missing

- Auditing

- Value-Added Tax (VAT)

- Tax Preparation

- Tax Accounting

- Financial Analysis

- Tax Law

- Tax Compliance

- Internal Controls

- International Financial Reporting Standards (IFRS)

Resume Skills: Tax Software

- Intuit ProConnect

- H&R Block

- Sovos

- Avalara

- TaxJar

- QuickBooks

- TurboTax

- TaxAct

- Drake Tax

- AvaTax

- ProConnect Tax Online

- ProSeries Tax

- XERO

- Zoho Books

- FreshBooks

- Wave

- YNAB

- Pabbly

- Intuit ProSeries

- BNA Income Tax Planner

- H&R Block Tax Software

- Match your resume to these skills

Resume Skills: Regulation Knowledge

- Income Tax Act

- Sales Tax

- Corporate Tax

- International Tax

- Audit Processes

- Tax Planning

- Match your resume to these skills

Resume Skills: Software

- Microsoft Excel

- SQL

- Oracle

- SAP

- IBM Cognos

- Match your resume to these skills

Resume Skills: Languages

- English (Fluent)

- Spanish

- Chinese

- English

- German

- Match your resume to these skills

Resume Skills: Regulations & Standards

- GAAP

- IFRS

- Tax Codes

- SEC Regulations

- Financial Reporting

- Match your resume to these skills

Resume Skills: Advanced Analytical

- Financial Modelling

- Balance Sheets

- Revenue Projections

- Income Statements

- Profit and Loss Statements

- Match your resume to these skills

Resume Skills: Regulatory Compliance

- ITO Regulations

- IRS Exam and Audit Procedures

- Federal and State Tax Codes

- Foreign Tax Regulations

- Match your resume to these skills

Resume Skills: Microsoft Office Suite

- Excel

- Word

- PowerPoint

- Access

- Match your resume to these skills

Does your resume contain all the right skills? Paste in your resume in the AI Resume Scan ↓ section below and get an instant score.

Compare Your Resume To These Tax Specialist Skills (ATS Scan)

Paste your resume below and our AI will identify which keywords are missing from your resume from the list above (and what you need to include). Including the right keywords will help you get past Applicant Tracking Systems (i.e. resume screeners) which may scan your resume for keywords to see if you're a match for the job.

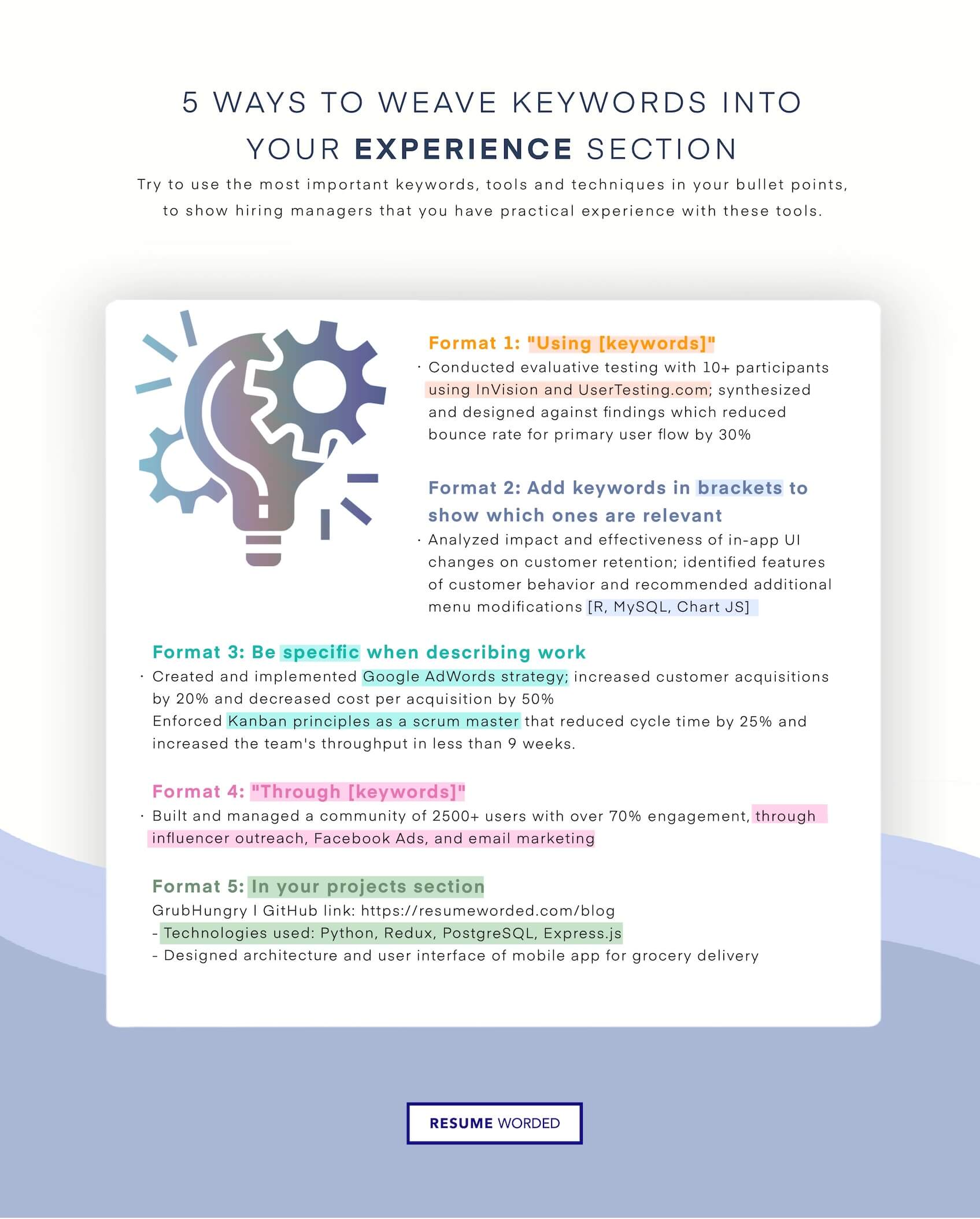

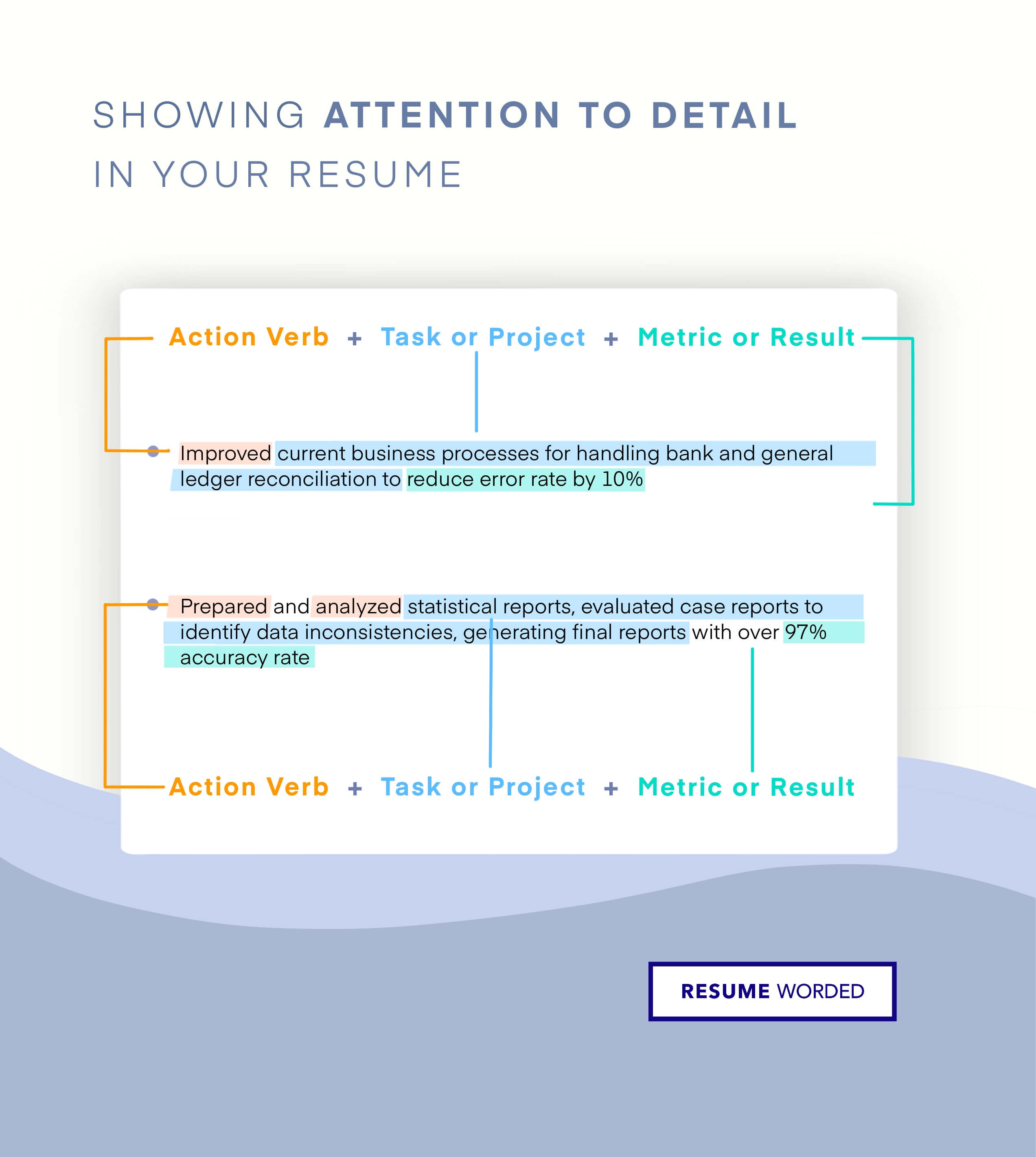

Sample Tax Specialist Resume Examples: How To Include These Skills

Add keywords directly into your resume's work experiences, education or Skills section, like we've shown in the examples below. Use the examples below as inspiration.

How do I add skills to a Tax Specialist resume?

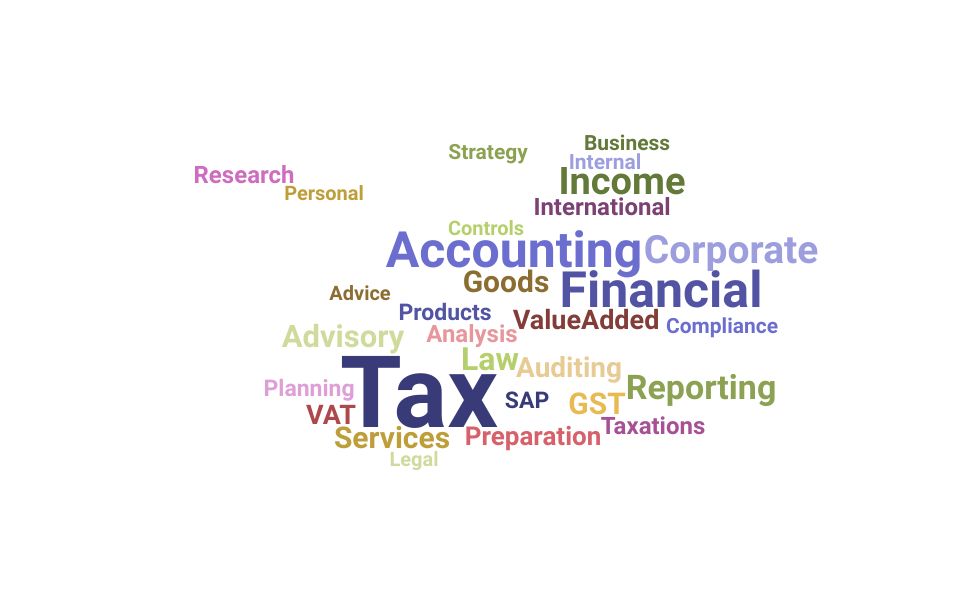

Word Cloud for Tax Specialist Skills & Keywords

The following word cloud highlights the most popular keywords that appear on Tax Specialist job descriptions. The bigger the word, the more frequently it shows up on employer's job postings. If you have experience with these keywords, include them on your resume.

Resume Skills and Keywords from Related Jobs

We also found variations and further specializations to your job title. Browse through the related job titles to find additional keywords that you can include into your resume.

Get your Resume Instantly Checked, For Free

Upload your resume and we'll spot the issues in it before an actual Tax Specialist recruiter sees it. For free.

Tax Specialist Resume Templates

Here are examples of proven resumes in related jobs and industries, approved by experienced hiring managers. Use them as inspiration when you're writing your own resume. You can even download and edit the resume template in Google Docs.

Frequently Asked Questions

What skills should you put on a Tax Specialist resume?

Here are some of the most popular skills we see on Tax Specialist resumes:

- Tax

- Income Tax

- Accounting

- Corporate Tax

- Tax Advisory

- Financial Accounting

- Financial Reporting

- Auditing

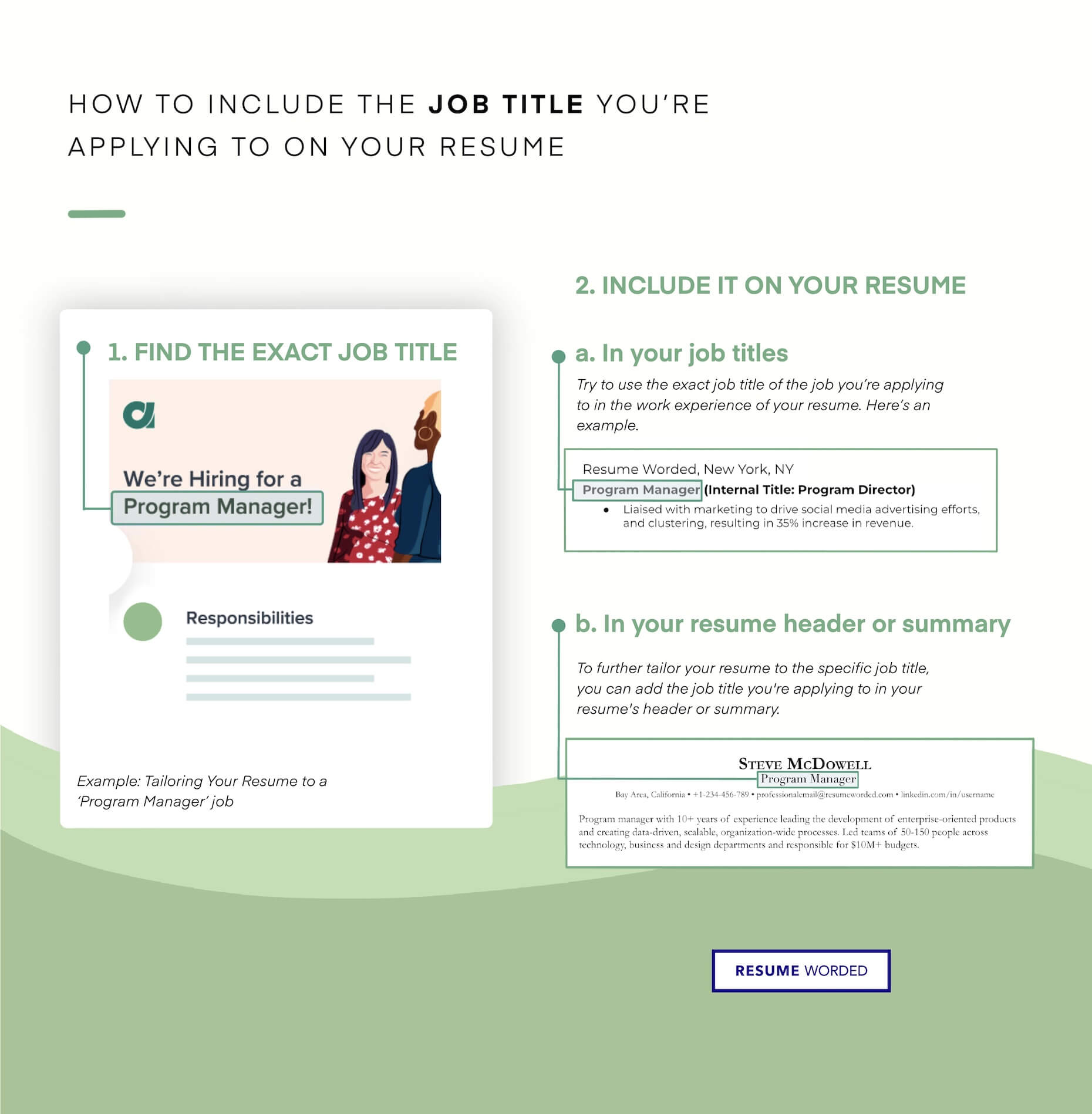

Target your Resume to a Job Description

While the keywords above are a good indication of what skills you need on your resume, you should try to find additional keywords that are specific to the job. To do this, use the free Targeted Resume tool. It analyzes the job you are applying to and finds the most important keywords you need on your resume.

It is personalized to your resume, and is the best way to ensure your resume will pass the automated resume filters.